Listen Now

Show Notes:

The market has hit an all-time high, what does this mean for investors?

What significance do record-breaking returns have when looking back at past market cycles? How can you balance risk and opportunities to make confident investment decisions if the market is up?

I dive into all this and more from a Chief Investment Officer’s perspective in this week’s episode.

Navigating the Peaks: A Rational Approach to Investing at Market Highs

In the ever-evolving landscape of the stock market, reaching all-time highs can often be perceived as a double-edged sword by investors. While such peaks are a testament to the growth and resilience of the market, they also bring about a sense of caution and uncertainty.

On one hand, your existing investments are soaring. On the other, there’s this niggling worry – are we on the brink of a downturn?

…

Sign up for my newsletter so you can easily reply to my emails with your thoughts or questions for the podcast:

Understanding Market Dynamics at All-Time Highs

Looking at the S&P 500, which has data going back to 1926, provides useful perspective. Using monthly data, roughly 30% of closing levels have been new highs.

This statistic underscores a fundamental characteristic of the stock market: it is inherently inclined to reach new heights over time.

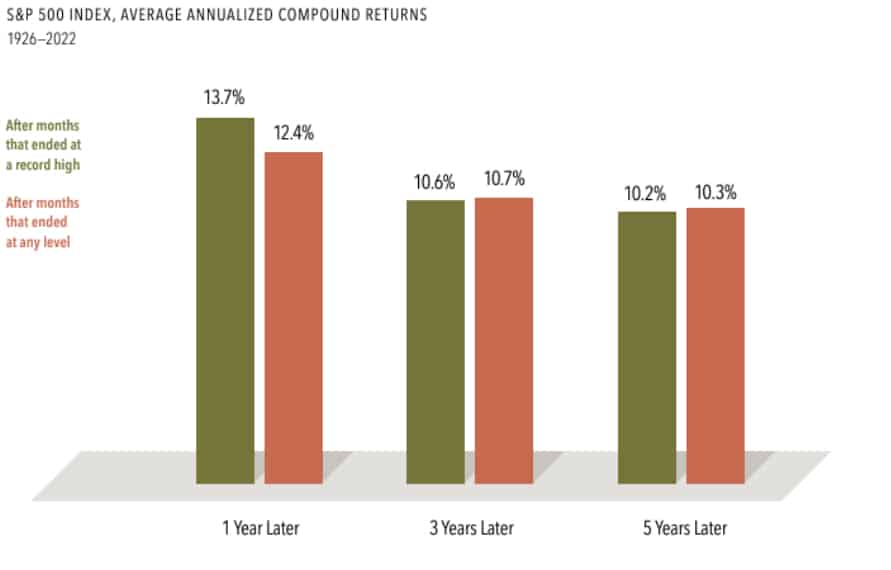

Following these all-time highs, the market has shown a tendency to continue its upward trajectory, with average annualized returns of 13.7% one year later, while averaging 10.6% over the subsequent three-years and 10.2% in the five years following a new all-time high.

Those three and five-year figures align closely with the market’s overall average performance across similar time frames, so that should give you some confidence for what lies ahead. And while the market doesn’t always go higher, historically the market has been higher 82% of the time one year after making a new all-time high.

A common misconception among investors is the belief that a peak must invariably be followed by a decline.

This notion, often fueled by sensationalist financial journalism and a human tendency to expect reversion, overlooks the fundamental nature of stocks.

Stocks represent perpetual claims on companies’ earnings and dividends, grounded in the continuous efforts of businesses to innovate and provide value. As such, they are priced with a positive expected return, making the achievement of record highs a likely and regular occurrence.

Long-Term Perspective and Embracing Market Fluctuations

The key to navigating market highs lies in maintaining a long-term investment perspective.

When you have broad market exposure, the risk and uncertainty you assume is compensated with higher long-term returns than what you’d earn in bonds or cash.

Said another way, the risk and uncertainty you assume when investing broadly in the stock market is simply the cost of higher expected returns.

You can’t have equity returns without equity risk.

Yes, it would be profitable to avoid the downturns, but that’s not really possible to do without missing out on substantial parts of up markets, which are disproportionately larger than down markets and last a disproportionately longer period of time.

As a long-term investor, you must embrace losses.

They are incredibly normal. In fact, the S&P 500 averages a 10% loss about every 12 months, so any such pullback should always be expected. And historically 20% drops happen about every 3.6 years and 30%+ drops about once a decade.

But historical data illustrates those downturns, while inevitable, are often followed by robust recoveries.

Ben Carlson published a great piece showing the average performance of the S&P 500 after enduring a bear market was 16%, 27%, 59%, and 206% over one, three, five, and ten-year periods, respectively.

This resilience underscores the importance of staying the course, as attempting to time the market often leads to missed opportunities.

Acknowledging and accepting market fluctuations is vital. Recognizing these patterns as a normal aspect of market behavior is crucial for long-term investors.

Instead of attempting to predict and avoid downturns, a more pragmatic approach involves preparing for them through a balanced mix of stocks and bonds, tailored to one’s risk tolerance and investment goals.

Moving Forward with Confidence

To sum it up: Investors should approach market highs not with trepidation but with informed confidence.

The data and historical trends suggest that new highs are not harbingers of doom but are integral parts of the market’s growth trajectory.

By focusing on long-term strategies, diversification, and a rational understanding of market dynamics, investors can navigate these peaks with a clear vision, turning what seems like a precarious position into a vantage point for future success.

Resources:

- New All-Time Highs After a Bear Market (A Wealth of Common Sense)

- The Stock Market Hit a Record High. Now What? (AARP)

- S&P 500 Hits All-Time High (Schwab’s Liz Ann Sonders and Kevin Gordon)

- Related Episode: What’s the Best Strategy For Investing a Large Amount of Cash?

- Related Episode: The Secret to Timing the Market

The Long Term Investor is edited by the team at The Podcast Consultant

Submit Your Question For the Podcast

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

I read every single one and appreciate you taking the time to let me know what you think.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.