Listen Now

I’d like to start today’s conversation by zooming in on the ‘Magnificent 7.’ If you’re not familiar with the Mag 7, that’s: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla.

Each of these companies has fundamentally transformed the industries they operate in—from how we communicate and consume media, to the way we shop, work, and even drive.

Alphabet’s innovations in search and advertising, Amazon’s revolution in retail and cloud computing, Apple’s iconic products that have become a part of daily life, Meta’s social media empire, Microsoft’s dominance in software and cloud services, Nvidia’s groundbreaking advancements in graphics and AI, and Tesla’s disruptive impact on the automotive and energy sectors.

See EP.142: Why Nvidia’s Boom Isn’t a Missed Opportunity

These titans of technology and innovation have been at the forefront of the S&P 500’s extraordinary performance, delivering a combined return of 75% in 2023 alone. Meanwhile, the S&P 500 as a whole posted a return of just 24% for the same period.

Sign me up for an annual return of 24% anytime…but the performance disparity between the Magnificent 7 and the S&P 500, along with the size of the Mag 7 relative to the broader index, has many investors wondering…

Have U.S. markets become too reliant on the largest companies?

…

Sign up for my newsletter so you can easily reply to my emails with your thoughts or questions for the podcast:

Equity Concentration Isn’t New

This phenomenon isn’t new. History shows us that market concentration has always been a factor in overall returns.

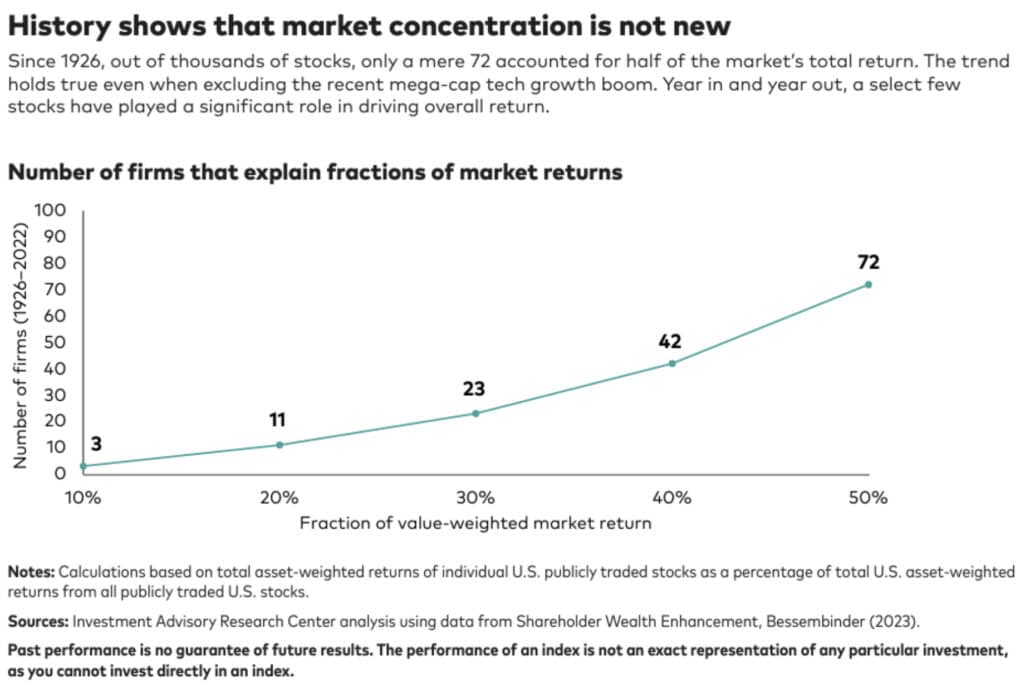

The chart below comes from a Vanguard Investment Advisory Research Center analysis.

As you can see, since 1926, market concentration has been a recurring theme, with a small fraction of companies often driving a disproportionate share of market returns.

However, the S&P 500 is witnessing its highest level of market capitalization concentration in decades.

The chart below from Goldman Sachs Research highlights that the dominance of the ‘Magnificent 7’ today is unprecedented in its scale and impact.

According to Goldman Sachs Research, the top 10 U.S. stocks now command a staggering 33% of the S&P 500’s total market value. This level of concentration surpasses even the peak of the tech bubble in 2000.

While the dominance of a handful of companies often seems to raise alarms over market health, here’s where things get interesting.

According to this historical data from Goldman Sachs, periods of high concentration have not necessarily spelled doom for the market. In fact, more often than not, the S&P 500 has rallied in the 12 months following these peaks of concentration.

History tells us that such concentration isn’t inherently negative and can, in fact, precede significant rallies. But there is still the question of how our approach to diversification is impacted by a landscape where the Magnificent 7 not only shines but sometimes seems to overshadow the rest.

Diversification in a Concentrated Market

The concept of not putting all your eggs in one basket is foundational in investing.

Yet, the balance between embracing the growth potential of the ‘Magnificent 7’ and maintaining a diversified portfolio presents an interesting challenge.

In charting your course through the waters of market concentration, remember that the goal isn’t just to avoid risk but to understand and manage it.

Looking beyond the market-cap-weighted S&P 500 to other indices or diversification strategies could mitigate some of these concentration risks.

Within the U.S. alone, diversifying beyond the S&P 500 could involve including mid-and small-cap stocks, adding intentional factor weights, or perhaps even ESG exposures. Diversifying doesn’t mean abandoning the Magnificent 7; rather, it’s about complementing them with exposures that have different expected returns.

In addition, most investors should have international market exposures.

I recognize the increasingly popular idea for investors—although I believe it to be fundamentally flawed—is that the S&P 500 offers enough global diversification that directly owning international stocks isn’t necessary. I’d like to point out that the gain in popularity of this idea seems to be perfectly correlated with recent U.S. outperformance, but I’ll avoid that tangent for now.

For the purposes of this conversation, international exposure offers a twofold advantage: not only do you tap into the growth potential of emerging and developed economies, but you also dilute the concentration risk tied to the U.S. market.

I think that mostly covers the concerns one might have related to the S&P 500 being highly concentrated among the largest companies. So I’d like to conclude with two ideas related to this topic that don’t get as much attention.

Beyond the S&P 500 Concentration Headlines

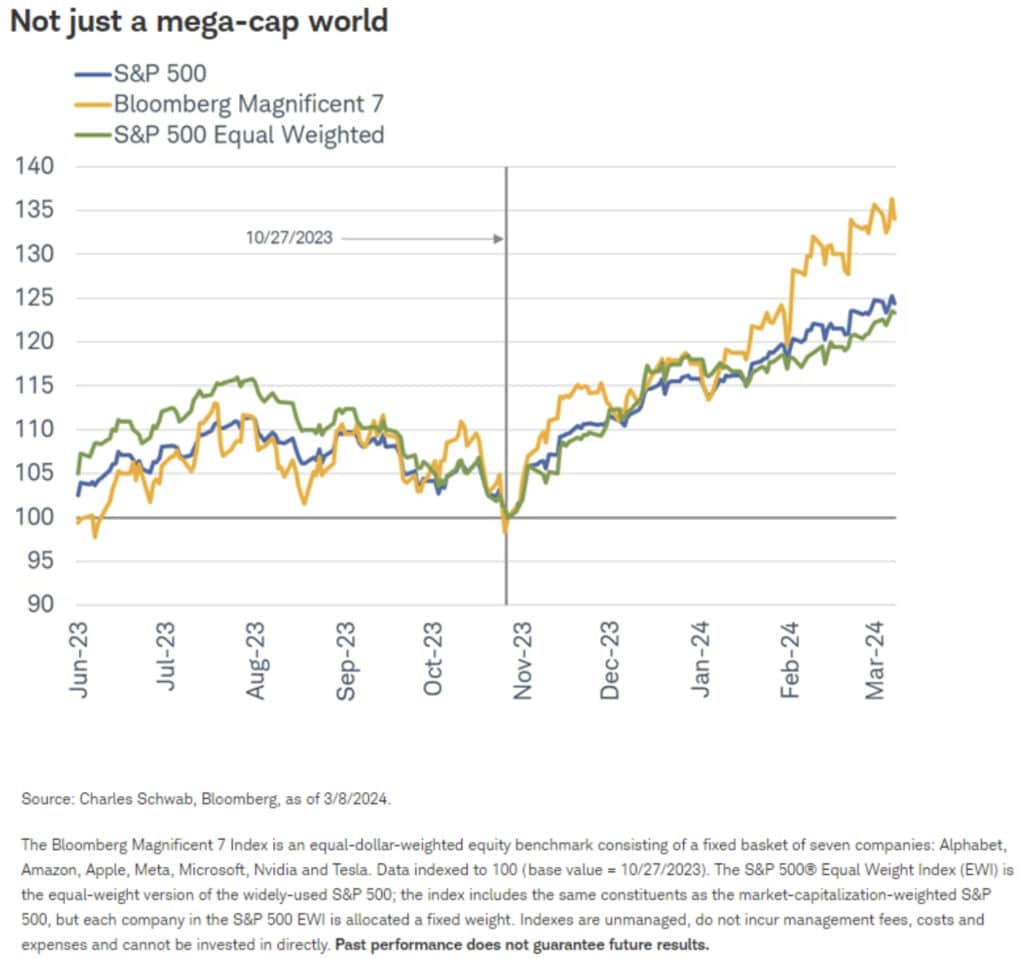

Despite all of today’s discussion on the Magnificent 7’s dominance, it’s worth pointing out that both the market-cap-weighted and equal-weighted S&P 500 indexes have been tracking closely with each other since the end of the last major correction.

The chart below from Charles Schwab illustrates this well.

This development is noteworthy for several reasons.

Firstly, it highlights the resilience and dynamism of the broader market. While the ‘Magnificent 7’ continue to play a pivotal role, the performance of the equal-weighted S&P 500 Index suggests that the strength of the market’s rally is not solely dependent on these tech behemoths. This is a welcome shift for investors who value diversification as a core principle of their investment strategy.

Secondly, the narrowing performance gap within the ‘Magnificent 7’ itself—with members like Apple, Tesla, and Alphabet showing varied returns—underscores the importance of systematic rebalancing.

See EP.144: Why You Must Take Capital Gains to Rebalance Your Portfolio

If you happen to own some of the individual stocks within the Mag 7, chances are you have some really nice returns because as companies grow to become some of the largest on the US stock market, their returns can be impressive.

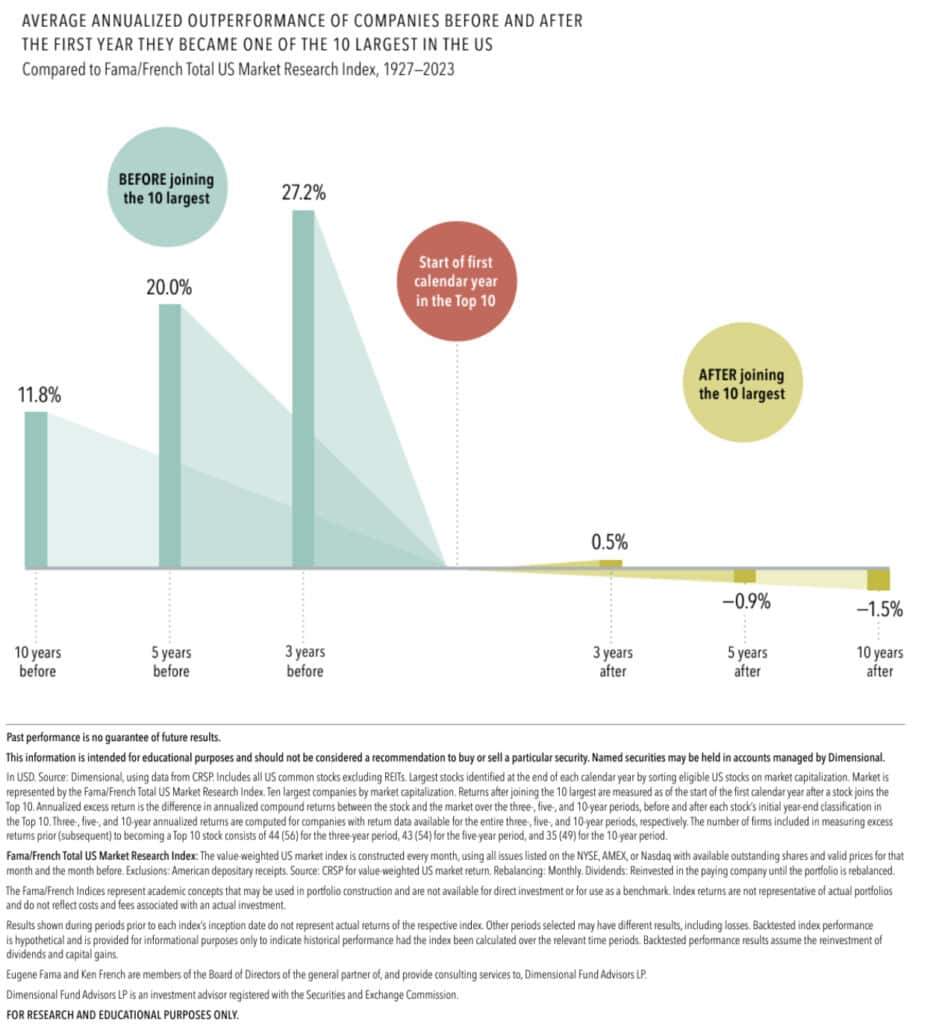

As you can see in the chart below from Dimensional Fund Advisors, not long after joining the Top 10 largest by market cap, these stocks, on average, have lagged behind the market.

- From 1927 to 2023, the average annualized return for these stocks over the three years prior to joining the Top 10 was more than 25% higher than the market.

- Five years after joining the Top 10, these stocks were, on average, underperforming the market— a stark turnaround from before. The gap was even wider 10 years out. −1.5% 10 years after

See EP.118: 4 Ways to Diversify Concentrated Stock Positions

See EP.63: Should You Invest in Individual Stocks?

Expectations about a firm’s prospects are reflected in its current stock price. Positive news might push prices higher, but those changes are not predictable.

Resources:

- See EP.142: Why Nvidia’s Boom Isn’t a Missed Opportunity

- See EP.144: Why You Must Take Capital Gains to Rebalance Your Portfolio

- See EP.118: 4 Ways to Diversify Concentrated Stock Positions

- See EP.63: Should You Invest in Individual Stocks?

- Is the S&P 500 Too Concentrated? (Goldman Sachs)

The Long Term Investor audio is edited by the team at The Podcast Consultant

Submit Your Question For the Podcast

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

I read every single one and appreciate you taking the time to let me know what you think.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.