Developing and executing an estate plan is one of the most important pieces of your financial plan.

While you are alive, the estate planning process allows you to manage and preserve your assets during your lifetime. At death, your estate plan allows you to conserve and control the distribution of your assets according to your goals and objectives.

The estate planning process and need for advanced strategies will differ from person to person, but here’s what you need to do to start getting your plan in order.

What’s Included in an Estate Plan?

Everyone should have an estate plan in place regardless of age, level of assets, or life stage.

But if you ask five different estate attorneys when it makes sense to get estate planning documents, you might receive five different opinions.

Here’s my take: the trigger point for getting a full set of estate planning documents is when you get married. Prior to getting married, how much estate planning you do should be driven by how passionate you are about the way medical and financial decisions are made when you are unable to make them yourself.

A full set of estate planning documents typically include the following:

Will

At the crux of any estate plan, a will indicates how you want your property distributed after your death. Without a will, disbursements are made according to state law – and those laws might not align with your priorities. A will also names an executor to manage and settle your estate as well as a legal guardian for any dependents.

Living Trust

A living trust (also known as a revocable or inter vivos trust) creates a separate legal entity to own property. The primary benefit of a living trust is that your assets avoid probate, which can be costly and time consuming – not to mention emotionally taxing – for your heirs. Furthermore, your estate becomes public record by going through probate, but having a trust in place generally prevents public knowledge of your estate.

Durable Power of Attorney

A durable power of attorney (DPOA) authorizes someone to act on your behalf should you become physically or mentally unable to handle financial matters. The person you designate in the DPOA can pay bills, file taxes, direct investments, and complete important money management tasks on your behalf.

Advanced Medical Directives

Advanced medical directives allow you to specify the medical treatments you desire in the event you can’t express that on your own. These directives also appoint someone to make medical decisions if you are incapacitated. The three types of advanced medical directives are a living will, a durable power of attorney for health care, and a Do Not Resuscitate order.

Letter of Instruction

A letter of instruction is a nonlegal document that may accompany your will to express personal thoughts and directions. Unlike a will, the letter of instruction remains private and its directions are not binding.

What Are the Consequences of Waiting?

If you feel strongly about who should receive your money, property, and possessions in the event of your death, you need to write a will.

Without a will, your wealth and possessions will most likely go to your most immediate living family member(s) after being processed in probate. There’s nothing inherently wrong with that, but it might not be what you want — and you may not want to make your surviving family members deal with the probate court process regardless of where your assets go after you pass.

The court system can be a costly, time-consuming, and inefficient process for your assets to work through. Not only does it open the door for increased litigation if family or friends disagree on a probate judge’s ruling, but what happens in probate court is also a matter of public record.

If you have minor children, an estate plan is likely going to be critical for your family. A probate court judge will decide guardianship for your kids if you don’t have documents that clearly name who should take custody of your children should something happen to you.

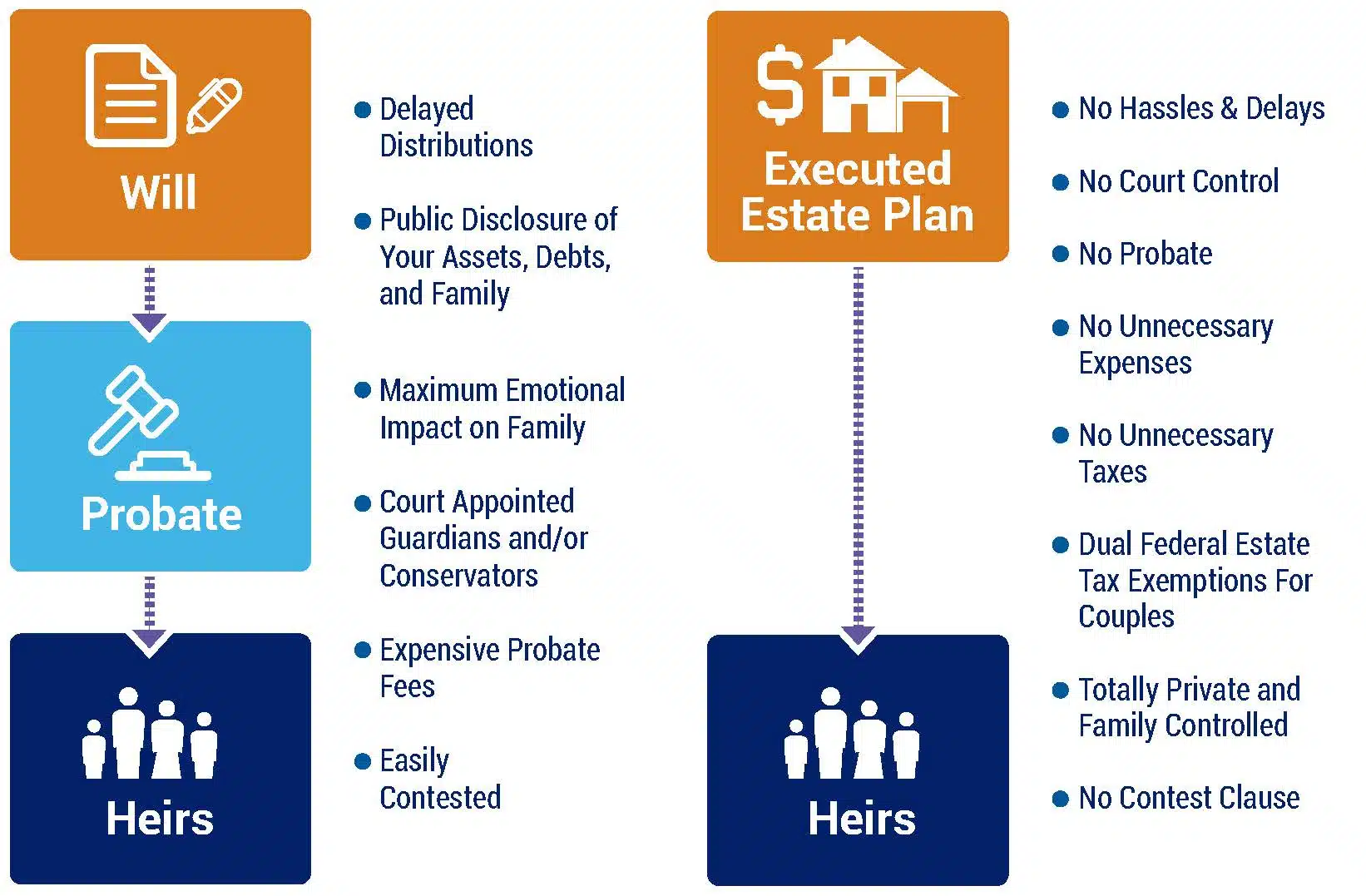

This graphic does a good job of quickly outlining the differences between dealing with probate court — and making sure things happen according to your wishes even if you’re not here.

What Happens After You Create an Estate Plan?

After executing your estate plan, make sure the executors and trustees you named are aware of your wishes and know where your documents are located. You want to keep your documents in a safe place, of course — but not so safe that they can’t be found when needed.

It’s also helpful to create an estate memo listing all of your financial information. Staying organized helps ease the burden of administering your estate for your loved ones.

Finally, it’s important to review your estate plan every few years to make sure it remains up to date with current laws and reflects your wishes as your life changes.

Other trigger points for an estate planning review include major life events like:

- Changes in your marital status

- Changes in the marital status of your children or grandchildren

- Additions to your family through birth, adoption, or marriage

- The death of a spouse or family member (or if a family member becomes ill, dependent on you, or incapacitated)

- A substantial change in the value of your assets or in your plans for their use

- Receiving a sizeable inheritance or gift

- A change in the amount of income you make or need

- Retirement

Our lives typically get more complex as we age. We grow our families, accumulate property, and build our wealth. That makes it crucial to implement estate planning tools early—and review them often.

Estate planning is a little different for everyone. The process may seem overwhelming, but once you execute your estate plan, your peace of mind will be worth it.

There’s no better way to ensure your assets get distributed according to your wishes, making things as easy as possible on your family.

…

RESOURCE: Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.

It makes sense that you should review your estate plan on occasion to confirm that it aligns with your current wishes. My brother is interested in creating an estate plan to ensure that his children inherit his home once he passes away, but he wants to make sure that his plan is adjustable since he plans on getting married next month. Maybe he should find an attorney that can help ensure that his estate plan suits his needs.