Happy Birthday, Blog!

This week marks my one-year blogiversary. Although I’ve been blogging since 2008, this post marked the first time I wrote and published something on my own site.

What I’ve Been Working On

Earlier this month, BrightPlan released its digital financial planning and investment platform to the public.

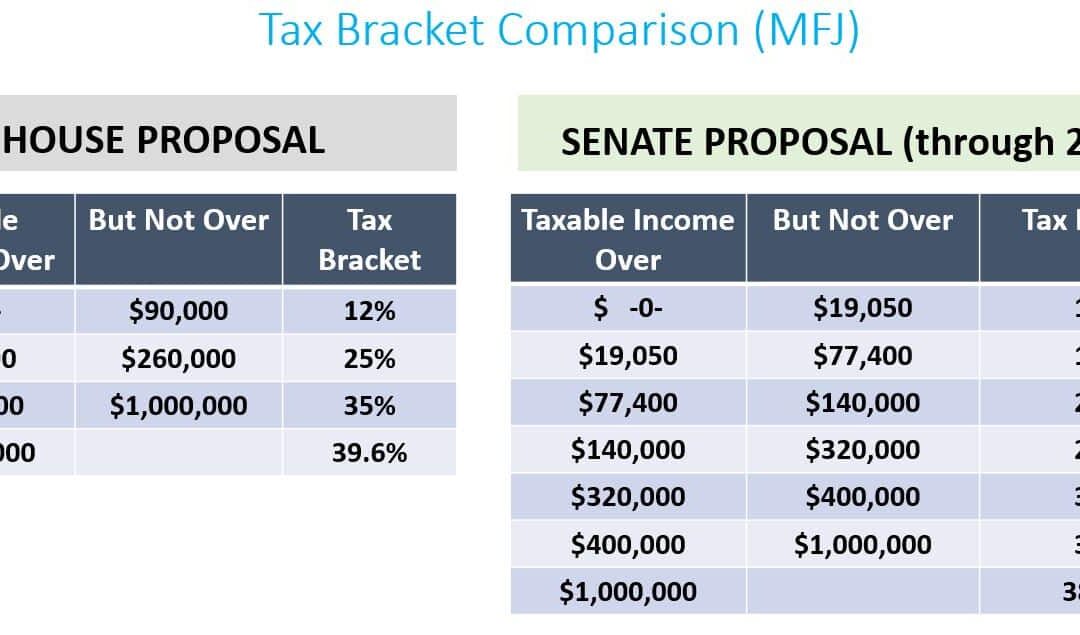

What You Need to Know About U.S. Tax Reform

Here’s are the key differences in the House and Senate versions of tax reform as well as some early financial planning considerations.

Guest Post: Mike Dariano on How to Spend Less

Saving is a great idea, in fact, it may be the best one. Mike Dariano of The Waiter’s Pad explains how to spend less.

Highlights From The Evidence Based Investing Conference

Last week I attended the Evidence Based Investing Conference and it did not disappoint. Here are some highlights and takeaways from each of the presentations.

Why Alternatives are Bad for Your Portfolio

It’s never been easier for investors to add exposure to alternative investments into their portfolios, but that doesn’t mean you should.

Financial Blogger Wisdom: Fall 2017

Last week, Tadas Viskanta of Abnormal Returns rounded up some of the best finance writers around to answer a series of questions. Here were my responses.

5 Essential Estate Planning Documents

Estate planning is a little different for everyone, but there are five documents that you should consider regardless of your age, health, and wealth.

Active vs. Passive: The Wrong Debate

With the distinction between active versus passive becoming less informative, investors must seek out information on more relevant characteristics when evaluating investments.

Spending Too Much? Here’s What to Do

The idea of cutting expenses is often talked about like a tragic event, but that isn’t a productive way to frame the act of saving money.

Saving isn’t about making sacrifices. It’s about keeping your priorities and getting more of what you really want.

There are many ways to increase your savings that involve delaying gratification or examining the importance of your everyday expenditures. Here are a few to get you started.

Get A Free Financial Wellness Assessment

Take our assessment and quickly learn specific areas of your finances you should focus on to build and protect your wealth.

Peter Lazaroff, CFA, CFP® is Plancorp’s Chief Investment Officer, a financial advisor, speaker, and author of the book Making Money Simple.