Successful investing is all about minimizing mistakes. Perhaps the most common mistake among people who take a natural interest in investing is owning individual stocks.

Listen now and learn:

- How many professional investors failed to outperform the market

- A few mind-blowing statistics on the historical performance of individual stocks

- How taxes should be considered when diversifying out of stock positions

Listen to the show below or read my detailed show notes.

Listen Now

Show Notes

The purpose of investing is to grow your money at a rate greater than inflation without taking undue risk.

So when you hold individual stocks, what is it you are trying to achieve?

To me, an investor holding individual stocks is doing so because they think it will outperform the overall market. I used to hear people talk about holding a diversified basket of individual of, say, 10-30 stocks as a way to get broad market exposure at no cost.

Some people still make this argument, but I’m not sure it’s really valid when you can buy the Vanguard Total Stock Market Index Fund ETF (VTI) for 0.03% and over 4,000 stocks that track the overall U.S. stock market.

If you want to capture the market return for the entire world, the Vanguard Total World Stock ETF (VT) owns over 9,400 stocks as it seeks to track the performance of the entire global stock market and only costs 0.07%.

Thus, the only real reason someone would own an individual stock is because they think it will beat the overall market.

Remember, the purpose of investing is to grow your money at a rate greater than inflation without taking undue risk. When you hold individual stocks – whether it’s because you bought them yourself, accumulated a position from equity compensation, or inherited shares – you are taking far more risk than you probably realize.

The Pros Can’t Do It, So Why Would You Be Able to Do So?

This to me is the most common-sense reason people shouldn’t be holding individual stocks is that even professional investors can’t successfully do so.

Each year, S&P Dow Jones Indices puts out a scorecard for how active managers perform versus their benchmarks as well as the overall market. It’s called S&P Index Versus Active (or SPIVA) Scorecard. You can see the latest one here.

There are a lot of ways they splice up the data, but there is a nice table that summarizes the underperformance of professional active managers.

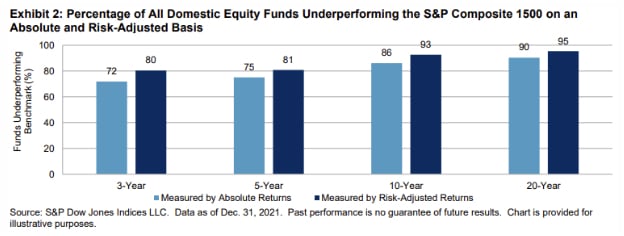

The chart shows the percentage of U.S. equity funds underperforming the S&P Composite 1500 on an absolute and risk-adjusted basis.

- Over the last three years, 72% underperform in absolute terms and 80% underperformed when measured by risk-adjusted returns.

- Over the last 5-years, 75% underperformed on an absolute basis and 81% when measured by risk-adjusted returns.

- For the 10-year period, 86% underperformed on an absolute basis and 93% on a risk-adjusted basis

- For the last 20 years, 90% underperformed on an absolute basis and 95% on a risk-adjusted basis

The takeaway here is clear: professional managers fail to outperform the market. It’s their full time job. They have unbelievable data and resources. And yet they still fail.

Individual investors holding individual stocks as well as brokers or advisers recommending the use of individual stock positions should not expect to do any better.

The Risk of Owning Individual Stocks

JP Morgan studied individual stock performance from 1980-2014 and uncovered some really eye-popping risks. The big takeaway is that over the long run, the odds are stacked against individual stocks.

The Agony and the Ecstasy: The Risks and Rewards of a Concentrated Stock Position

There are two really big statistics that stand out to me from this report.

The first has to do with the risk of permanent impairment. Using a universe of the Russell 3000 companies since 1980, roughly 40% of all stocks have suffered a permanent 70%+ decline from their peak value.

For reference, the Russell 3000 measures the performance of the largest 3,000 U.S. companies, representing about 98% of the investable U.S. equity market.

Let’s dig into the first statistic on catastrophic loss stat a little bit…

JP Morgan analyzed all stocks that were members of the Russell 3000 at any time from 1980 to 2014. They defined a catastrophic loss as “a decline of 70% or more in the price of a stock from its peak, after which there was little recovery such that the eventual loss from the peak is 60% or more.”

This is obviously a subjective cutoff point, but that 40%% of all stocks suffered such a catastrophic loss is a very big number. And while the rate at which companies experience this type of loss increases during recessions and market corrections, the data shows a pretty steady pace of distress during economic expansions, too.

While I’m simply verbalizing what I’m seeing here in the data, here is a quote directly from the research report: “A meaningful number of companies are always in the process of suffering sharp, unrecovered price declines at any given time, even during an economic expansion.”

The second set of statistics that stands out to me in this report is that most stocks experience negative lifetime returns vs the broad market.

- The study found that the return on the median stock since its inception vs an investment in the Russell 3000 Index was -54%.

- They also found that two-thirds of all stocks underperformed vs the Russell 3000 Index

- And for 40% of all stocks, their absolute returns were negative

One might think that perhaps you can avoid these outcomes by avoiding certain sectors and/or emphasizing others. But in reality, the report shows that the success/failure distribution is similar across most sectors.

One final focus area of note that I’ll share from the report is the sector case studies. Basically, they take a deep dive into specific companies experiencing catastrophic losses on a sector by sector basis.

One of the common things I hear from people holding individual stocks, particularly those who acquired the stock via an equity compensation plan, is their perceived knowledge of the company’s outlook and future returns.

As I like to remind people, the analysts covering their company’s stock often know more than the company’s management, so any expectations about the future are likely priced into shares already. Short of material inside information that a few top executives might hold, it’s naïve to think you have more information and insight about your company than the overall market.

But I think another thing that gets overlooked is that sometimes things just go wrong.

The JP Morgan report certainly highlights that many companies suffered catastrophic losses due to factors largely outside management’s control. They provide a table summarizing some of the exogenous factors that can put companies at risk and which are outside of management’s control:

What About Taxes?

More times than not, you don’t want to let the tax tail wag the dog. But there are instances when diversifying away from individual stocks needs to be viewed through a tax lens.

This is particularly true for older owners of individual stocks with low cost basis because (according to current tax law) they will receive a step-up in basis at death, which then wipes away any capital gain exposure.

But even still, most people seem to overestimate the tax costs relative to the potential return benefits associated with diversifying out of individual stocks. Page 35 of the report models out the impact of taxes on the overall returns realized from diversifying out of an individual stock with a cost basis that is 20% of the current stock price. It basically compares how a stock performs relative to the Russell 3000 after the sale and the time horizon, which reflects how long the owner would have held the stock otherwise (until a step-up in basis at death).

If it outperforms, then selling to diversify is obviously a net negative outcome. However, if it underperforms, selling to diversify typically results in a positive outcome net of taxes. In the very few instances in which this is not true, the holding period is less than 6 years.

Here’s how I interpret this data:

Unless you think you might die in the next 6 years, more often than not it’s going to make sense to realize capital gains in order to diversify out of individual stock positions with a cost basis that is 20% or more of the current stock price. If your cost basis is even lower, but you think you will live at least a decade, then you should still make the investment decision with the highest probability of success and not necessarily the lowest tax bill.

Investing in Individual Stocks as a Hobby

In any matter where we lack certainty, we can turn to probability. Probabilities give us a rational way to make decisions about a completely unknown future. And the probabilities in this situation suggest it’s best to stay away from stock picking.

But even if you were to ignore those probabilities and gamble on an individual stock or two, how would it change your life if you happened to pick a massive winner? Would you retire early? Buy a yacht?

My guess is it wouldn’t change anything. The only way it could change your lifestyle (currently or in the future) is if you bet an outsized portion of your net worth on a single position or two.

Given the probabilities, I think you would agree betting a large percentage of your net worth in this manner is simply irresponsible.

If you guess wrong and have a large amount of your wealth wiped out, can you afford to start over from scratch?

If you still want to buy individual stocks or even sector-specific ETFs in an effort to hit a home run, and you know it won’t change your lifestyle if you’re right – then I’d ask the most important question: What’s the goal?

If the goal is to provide yourself entertainment, I actually understand that and even sympathize with it. If your financial house is in rock-solid shape – and I mean ROCK solid – then here is a suggestion:

Put a small amount of money in a separate taxable account from your primary investments. In my opinion, this amount of money should represent 1% or less of your net worth because, remember, we know the odds say you are likely to trail the overall market and even experience a permanent loss of capital. Plus, even if you do a good job, it’s unlikely to change your life.

Then make your bets. Go crazy. Have fun. But leave your core long-term investments alone.

Meanwhile, remember: a good financial plan doesn’t require you to hit home runs. It merely requires you to earn a decent return that compounds its way into exponential wealth growth.

Good investing is boring. If you’re having more fun watching your portfolio than watching paint dry, you’re probably doing it wrong.

Resources

- S&P Index Versus Active (or SPIVA) Scorecard

- The Agony and the Ecstasy: The Risks and Rewards of a Concentrated Stock Position

- The Agony and the Ecstasy: The Risks and Rewards of a Concentrated Stock Position

Submit Your Question For the Podcast

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

If you enjoy the show, you can subscribe wherever you listen to podcasts, and please leave me a review. I read every single one and appreciate you taking the time to let me know what you think.

About the Podcast

Long-term investing made simple. Most people enter the markets without understanding how to grow their wealth over the long term or clearly hit their financial goals. The Long Term Investor shows you how to proactively minimize taxes, hedge against rising inflation, and ride the waves of volatility with confidence.

Hosted by the advisor, Chief Investment Officer of Plancorp, and author of “Making Money Simple,” Peter Lazaroff shares practical advice on how to make smart investment decisions your future self with thank you for. A go-to source for top media outlets like CNBC, the Wall Street Journal, and CNN Money, Peter unpacks the clear, strategic, and calculated approach he uses to decisively manage over 5.5 billion in investments for clients at Plancorp.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.