When you plan to invest a large amount of money, you probably want to know when it’s best to invest that cash. Should you invest it all at once or dollar cost average over time?

Listen now and learn:

- Historical probabilities of positive market returns

- How markets perform after reaching all-time highs

- Eye-opening results from a multi-decade study on market timing

Listen Now

Show Notes

We often feel regret when we can clearly envision the alternative paths we didn’t take and decide those paths would have been better than the one we ultimately chose.

It’s particularly easy to see the alternatives after the fact when you are an investor.

Investing is also highly quantifiable, which can lead us to believe there’s always an objectively optimal decision out there. Knowing that there’s an optimal choice as well as the opportunity for things to go wrong leads many investors to put a lot of pressure on themselves.

This is particularly prevalent at times when an investor has a large amount of money they plan to invest. Almost every time I’m working with someone in this situation, they want to know when it’s best to invest that cash.

The fear in these situations is that you invest a large sum of money at a market peak and experience a severe downturn right out of the gate. The degree of regret in such a situation is significant because, with the benefit of perfect hindsight, you could have avoided a large loss and invested your cash at a meaningful discount instead.

As with any investment decision, there will always be a “best” or “optimal” choice after the fact. But the only rational way to make decisions about an inherently unknowable future is to use probabilities.

So in this episode, I’m going to share the data and probabilities that support the notion that when you have a large amount of money to invest, investing the entire lump sum at once is the mathematically superior choice to dollar cost averaging.

Now to be clear, I think that systematic dollar cost averaging is the best approach to investing your regular savings. Still, it is suboptimal when considering a large sum of money that has either accumulated over time or been acquired via a liquidity event (i.e., inheritance, business sale, option exercise, bonus, deferred compensation, etc.)

Historical Probability of Positive Market Returns

The stock market is up more often than it’s down. In fact, the S&P 500 had positive returns in over 75 percent of 12-month periods from 1926 to the present. The frequency of positive returns jumps to 88 percent when you look at all rolling five-year periods and 94 percent when you observe rolling ten-year periods.

The takeaway here is that unless you need the money you are investing in the short run, the likelihood that the market will be higher a year from now is very good, so investing all at once is likely to be the winning strategy.

There are two common concerns people tend to have when presented with this information.

The first is in periods when the market is near or at all-time highs. You might be surprised to learn, however, how well markets have performed after.

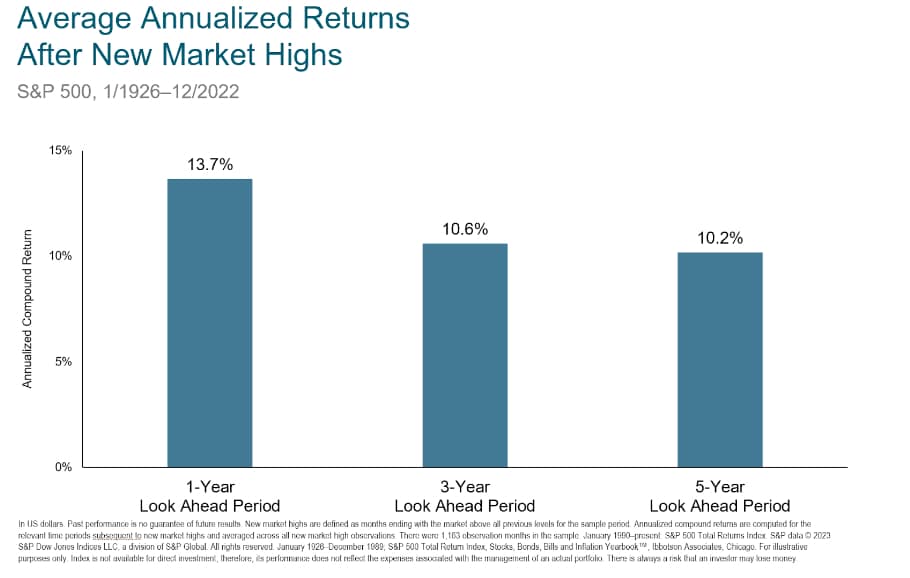

The graphic below from Dimensional Fund Advisors shows the average annualized returns for the S&P 500 after new market highs going back to its 1926 inception date.

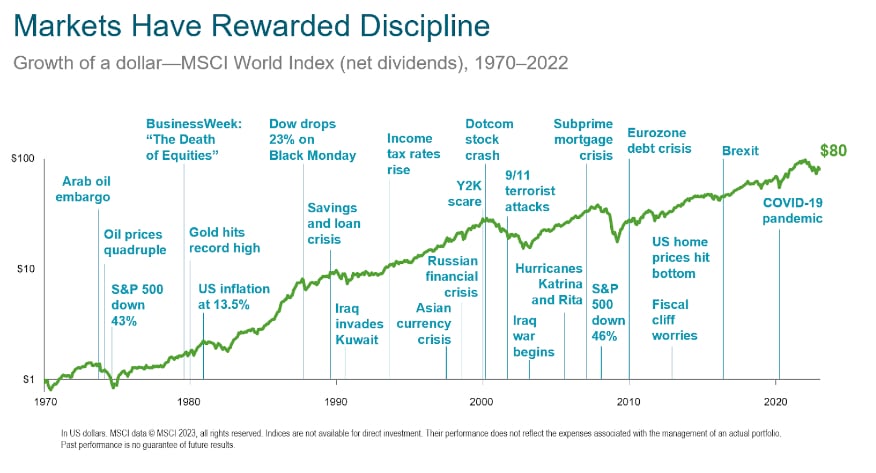

The other concern people have when faced with the historical probability of the stock market experiencing a positive return is what I refer to as “The Crisis of the Day.” Basically, there is always something to worry about.

But remember, risk and uncertainty about the future are the costs of the higher expected returns that stocks provide. The graphic does a nice job of highlighting that looking beyond the concerns of today unlocks the long-term growth potential of markets.

Time is More Important Than Timing

Even when we understand the historical data, the allure of buying and selling at just the right moment is intoxicating.

I’d like to share research published by Charles Schwab in 2021, which looks at hypothetical performance for five different investors over a 20-year period ending in 2020.

Each hypothetical investor receives $2,000 at the start of each year.

- The first investor has perfect market timing such that the $2,000 invested at the low point for the S&P 500 of each calendar year.

- The second investor immediately invests their $2,000 on the first trading day of the year.

- The third investor uses dollar cost averaging, by dividing the annual $2,000 allotment into 12 equal portions, which are invested at the beginning of each month.

- The fourth investor has perfectly bad timing, meaning the $2,000 is invested each year at the highest closing level for the S&P 500.

- The final investor leaves their money in cash and waits for a better opportunity to invest, always convinced that lower stock prices are just around the corner.

Naturally, the best results belonged to the investor who is a perfect market timer, which finishes with $151,391. But that perfect outcome wasn’t much better than the next best performer, which was the investor who immediately invested $2,000 on the first trading day of each year.

In fact, perfect market timing over a 20-year period only resulted in $15,920 more than investing immediately. And for what it’s worth, the next best performer was dollar cost averaging, which trailed the immediate investor by just $615.

As you would expect, the investor with perfectly bad market timing – the one that always invested at annual market peaks – trailed the perfect market timer, the immediate investor, and the dollar cost average. But the most important takeaway is that the investor with the absolute worst market timing ended up with nearly three times as much as the investor who stayed put in cash.

The researchers at Charles Schwab also ranked these different investment strategies over 76 rolling 20-year periods going back to 1926. And the rankings were identical in 66 of those 76 rolling periods. For those other 10 periods where the rankings were different, investing immediately was second-best four times, third-best five times, and never once came in last place.

But the research doesn’t stop there. Looking at all possible 30, 40, and 50-year time periods starting in 1926, there are only a few instances where investing immediately isn’t the second-best outcome to perfect market timing.

Next steps

If you’re tempted to wait for the best time to invest in the stock market, the benefits of doing so (assuming it was even possible to time it correctly) aren’t very impressive.

Knowing that it’s nearly impossible to accurately identify market bottoms on a regular basis, the relatively small benefit seen in the Schwab research isn’t very attractive given the extremely high likelihood that you will time the market incorrectly.

If you’re sitting on cash waiting for the right time to invest, the evidence suggests that the best course of action is to develop a plan that allows you to take action as soon as possible. Developing a plan helps prevent procrastination, minimize regret, and avoid market timing.

If you’re still feeling uncertain about the choice to invest a single lump sum vs. dollar cost average, one final thought exercise I like to use with clients is imagining how you might feel in the future about the choice you make today. So ask yourself: “In ten years, what would make me regret this decision? What are some ways this decision could lead to bad outcomes, and how would I feel in these scenarios?”

Resources:

- Does Market Timing Work? research by Charles Schwab

- How To Minimize Regret With Investment Decisions (read)

Submit Your Question For the Podcast

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

If you enjoy the show, you can subscribe wherever you listen to podcasts, and please leave me a review. I read every single one and appreciate you taking the time to let me know what you think.

About the Podcast

Long-term investing made simple. Most people enter the markets without understanding how to grow their wealth over the long term or clearly hit their financial goals. The Long Term Investor shows you how to proactively minimize taxes, hedge against rising inflation, and ride the waves of volatility with confidence.

Hosted by the advisor, Chief Investment Officer of Plancorp, and author of “Making Money Simple,” Peter Lazaroff shares practical advice on how to make smart investment decisions your future self with thank you for. A go-to source for top media outlets like CNBC, the Wall Street Journal, and CNN Money, Peter unpacks the clear, strategic, and calculated approach he uses to decisively manage over 5.5 billion in investments for clients at Plancorp.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.