Remember in high school when you had to read The Odyssey?

Homer’s epic told the story of Odysseus’ journey home to Ithaca, which included a part where Odysseus and friends had to sail past the island of Sirens.

The Sirens sang a song no sailor could resist. But if they steered their ship towards the island, they wrecked their vessels upon the rocks. Knowing this beforehand, Odysseus devised a plan to enjoy the song of the Sirens while still safely continuing to navigate toward his intended destination.

Odysseus instructed his crew to fill their ears with wax and sail past the Sirens no matter what. Odysseus then had the crew tie him to the ship’s mast so he could listen to the Siren song without being tempted to steer toward the island.

The plan worked beautifully. Odysseus was able to hear the Sirens’ song without wrecking his ship. Even though he begged to be freed the entire time, the process he committed to in advance safeguarded him from foolish decision-making.

You Need a Process to Keep You Safely on Track to Financial Success

Financial success isn’t magic, it’s engineering.

The key is to build systems and processes that limit undesirable behaviors in your present self and promote desirable behaviors that help your future self. In economics, this is called precommitment.

Keeping your long-term goals in mind at all times requires a lot of willpower and effort. But if you have a process in place that replaces willpower and eliminates temptation – just like Odysseus had with his plan to get past the Sirens – you can consistently make progress toward what you want.

Automating your finances helps you achieve specific goals by systematically creating positive long-term habits while fighting the temptation to deviate from your financial plan. For example, setting up an automatic deposit into my BrightPlan investment account each week requires little to no ongoing effort.

But first, let’s take a step back.

Prior to automating your financial life, you need to put your reverse budget in place. That requires you to write out and prioritize your financial goals so that you can focus on the tradeoffs such as investing or paying down debts.

Once you have a reverse budget, you can put your personal finances on autopilot in just a few easy steps.

Step 1: Open the Appropriate Accounts for Your Automated System

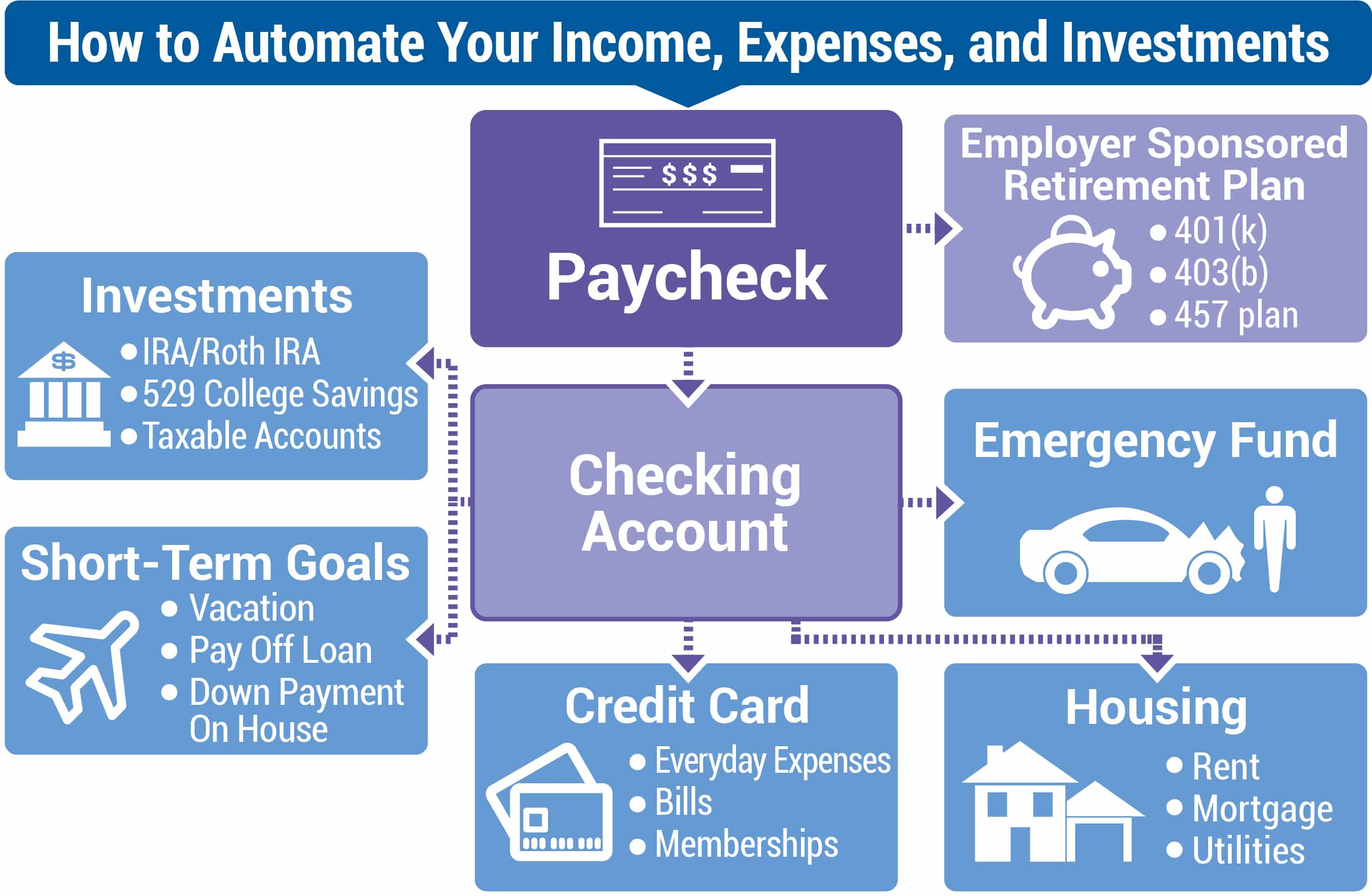

The first step of building an automated process is opening the right accounts. That starts with your primary checking account. That’s going to function like Grand Central for your money, with cash coming and going on a predetermined schedule.

In order to prevent the automation system from biting you, you must have a cash cushion in your checking account to protect against overdrafts or surprises that result from a mismatch in the timing of automatic bill payments and your paycheck.

The cushion doesn’t need to be very big. Most people find that 25 to 50 percent of one month’s expenses is sufficient. If you have unpredictable income and expenses, aim to keep 100 to 150 percent of a month’s expenses as your cash cushion.

The other accounts to utilize are credit cards that earn rewards or cash back on your everyday spending. There are plenty of credit cards that earn 2% to 6% on specific spending categories such as gas, groceries, dining, travel, etc.

Credit cards are NOT for everyone, but responsible and strategic use of credit cards provide your finances with an additional boost from automation.

Step 2: Pay Yourself First

After you create a cushion in your checking account and have credit cards that align with your largest spending categories, you can begin building the automation process. Start by paying yourself first.

On the days your paycheck hits your checking account, immediately direct a portion towards your emergency fund and retirement savings.

Even if you have high interest consumer debt or student loans to pay down, you need to be contributing something towards your emergency fund and retirement.

Step 3: Set Up Payments for Your Bills and Expenses

Next, focus on your bills. This obviously includes credit cards, which I alluded to earlier, but nearly all bills can be paid automatically.

Mortgage, utilities, tuition costs, memberships, subscriptions, and more – you can automate them all to eliminate worrying over whether you paid a bill or not.

Rent is an example of something that is harder to pay automatically, but you can still ask your landlord or building manager if you can set up automatic electronic payments. I’m sure they will be happy to know they won’t have to worry about collecting monthly rent.

Step 4: Automate Your Contributions to Your Investment Accounts

Once you have your savings and bills on autopilot, the last (and arguably most important) step is to set up automatic investing.

Making automatic deposits into your investment accounts at predetermined times and into a predetermined mix of funds prevents the urge to time the market.

This process, known as dollar cost averaging, also allows you to diversify your purchase price by making regular investment purchases over time. When you make equal dollar purchases over time, you buy more shares when prices are low and fewer shares when prices are high.

Ideally, you have an employer-sponsored retirement plan such as a 401(k) or 403(b). At a bare minimum, contribute to your employer’s plan that qualifies you for a full match. There is no better guaranteed return available to savers than the 100 percent return you receive simply for saving to your employer plan.

Assuming you have a good 401(k) plan, this should be where most of your retirement dollars should flow until you’ve reached the maximum contribution. (Here’s a refresher for how to prioritize your retirement savings.)

Step 5: Increase Your Automated Transfers Over Time

The final piece of automating your finances is finding a way to automatically increase your savings over time. Setting up automatic escalation requires a little more legwork depending on where the savings are going.

Many online investment platforms will allow you to increase your recurring contributions on an annual basis. Same goes for many online banks.

If this feature is not available, I’d recommend creating a recurring calendar event for January 1st of each year with specific instructions of how much you will commit to increasing your savings. The primary benefit of automatic escalation is it prevents lifestyle creep that occurs with a growing salary.

Get the Guide to Automating Your Financial Life and Getting Your Entire Financial House in Order

Finances have a way of getting increasingly complicated in all stages of life. Putting your savings, bills, and investments on autopilot can greatly simplify things.

A good system will direct dollars to the things that matter to us most and keep us on track for reaching our end goals. It also establishes a process that will help you fight temptation to deviate from your savings and investment plan.

Feel like you may need help or more ideas on the kind of processes and to-dos that can help you create the financial life you want?

I wrote a book that covers all this and more, Making Money Simple.

You don’t need to be an expert to achieve financial freedom. You just need a framework that makes the right choices simple and easy to make.

Making Money Simple provides that much-needed process so you can get on the right track to long-term financial security.

Now it’s your turn…

Share in the comments: what is one habit or decision you have made in your finances that has helped you move closer to your goals?

…

RESOURCE: Do you want to make smart decisions with your money? Discover your biggest opportunities in just 9 questions with my Financial Wellness Assessment.