The most important rule in planning for retirement is to save early and often.

How early and how often?

Start as soon as you begin earning an income and save some of every paycheck.

If you haven’t been saving, then the time to start is now. Saving early gives you what we’ve just seen is critical to leveraging the power of the compounding: a long time horizon.

Compound interest is like rolling a snowball downhill.

As it rolls along, it collects more snow with each rotation. The further it rolls, the more mass it can exponentially gain.

That’s why Warren Buffett says, “Life is like a snowball. The important thing is finding wet snow and a long hill.”

The wet snow is the interest you reinvest to pick up even more interest as you roll along.

The long hill is the multiple decades you give yourself if you start saving early.

Compound Interest in Action

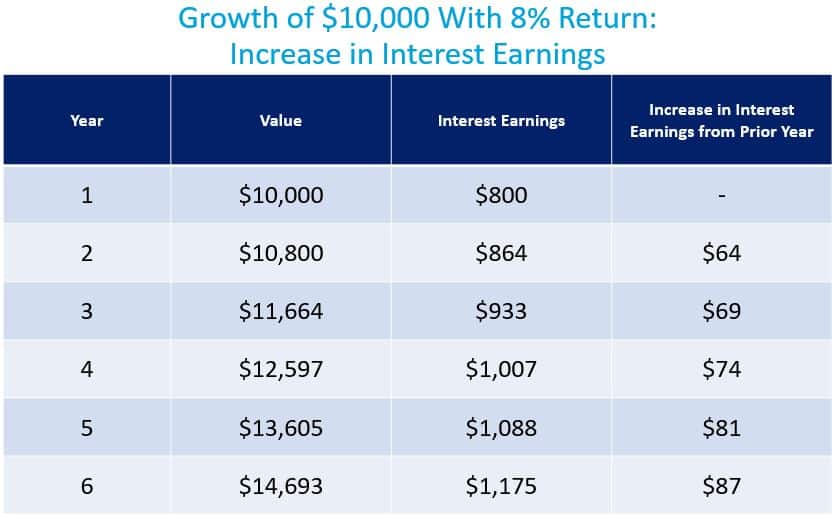

To see this in action, let’s look at a $10,000 investment earning 8 percent each year. As you can see, the amount of interest income increases every year even though the interest rate remains unchanged.

Just as a snowball accumulates more snow with each rotation as it increases in size, your investment generates a greater amount of earnings as the return is applied to a larger amount each year.

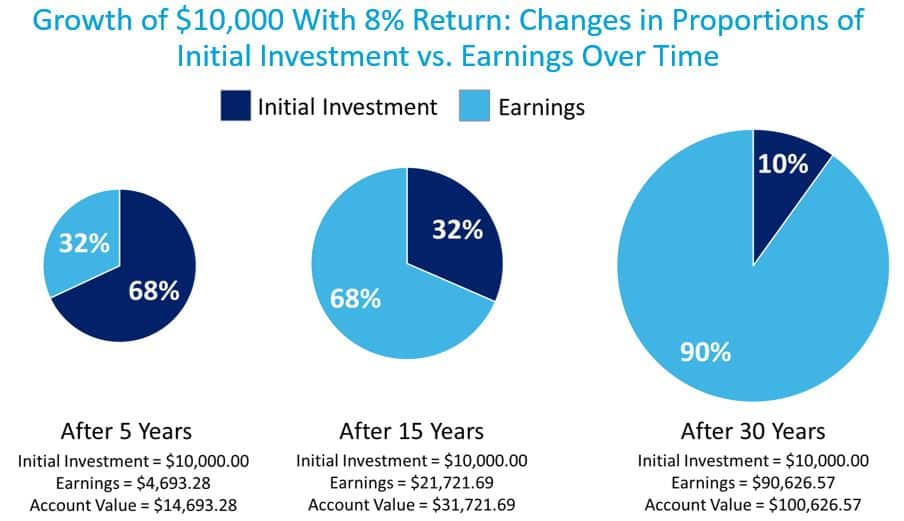

Over time, the interest earned surpasses that of the initial investment, which you can see in the next chart.

If you withdraw the interest earnings each year rather than reinvesting those earnings, then you receive $24,000 in interest payments over 30 years ($800 per year).

However, reinvesting the interest each year earns you an additional $66,626 in interest on top of the $24,000 earned by the initial investment.

While this math is compelling on its own, saving early creates an even more impressive impact.

Starting Today vs. Starting Tomorrow

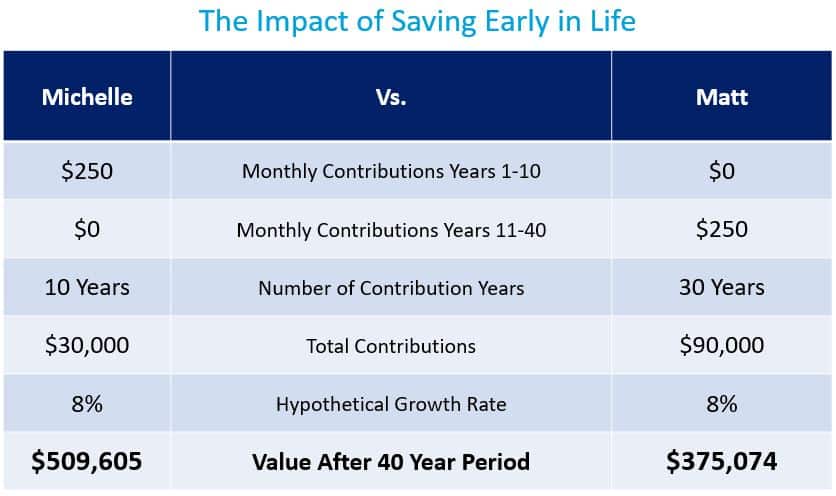

Let’s imagine two recent college graduates named Michelle and Matt, who each earn an 8 percent rate of return on their investments.

Michelle starts investing today by making a $250 contribution each month to her retirement account. After ten years of these monthly investments, Michelle needs the $250 to cover additional expenses related to relocating for a new job. She doesn’t make any further contributions to the account and doesn’t touch the balance until she retires 30 years later.

Matt, on the other hand, is still in the college mindset and figures there is plenty of time to save for retirement later. Ten years from now, he begins investing $250 every month until he retires 30 years later.

Whose nest egg is bigger at retirement?

Let’s take a look…

Michelle comes out ahead despite contributing less money to her account for fewer years than Matt. Michelle’s secret to success is starting early, which gives her a longer time horizon than Matt.

As your time horizon increases, so does the effect of compounding.

Even though Michelle made a smaller total contribution, her investment had more time to benefit from the effects of compounding.

That is why the most important rule of retirement savings is start early.

Make Compound Interest Work For You

For what it’s worth, if Michelle or Matt had found a way to save $250 a month from age 22 to age 67, they would have retired with $1,318,635. In other words, saving less than $10 a day can add up to over $1 million in wealth.

Can you find an extra $10 a day to contribute to your investment account?

It’s easy to procrastinate with savings, particularly for long-term goals such as retirement, but understanding the power of compounding should convince you to do otherwise.

Are You Ready To Make Smart Decisions With Your Money?

Saving early and often is just one of many different strategies you can use to grow your wealth and earnings overtime so you have a secure and comfortable future for yourself and family.

At times, decoding what to do with your money can feel complex and overwhelming. There are a lot of questions to answer…

- Am I making the right decisions with my money?

- How do I plan for the costs of my kids education?

- What should I be doing now so I can take care of my parents in their later years?

- What happens if there is another market meltdown?

However, if you have a trusted advisor who can map out your goals and give you professional insight, your finances can be simple, stress free and on-track.

Learn ways I can help you simplify your finances, build a secure future and take the guesswork out of growing your wealth.

Here are a few other resources you may find helpful:

- Take my financial wellness assessment and learn in just 9 questions your biggest areas of opportunities you should be focusing on in your finances.

- Get my book Making Money Simple for a full guide on getting your financial house in order and keeping it that way forever.

- Read popular posts How to Automate Your Finances and Should I Invest Or Pay Down Debt?

Now it’s your turn…

Share in the comments: if you could go back in time and give yourself one tip about making smart money decisions, what would it be?