Listen Now

Peter answers your questions in his latest mailbag episode.

Listen now to learn:

- What do to about an upcoming market downturn

- The implications of investing at all-time highs

- How to hedge inflation in your portfolio

Show notes and links to resources for this episode are below.

Show Notes

Before we jump into the episode this week, do you think you can forecast the market for 2022?

Forecasting market related events with consistent accuracy is nearly impossible, but that doesn’t make it any less entertaining. Try your chance at predicting the market for a chance to win a $500 Amazon gift card and bragging rights.

- Add your entry for a chance to win $500 here.

- Read more about the Outlook Survey: Forecasting the Market: The 2022 Outlook Survey

Now onto the show notes for this episode!

…

Happy New Year everyone. Before I jump into the listener questions, I have a few housekeeping items. The first is my 2022 Outlook Contest.

I’ve always wanted to do something like this with my followers, but I finally got my act together this year to make it happen. There is going to be a link at the top of the show notes at TheLongTermInvestor.com to a 13 question survey on a variety of economic, market, and political outcomes.

I strongly suspect most people will feel like they have no idea what to guess, but that’s okay. You can put as little or as much time into your guesses as you’d like. It’s just supposed to be fun.

But because I want people to participate, I’m going to give the winner a $500 Amazon gift card. So just head over to TheLongTermInvestor.com and click on the survey link in this episode’s show notes (this is episode 29).

I’ll be closing the survey at the end of January and if I get enough submissions, perhaps I’ll do a follow up episode on the range of estimates.

One more thing before jumping into questions, I want to give a few thank you’s to those that have been really helpful in the early success of this show.

First, a huge thank you to Kendra Wright who does all of my marketing work and coordination. There is no way I could publish a new podcast episode every week — not to mention all the other content I produce — without Kendra’s efforts and support.

I’d also like to thank my producer, Mathew Passey of The Podcast Consultant. Mathew has helped me through the learning phase of podcasting — and I’ll admit class is still very much in session for me — but he is truly the best in the business.

There have been several content curators that have also helped put the show in front of more eyeballs (or in more ears, however you want to think about it).

Thank you to Tadas Viskanta of Abnormal Returns. He was actually a guest, so check out Episode 27 for our conversation and be sure to subscribe to his newsletter.

Another newsletter I definitely think is subscribe worthy is Short Squeez, which I want to thank for sharing a few episodes of mine in 2021. This is one of the newsletters that I included in my blog post of favorite newsletters, which I’ll link to in the show notes. And of course I’ll also give you a link to directly subscribe to Short Squeez if you want to check it out.

A few more thank you’s before diving.

Thank you to Plancorp CEO Chris Kerckhoff for the support of my podcast launch. Chris fosters an innovative spirit at Plancorp, and I’m incredibly fortunate that he continues to cheer me on as I expand the number of ways I seek to educate and help the public.

I also think our Chief Compliance Officer, Mike Esson, deserves as massive shoutout because he listens to every single episode for compliance approval. He also has to review my other content, which if you subscribe to my newsletter or follow me on social media, you know is quite a lot. Thank you Mike for all your hard work and patience when I create time crunch deadlines.

And finally, I want to thank my wife Ann for her continued support of all my work. I’ve always had to work outside traditional office hours, but with the podcast, there have been several times when I’ve needed to record or prepare for an episode at a less than ideal time, so obviously that’s a huge help. But generally speaking, nothing gives me more energy than her support and encouragement, so thank you Ann for being in my corner.

Okay, let’s dive into some questions!

…

There was an article in Barron’s on the inevitability of a market downturn in January — huge selling from capital gain postponement, frothy valuations, and a decline in big tech which makes up 25-30% of the S&P 500. One of the suggestions was buying puts. Is that a good strategy or is it better to sell some stocks ahead of a big decline?

It’s one thing to employ option strategies when you have significant single stock exposure because that idiosyncratic risk isn’t compensated, so there is merit in wanting to hedge it away. But I don’t think options make sense for a long-term investor with a globally diversified portfolio.

When you have broad market exposure, the risk and uncertainty you assume is compensated with higher long-term returns than what you’d earn in bonds or cash.

Said another way, the risk and uncertainty you assume when investing broadly in the stock market is simply the cost of higher expected returns.

You can’t have equity returns without equity risk. Yes, it would be profitable to avoid the downturns, but that’s not really possible to do without missing out on substantial parts of up markets, which are disproportionately larger than down markets and last a disproportionately longer period of time.

As a long-term investor, you must embrace losses. They are incredibly normal. In fact, the S&P 500 averages a 10% loss about every 12 months, so any such pullback should always be expected. And historically 20% drops happen about every 3.5 years and 30%+ drops about once a decade.

When you really internalize the normalcy of losses, predictions of a stock market downturn simply just aren’t that interesting.

Rather than try to predict when the market will fall and make portfolio moves based on those predictions — a process that research conclusively shows is a bad approach — you should plan on losses occurring with a similar magnitude and frequency as they have in the past.

This means having a mix of stocks and bonds that aligns with your ability and willingness to live through these inevitable downturns.

That’s literally the first thing we do after building out a financial plan. We stress test that financial plan across thousands of scenarios using different mixes of stocks and bonds to find the right mix.

Related Episodes:

- EP 10: The Secret to Timing the Market

- EP 23: Valuations, Interest Rates, and Inflation with Gerard O’Reilly Co-CEO of Dimensional

I’ve had a few other questions related to investing at all time highs, so I won’t read them all, but instead will share just one quick thing about all-time highs:

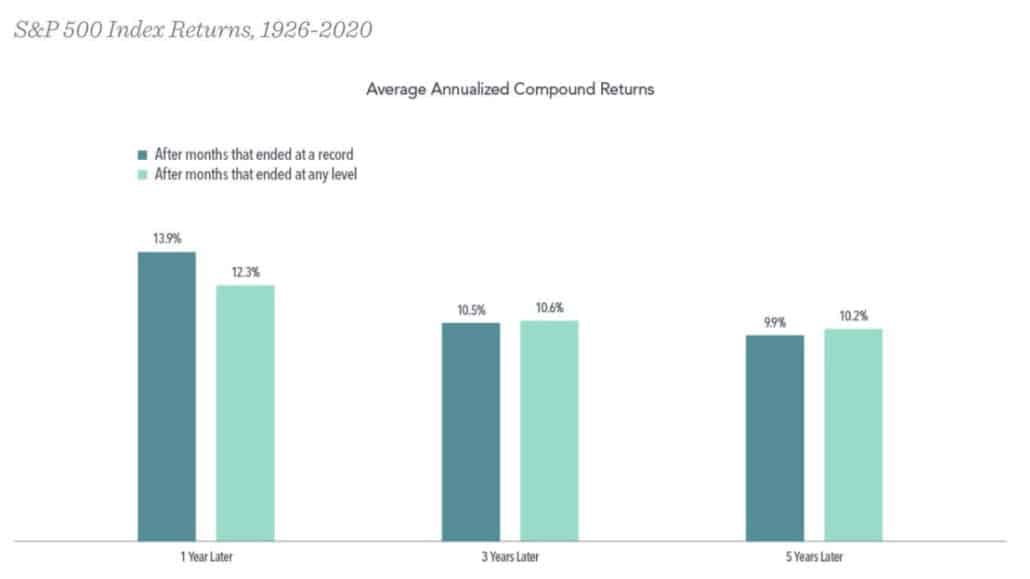

When you look at S&P 500 Index data, the returns in the one, three, and five years after a new market high are incredibly similar to the average returns for the index over any one-, three-, or five-year periods.

If you were to look at the 1,000-plus monthly closing levels between 1926 and 2020 for the S&P 500, 30% of the monthly observations were new market highs.

After those highs, the average annualized compound returns ranged from 14% one year later to just under 10% five years laters.

And if you just look at whether the S&P rises or falls after an all time, 82% of the time it’s higher one year after reaching an all time, and 78% of the time it’s higher five years after the all time high.

I’ll share a chart recently published by Dimensional Fund Advisors that relays a lot of this information, but the short of it is that reaching a new market high doesn’t mean the market is set for doom. Reaching record highs with some regularity is exactly what one should expect.

Would it make sense to sit in cash rather than bonds for a while? Is anybody doing this? I’m convinced that inflation is here to stay and that interest rates will be rising. What are you guys advising these days?

I had a couple of inflation questions, so I’ll address that part of the question more squarely in a moment. But first I’m going to focus on the rising interest rates aspect.

Episode 18 is a quick primer on what you need to know about bonds. If this listener’s question is something on your mind, you should check it out because it provides a lot of context to the interest rate environment we’re in today…

When interest rates rise, bond prices fall. This is because existing bonds are less valuable than newer bonds being issued at higher rates.

If you own a portfolio of individual bonds, rising rates are particularly harmful as it’s nearly impossible to have enough regular cash flow from a dozen or even two dozen bonds to take advantage of the higher rates.

But rising rates are actually a good thing for bond funds owning hundreds, if not thousands, of bonds. That’s because they are constantly receiving cash from interest and principal, which means they can quickly reinvest at higher rates to help boost long-term returns.

For what it’s worth, I think interest rates will rise in 2022, but that doesn’t mean I’m altering portfolios to reflect that viewpoint. And I certainly don’t like the idea of going to cash.

While sitting in cash ensures that you won’t experience any nominal losses, it is also ensures that you will lose purchasing power over time.

Also, you would have to make a decision at some point on when to get back into the bond market and that wouldn’t be a straightforward decision either. That’s the problem with any form of market timing whether it’s with stocks or with bonds.

Look…Risk and return are related. Bonds do occasionally lose money, but the good news is that their losses are far less severe than stock market losses.

And if bonds lose money, that doesn’t mean they aren’t doing their job within a portfolio.

The primary role of bonds for a long-term investor is to reduce the overall volatility of the portfolio. Contrary to what many believe, the role of fixed income is not actually income. It’s certainly not supposed to be the driver of growth or returns either.

The role of bonds in a portfolio is diversification and stability relative to stocks.

So that’s a really long way of saying that I don’t see how going to cash helps anything. Again, my personal opinion is that interest rates are likely to rise in 2022, but that doesn’t mean I’d move out of bonds.

Should we be looking at TIPS or inflation protected bonds?

This question is me shortening many versions of this question…

One thing that has bothered me a bit about people wanting to add inflation protection now is that the unexpected inflation has already happened. The cost of insuring against an event that is currently happening is naturally going to be higher than it would have been in advance.

Now, I personally think about portfolio design using the well-founded idea that stocks are the best long-term hedge against inflation and, for most people, short duration bonds offer enough of a hedge against short-term inflation.

However portfolios that are bond dominant — portfolios with at least 50% allocated to bonds — might have more need for an explicit inflation hedge.

When it comes to TIPS, those are usually the most commonly discussed investment for those wanting to hedge inflation.

But TIPS returns don’t track inflation, they are actually driven by unexpected changes in inflation. So if you buy TIPS today, inflation needs to be higher than the market is expecting in order for it to pay off. Betting against the market is always a dangerous proposition.

TIPS are also far more volatile than other investment grade bonds, in large part because of their high duration, which means they are very sensitive to changes in interest rates.

In my experience, people love TIPS on paper, but have a really hard time sticking with them due to the way the behave in real time. I think they have a place in hedging specific liabilities several years out, but I personally prefer stocks to hedge against inflation future liabilities that are five years away or more.

When it comes to explicitly hedging in a fixed income portfolio, I’m more in favor of products that use CPI swaps to hedge inflation because they are far less volatile and represent a more direct hedge to the liability those types of portfolios ought to be concerned about.

With the yields on I-Bonds above 7%, why wouldn’t someone invest their entire bond portfolio in something like this?

I really wished I could have done a mailbag episode in December just for this question because I-Bonds were getting a lot of attention in the media and finance blogosphere as this great hack.

I Bonds are government securities that pay a fixed rate and the inflation rate. Right now the fixed rate is 0.00% and the inflation rate is 7.12%, so naturally you can understand why people might be interested in a government bond yielding 7.12%.

The fixed rate and inflation rate change every six months, so you shouldn’t expect to necessarily earn this rate for more than six months. You can find details for how the rate is set and the historical rates here

So while it’s great to get a 7.12% rate on a government security, there are a few catches:

- You can only purchase $10,000 per person (although you can get up to $5,000 of your tax return issued in paper issued I-Bonds that don’t count towards the annual purchase limit)

- Purchases must happen directly through Treasury Direct

- The rate is very unlikely to remain this high and historically the rate has been very low

- You can redeem Series I bonds any time after 12 months and receive the original purchase price plus interest earnings. But I bonds are meant to be longer-term investments; so if you redeem an I bond within the first 5 years, you’ll lose your last 3 months interest. For example, if you redeem an I bond after 18 months, you’ll receive the first 15 months of interest.

The thing you may have seen in the media suggested that a married couple should buy $20,000 at the current rate this December and buy another $20,000 in January. Then you could have a total $40,000 in this security.

If you want to buy I-Bonds, there isn’t much harm. Just be aware of the information I’ve shared and keep your expectations in check.

Final question: I’ve been using a 2055 Target Date Retirement in my 401(k) for several years now. I know it’s cheap, but I was looking at performance and thinking it was a bit of a dog relative to what the market did in 2021. Should I be looking at other options?

A lot of people these days have access to Target Date Funds, which simply give people a mix of stocks and bonds that the provider feels is appropriate based on the approximate year you plan to retire.

Target date funds from Vanguard, Fidelity, and T Rowe Price make up almost 90% of the overall target date universe (although there are many more providers than that), so I’m going to assume this listener is using one of those funds which gives me confidence in my response to this question.

Most people use the S&P 500’s return as their proxy for “the market.” The S&P 500 was up 28.71% in 2021, so it was a really nice year, no doubt about it.

But target date funds own more than the S&P 500, which represents U.S. Large Cap Stocks. TDFs own other parts of the equity market such as mid cap, small, international, emerging markets – all of which had lower returns than the S&P 500 (which again, measure the performance of U.S. Large Cap stocks).

TDFs also have a bond allocation, which in many cases had a negative return in 2021 since interest rates rise.

The point here is that there is nothing wrong with your TDF underperforming the S&P 500. There will undoubtedly be years where U.S. Large Cap stocks are not the best performing asset class and the TDF’s performance will look superior.

That’s all for today. I know I started the episode thanking a bunch of people who have helped make this podcast possible, but somehow I forgot to thank you, the listeners.

This has been a great new experience for me and I want it to be a great one for you, so please leave me reviews on Apple Podcast or Spotify Podcasts. This helps me make the show better and (believe it or not) it also helps people find the show more easily.

And don’t forget to subscribe to the show so that you never miss an episode.

As always, you can find show notes on TheLongTermInvestor.com. And keep sending me questions. These Q&A/mailbag episodes are great.

Until next time, to long term investing!

Resources

- Enter my 2022 Outlook Survey to try and win a $500 Amazon Gift Card

- Read more about the 2022 Outlook Survey Here: Forecasting the Market: The 2022 Outlook Survey

- EP 10: The Secret to Timing the Market

- EP 23: Valuations, Interest Rates, and Inflation with Gerard O’Reilly Co-CEO of Dimensional

- EP 18: What You Need to Know About Bonds

- EP 8: Investing For Inflation

- I-Bond Rates

- Submit your question for the show through my “Ask Me Anything” form

Get Your Finance Questions Answered

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

If you enjoy the show, you can subscribe wherever you listen to podcasts, and please leave me a review. I read every single one and appreciate you taking the time to let me know what you think.

About the Podcast

Long term investing made simple. Most people enter the markets without understanding how to grow their wealth over the long term or clearly hit their financial goals. The Long Term Investor shows you how to proactively minimize taxes, hedge against rising inflation, and ride the waves of volatility with confidence.

Hosted by the advisor, Chief Investment Officer of Plancorp, and author of “Making Money Simple,” Peter Lazaroff shares practical advice on how to make smart investment decisions your future self with thank you for. A go-to source for top media outlets like CNBC, the Wall Street Journal, and CNN Money, Peter unpacks the clear, strategic, and calculated approach he uses to decisively manage over 5.5 billion in investments for clients at Plancorp.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.