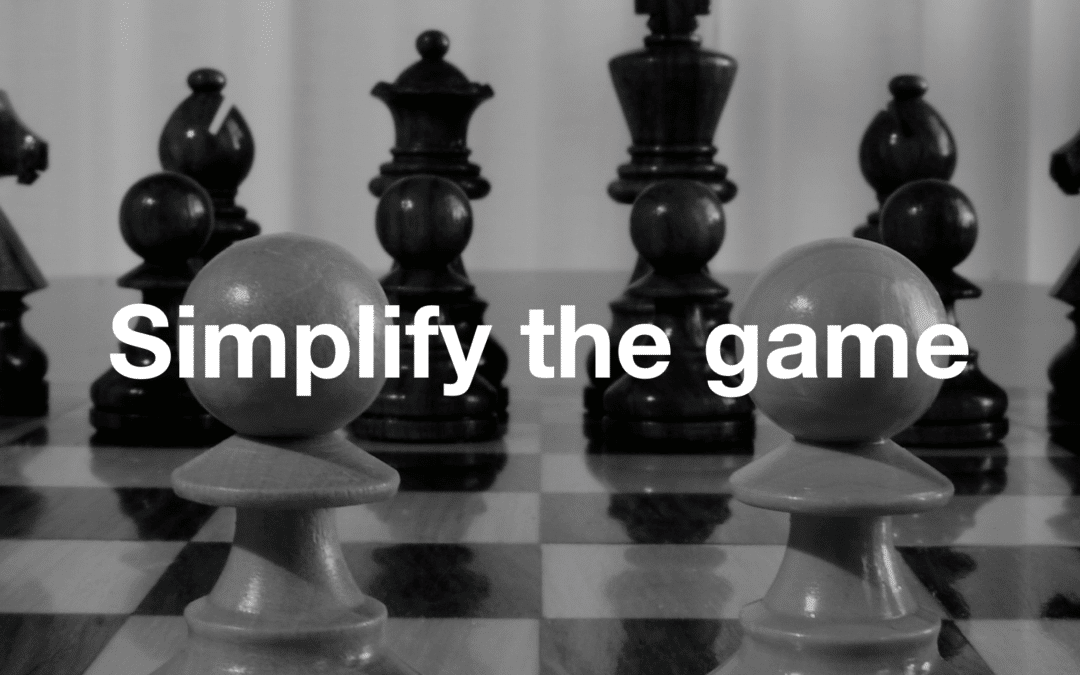

Simplify The Game

Investing is a zero sum game in which individual investors frequently end up on the losing side, but that doesn’t have to be the case.

Favorite Articles With Low Readership

One of the things you come to learn about writing is that some of your favorite work doesn’t generate the buzz you expect. Almost every writer has experienced this a few times, so I turned to the blogging community to get their thoughts.

2017 Annual Investment Review

Every year I address some of the most common client questions in a publication titled Annual Investment Review. Check out the 2017 issue here.

The Collective Knowledge of Financial Markets

Rather than compete against the vast knowledge of the world’s market participants, the vast majority of investors should harness the knowledge of markets and focus on things that can be controlled such as risk exposure, costs, taxes and investment behavior.

What’s The Biggest Mistake Investors Make?

What the biggest mistake investors make? Your favorite financial bloggers share their thoughts.

Invest or Pay Down Debt?

Should you pay down debt or invest Here are the 7 most important questions to ask to help you decide.

What Isn’t Getting Enough Attention?

What issue in the world of finance isn’t getting enough attention? The biggest financial bloggers weigh in.

4 Reasons to Buy Bonds in 2017

Bond returns may be low or even negative in the future, but they will remain an important part of your portfolio for these four reasons.

Financial Insights in 140 Characters

Being able to communicate ideas succinctly is a great skill, because clarity of writing usually follows clarity of thought. I’m always amazed at how well some people express themselves on Twitter when they are limited to 140 characters. This was my inspiration for a question I posed to several of my favorite bloggers: What’s the most important financial insight you can convey in 140 characters or less?

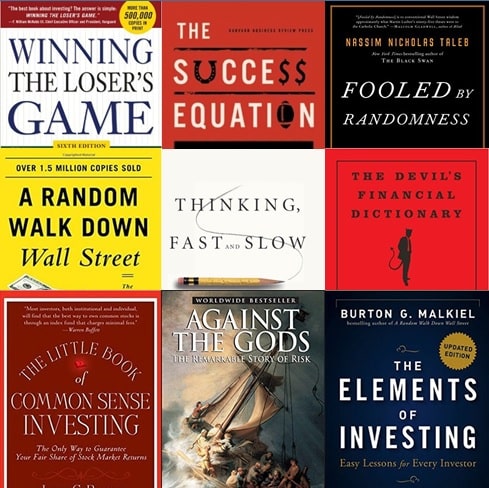

10 Books To Make You A Better Investor in 2017

Whether you are looking to spend a holiday gift card or your New Year’s Resolution is to read more, these books provide an extremely high return on investment.

Get A Free Financial Wellness Assessment

Take our assessment and quickly learn specific areas of your finances you should focus on to build and protect your wealth.

Peter Lazaroff, CFA, CFP® is Plancorp’s Chief Investment Officer, a financial advisor, speaker, and author of the book Making Money Simple.