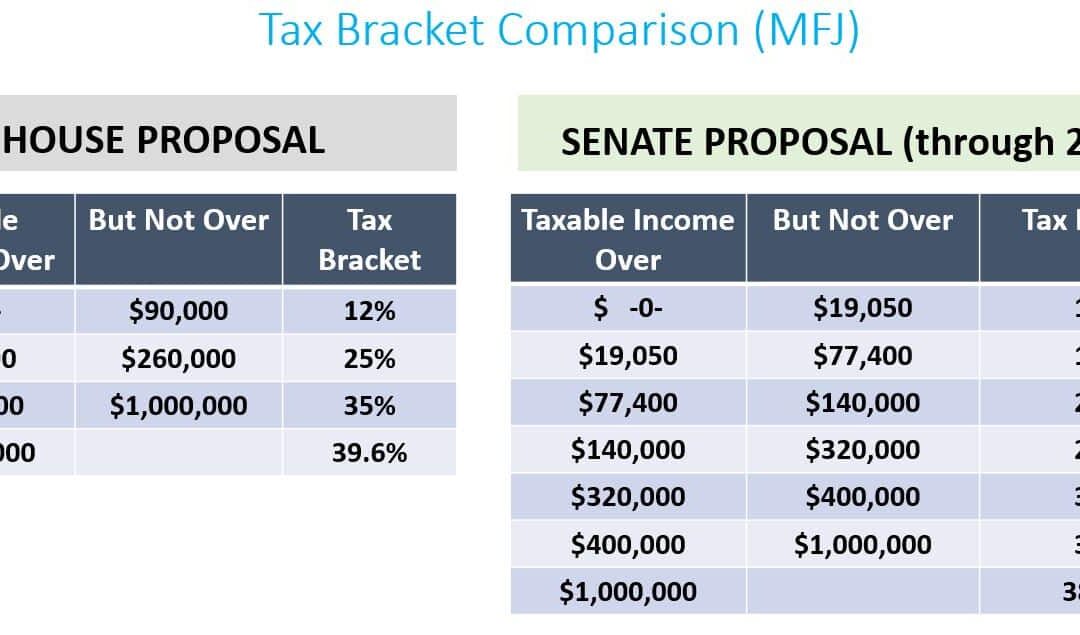

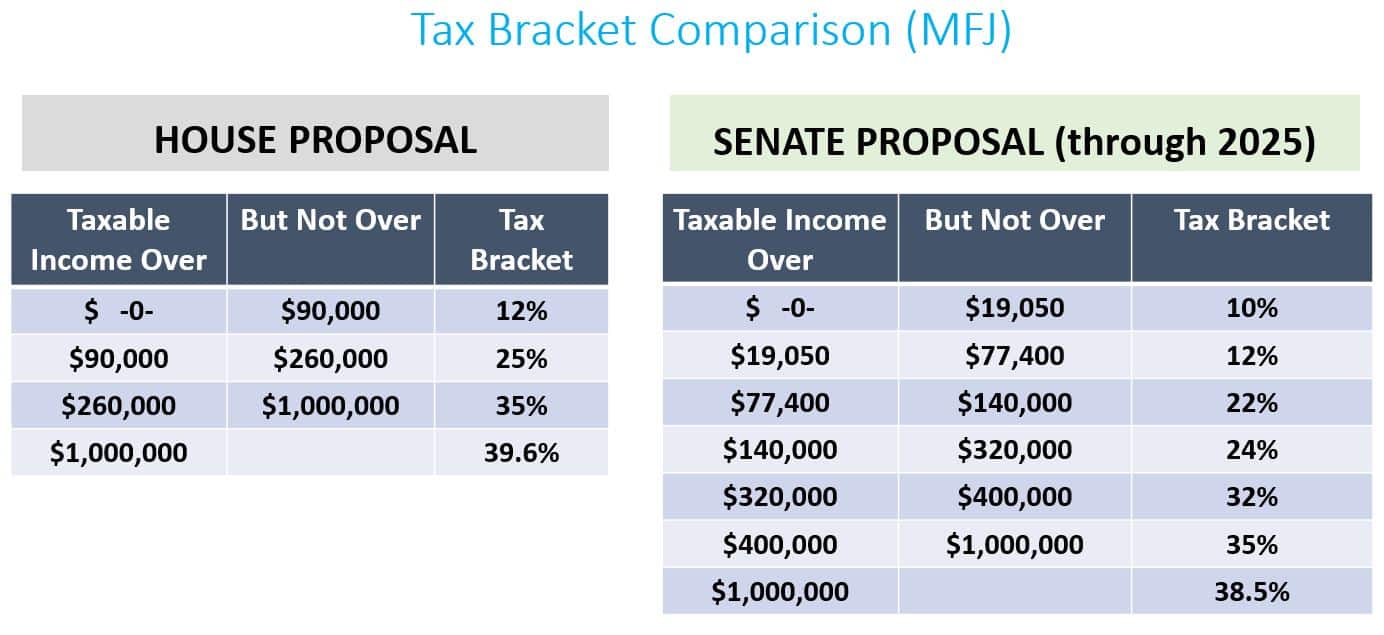

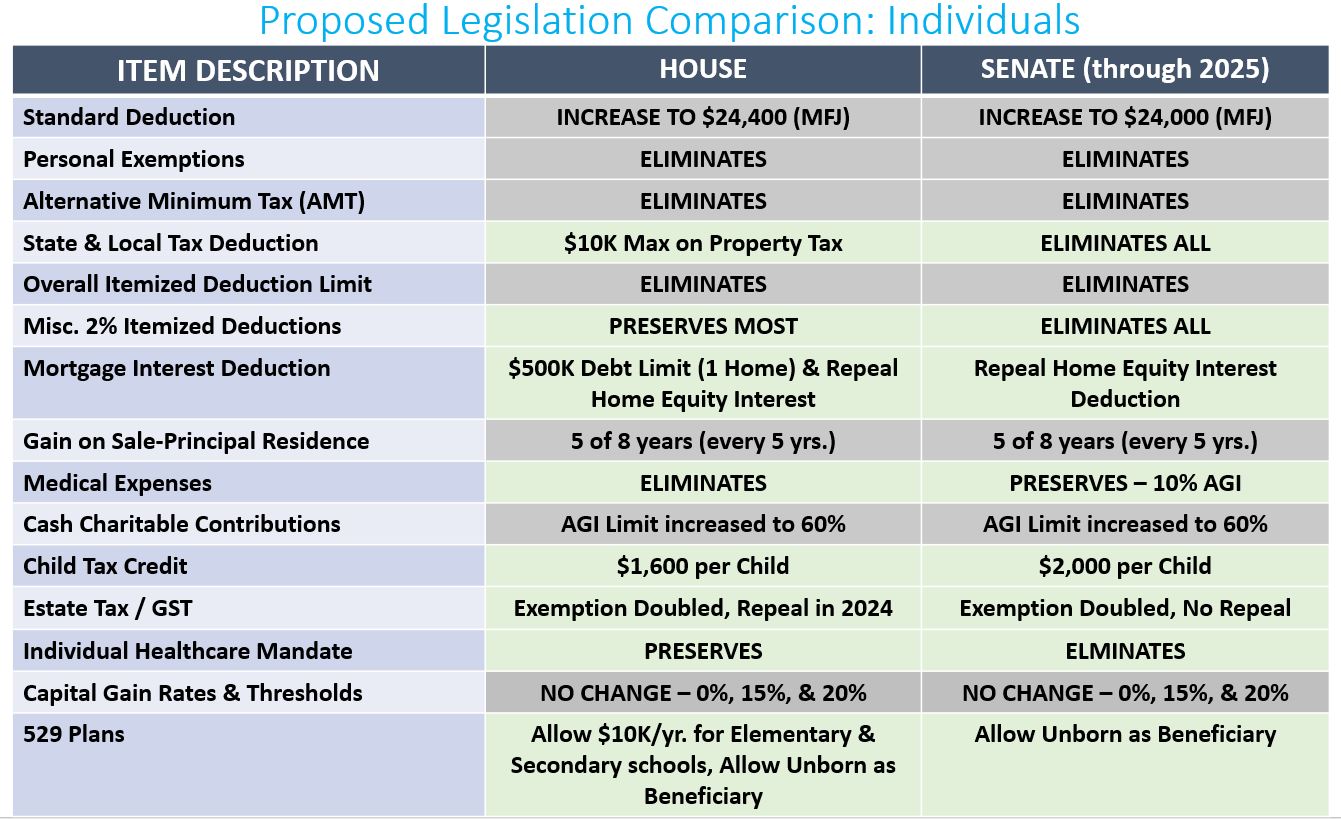

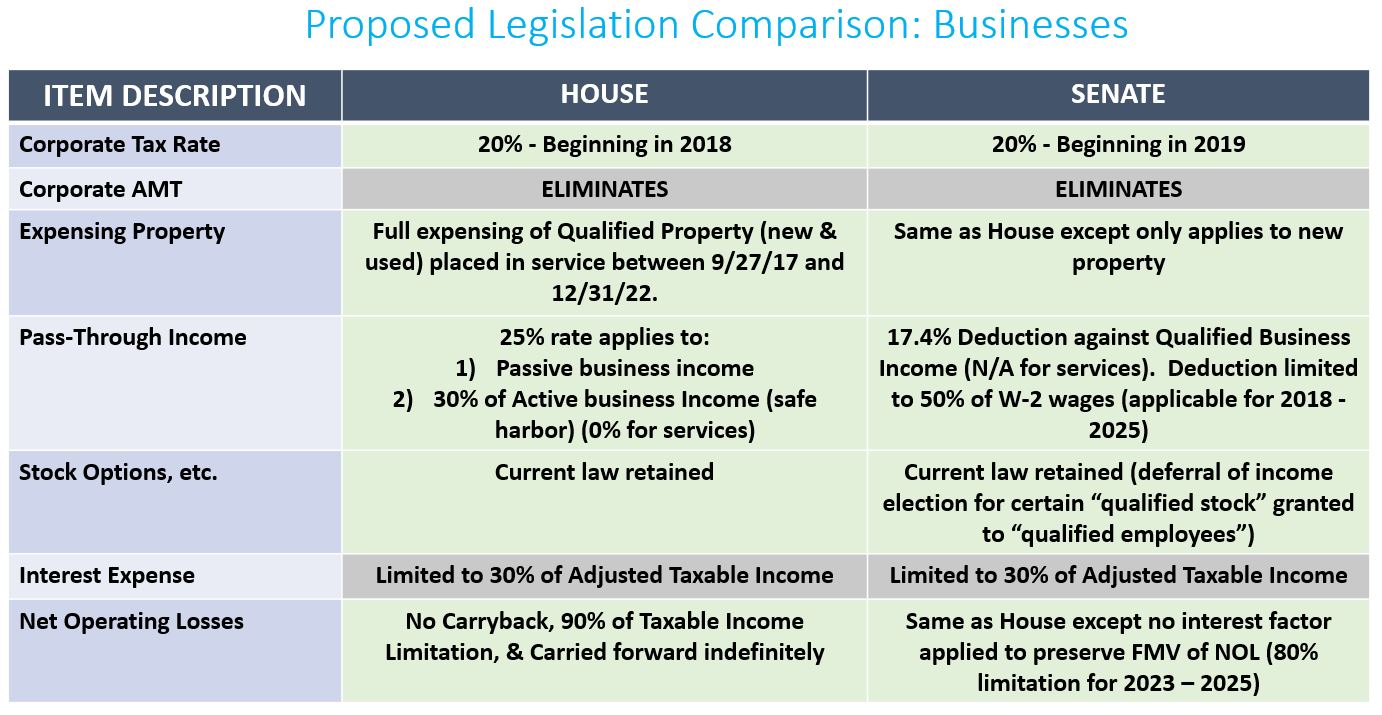

The charts below were created by Plancorp to summarize the key provisions within the proposed House and Senate bills as they currently stand. This is not an all-inclusive list, but gives you a good idea of the differences as it stands today (the Senate bill may see changes prior to a final vote).

Good tax planning is about eliminating surprises on April 15th. Unfortunately, there isn’t much concrete tax planning that can be done at this point, but here are a few ideas from Plancorp’s Brian King (Chief Planning Officer) and Scott Ngo (Wealth Manager).

1. If not subject to AMT, prepay state and local income as well as property taxes in 2017.

This will allow you to deduct these items in 2017 as these deductions may be limited/eliminated in 2018. If you expect to pay AMT in 2017, you lose the benefit of the deduction for state and local taxes anyway. So, you would not benefit from this tactic.

2. If taxable income exceeds $1,000,000 (MFJ and not in AMT), consider accelerating income (options, capital gain, etc.) into 2017, and prepay related state income tax.

Under the House bill, your marginal rate on this income could actually be lower in 2017 due to the phase out of the 12% income bracket for high income individuals.

3. Plan for estate tax to remain.

The estate tax and Generation Skipping Tax are only repealed under the House bill. The exemption is doubled under both bills but under the Senate version it would revert back to the current exemption amount (presumably adjusted for inflation) after 2025.

The “death tax” is always a hot topic in our nation’s capital. Any changes as a result of near term tax reform could be the focus of change in the future, especially if Republicans lose control of the House or Senate.

4. Reconsider choice of entity for new businesses; C corporation versus pass-through entities.

Double taxation on C corporations have made pass-through entities the popular choice for new businesses for some time. However, if the corporate tax rate is reduced to 20%, the spread between C corporations and pass-through entities will shrink and C corporations may become more attractive again.

5. Run the numbers.

Quantifying the savings of any year-end tax planning is always important. Even more so when the rules may change and uncertainty is involved. Running a detailed tax projection with a CPA helps minimize error and maximize opportunity.

And, of course, always speak with your CPA before executing any strategies based on potential reform. I’ll likely have some additional information posted once the bill is finalized.