Listen Now

This is the third and final episode in a series on hiring an advisor.

The first two episodes Do It Yourself or Hire an Advisor and Not All Financial Advisors Are Created Equal focused on the basic differences among financial professionals.

This episode focuses on the process of hiring the right person for you.

Listen now and learn:

- The 4 steps to identifying an ideal advisor

- Questions to use when interviewing prospective advisors

- Things to consider when selecting a robo-advisor rather than a human advisor

Show Notes

This is the third and final episode in the Do It Yourself or Hire an Advisor series.

In episode 24, I gave some simple context to the initial part of the decision to manage money yourself or hire a professional to help. This episode goes through some typical motivators for both managing finances yourself and hiring a professional. It also summarizes a highly cited Vanguard research study on the quantitative value of a financial advisor.

In Episode 26, I highlighted the differences in types of advisors. In that episode, you learned about different advisor titles and professional designations people list in their email signatures and on their business cards, but I also explained the trickier things like differences in compensation (both at the firm level and the individual advisor level) and perhaps most importantly, the differences in standard of care that professionals are held to.

You can find these episodes as well as a full archive of all past episodes by visiting TheLongTermInvestor.com, and please be sure to subscribe on whatever mobile app you use for podcasts to make accessing old and new episodes even easier.

With those first two episodes focused on understanding some of the basic differences among financial professionals, this episode will focus on the process of hiring the right person for you.

Fortunately, the Internet has all of the meaningful information needed to narrow down your choices to two or three prospective advisors.

Here’s how to start your search.

1. Make a list of firms or people you know that you would consider hiring.

You may not know if people on your list act as a fiduciary at all times or carry one of the three best professional designations. That’s okay for now.

Feel free to ask family, friends, professional colleagues, or another trusted source to expand your list of advisor prospects.

If you aren’t comfortable asking others for referrals, then visit www.letsmakeaplan.org, which allows you to search CFP® professionals by city, state, or zip code.

From there, you can narrow the search by portfolio size, type of advice, language capabilities, and advisor compensation.

2. Check each prospective advisor’s record for misconduct.

You can check an advisor’s record for misconduct at www.brokercheck.finra.org.

If the prospective advisor is a Registered Investment Advisor who is bound by the fiduciary standard, you’ll be redirected to the Securities and Exchange Commission (SEC) website, where all records of dispute (if any) are listed.

If there’s any record of misconduct, remove that advisor from your prospect list.

These websites also list any credentials the prospective advisor has earned such as a CFP®, CPA, or CFA.

Anyone without at least one of these designations should be crossed off your list as well.

3. Visit prospective advisors’ websites.

While this is a bit like judging a book by its cover, a website contains valuable information about a person’s background and capabilities. You might consider viewing a firm’s blog to see if they have content that is relevant to you.

Not every article needs to be tailored to your needs, but a firm that hasn’t written about things that are important to someone in your stage of life probably doesn’t have a lot of experience providing advice to someone like you.

You can also check out a prospective advisor’s LinkedIn profile for additional information.

4. Narrow down your list down to finalists.

Send two or three advisors an email requesting a discovery meeting. They will undoubtedly have questions about you, but your questions are going to be more important at this stage.

Equally important is how you ask those questions. People tend to ask different prospective advisors different questions, which makes comparisons tricky. You also must contend with the human brain—specifically, our memories are worse than we realize and our decision-making is often biased by unimportant factors.

The way to combat these issues is to hold a structured interview.

Complete A Structured Interview

The structured interview process was made popular by Nobel Prize–winning psychologist, Daniel Kahneman, to help reduce the impact of bias on our decision making. However, the first time I saw it applied to hiring a financial advisor was in a column by Jason Zweig of The Wall Street Journal.

The following is a list of the questions for a structured interview, along with some commentary to help you identify responses that are in your best interest. I’ve also included some follow-up questions you might want to ask.

If you add one of these follow-up questions to your list, then make sure to give the other prospective advisors an opportunity to answer those questions as well. After this list of questions are instructions for how to conduct and score a structured interview.

For your convenience, you can download a Structured Interview Worksheet from peterlazaroff.com/worksheets or, of course, in the show notes at TheLongTermInvestor.com.

1. How do you get paid?

Ideally, an advisor is paid by the client and only by the client. If the firm is receiving revenue from any other sources, then there is an opportunity for a conflict of interest.

2. Does your firm earn revenue from anyone other than me?

The answer you want to hear is “no.” Fee-only firms that generate revenue paid directly only by clients have the fewest potential conflicts of interest.

Good follow-up questions:

- Do you earn fees for referring clients to specialists like estate attorneys or insurance agents?

- Do you participate in sales contests or award programs creating incentives to favor particular vendors?

3. What services do you provide? Would you consider charging a retainer or by the hour instead of a percentage fee based on my assets?

Advisors who won’t consider a financial planning fee are probably more focused on investment advice. They likely consider financial planning advice as an afterthought, meaning it will be far from comprehensive.

I’m of the opinion that hiring an advisor by the hour is better than nothing, but hiring an advisor on a flat retainer fee will make it more likely they reach out to you proactively with money moves that will help you at important times.

I’ve also seen that people who hire an hourly advisor will occasionally put off calling or emailing the advisor because they don’t want to pay for the advice. So instead of getting professional advice, they rely on themselves and Google searching.

One final thing about advisors charging hourly vs a flat retainer fee — an advisor that charges hourly has an incentive to make you keep coming back. And if you don’t, the compensation they receive will be less than other clients and, thus, make you less of a priority to them.

4. How are you personally (not the firm) paid?

There isn’t a perfect answer here, but it may uncover an individual’s incentives. A salaried employee has fewer conflicts of interest than someone who gets paid a percentage of the revenue their clients generate.

I also find that a firm with salaried advisors typically give the client more access to more people.

Think about it, if you are working with an advisor whose compensation is based off some percentage of the revenue they manage, will their colleagues be incentivized to help out? For example, if someone has deep experience helping with college financing and planning decisions for parents with high school aged children, wouldn’t you want the input of that person?

Or what if there is another advisor at the firm that isn’t your primary advisor that has deep expertise in Social Security and Medicare?

Or someone with a deep background in exercise strategies for individuals with multiple forms of equity compensation.

The list goes on and on….the point is that you want access to more than just your primary advisor, you want access to the specialists. Your lead advisor is much like a primary care physician, well-trained in diagnostics and properly capable of prescribing and treating.

But occasionally you need a specialist, so you want your advisor and that advisor’s teammates to be financially incentivized to give you that level of care when it’s needed.

5. Do you always act as a fiduciary, and will you state that in writing?

Obviously, you want a clear and simple “yes” to this question. If the advisor isn’t willing to put it in writing, then they can’t be held accountable.

I would think the most obvious place for this is to be included in an advisors client agreement. If you’re unsure of where it appears, ask the advisor to point it out. If it isn’t in writing, then you might consider having them sign a fiduciary pledge like this one.

6. Do you have experience working with clients like me?

You want to work with someone who has experience dealing with issues that are relevant to you. If their response leaves you uncertain, you might consider asking what are the most common services clients like you receive.

7. What experience, education, and credentials do you have?

You should want someone with at least the Certified Financial Planner (CFP®) designation, but it’s nice to also see someone who is a Chartered Financial Analyst (CFA) or Certified Public Accountant (CPA).

Good follow-up questions:

- Who else will I be working with, and what are their credentials?

- Is there a succession plan in place? If so, how far along into it are you? When do you anticipate the succession to be completed?

8. What is your investment philosophy?

Ideally, you want someone who believes in setting a long-term asset allocation and broadly diversifying using low-cost options. For firms with multiple advisors, it’s also important that they all have the same investment philosophy.

When advisors don’t share the same investment philosophy, it signals that your advisor may be performing due diligence on their own. The problem when a lead advisor is responsible for due diligence is that it’s somewhat unreasonable to expect someone to dedicate the necessary time to fully vetting the available investment universe to make sure they have portfolios that are best for you.

It might even signal that this advisor is responsible for trading too, which is less than ideal. Imagine there is a big market move when tax loss harvesting would benefit clients, but the advisor is in meetings all day and unable to trade.

Good follow-up questions:

- What was the last change made to your firm’s portfolios? Why was the change made?

- How often do you trade?

- How is my portfolio managed?

- What’s your favorite investment in your own portfolio?

- Who manages your money?

- Do you believe you can beat the market?

9. What is the all-in cost of working with you?

Costs will vary depending on the size of your investment account and the financial planning services you require.

The bigger your account, the smaller percentage fee you should expect, but there’s no reason to pay more than 1.0 percent of the assets under management. Ideally an advisor’s fee would cover all of your financial planning needs.

10. What is your overall impression of the advisor?

This final question is for you to answer at the end of the interview before walking out of the room, and the intention is to capture your gut feeling about an advisor. Try not to overthink it. This time you will score on a scale of one to five, with five being the best score.

- The purpose of this question is to capture the intangibles the other questions lack. Did the person communicate with too much jargon?

- Can you envision your kids one day working with this person?

- Do you feel comfortable sharing every detail of your financial life with this person?

If you have a significant other, you should both print the questions to individually and independently score the advisor’s answers. You will want to rate each response on a scale of one to five immediately after you receive a response to your question. Don’t look at each other’s scores.

A structured interview is beneficial in a few ways.

First, scoring all of the questions on the same scale prevents one answer from coloring your judgment about other aspects of the advisor.

Second, the structured interview process prevents your brain from forming false memories by keeping an accurate measure of how you felt about an advisor’s response. There will likely be some time lag between your different advisor interviews. Most people schedule advisor interviews over the course of a few weeks, but it could take longer if you have a busy schedule.

After you complete all your advisor interviews, add up the total scores for each score sheet. If you and your significant other scored the same advisor highest, go with that advisor. If there is a discrepancy, talk it out or find a way to reach a clear consensus.

For example, you could ask your two favorite advisors to draft a sample financial plan for you to review and compare. They’ll require you share personal information such as investment statements and tax returns, but this ought to help you identify the person who will best meet your needs.

This probably sounds like a lot of work, but it’s a huge decision.

As I expressed a few times in this series, hiring a financial advisor can be the best decision you ever make—so long as you hire a good advisor.

Following the process laid out here increases your chances of avoiding a bad advisor. Make sure to work through this process with your significant other, even if one person handles most of the household’s finances. Alternatively, if you’re single, you might consider bringing along a trusted friend or family member to provide a second set of scores.

Using a Robo Advisor

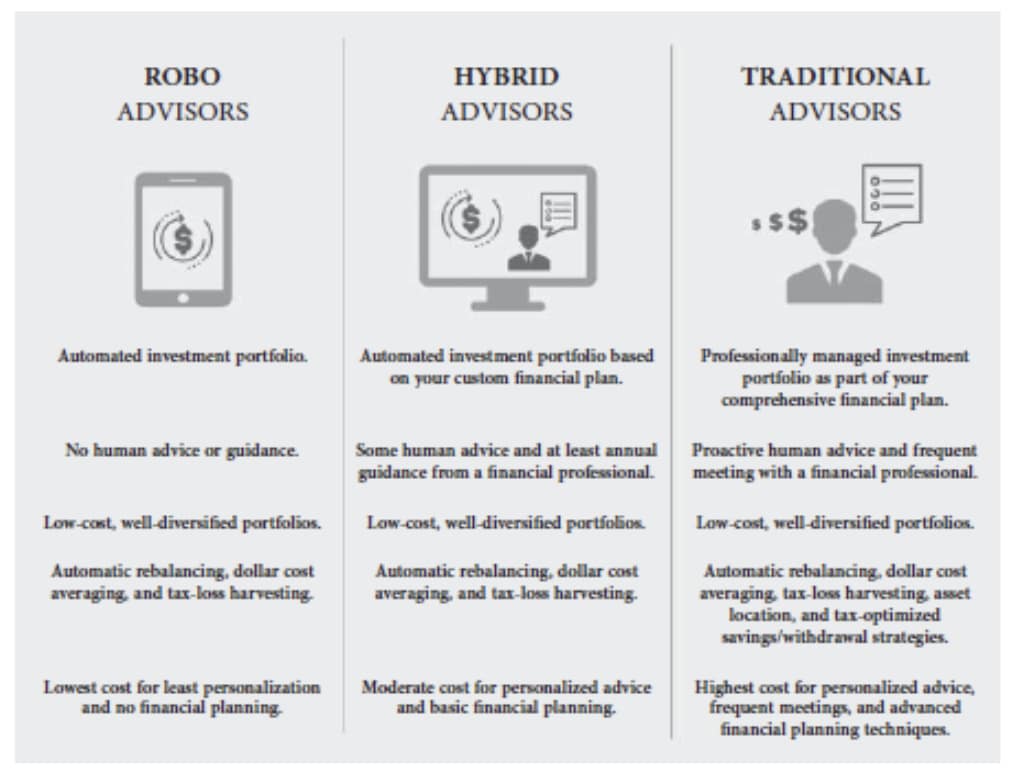

“Robo advisor” is the industry term for a digital platform that automates your investments for a percentage fee based on your assets under management (see Figure 12.2).

This growing segment serves a huge segment of investors who were previously forced to do it themselves, which opens most people up for a plethora of mistakes, or work with brokers who weren’t required to act as fiduciaries.

Hybrid advisors go beyond automated investment portfolios by also providing financial planning through a digital platform you can use to track progress, make adjustments, and manage various goals. On top of the digital experience, hybrid advisors also provide you with access to Certified Financial Planner (CFP®) professionals to help further hone and personalize your financial plan.

Robo or hybrid advisors are the most cost-effective way for people with less than $500,000 in investable assets to manage their money.

Nearly all digital advisors believe in the tents of long-term asset allocation, diversification, low costs, dollar cost averaging, rebalancing, and tax-efficient portfolio strategies. If you also need financial planning, hybrid advisors provide financial planning advice at a fraction of the cost of a human financial planner.

In my opinion, there are two things to look for in a digital advisor: (1) being able to meet with a Certified Financial Planner (CFP®) at no additional cost because life is more complicated than an algorithm; and (2) a digital advisor that always acts as a fiduciary.

Several digital advisors are Registered Investment Advisors (RIA), which means that by law they must always act in your best interest, but you can also look for the certified fiduciary designation from the Centre For Fiduciary Excellence (CEFEX). All CEFEX certified firms are listed at www.cefex.org/CertifiedAdvisors.

Click here to learn more about working with me.

Resources

- The first episode in this series: EP 24: Do it Yourself or Hire an Advisor?

- The second episode in this series: EP 26: Not All Financial Advisors Are Created Equal

- Submit your question for the show through my “Ask Me Anything” form

Get Your Finance Questions Answered

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

If you enjoy the show, you can subscribe wherever you listen to podcasts, and please leave me a review. I read every single one and appreciate you taking the time to let me know what you think.

Until next time, to long-term investing!

About the Podcast

Long term investing made simple. Most people enter the markets without understanding how to grow their wealth over the long term or clearly hit their financial goals. The Long Term Investor shows you how to proactively minimize taxes, hedge against rising inflation, and ride the waves of volatility with confidence.

Hosted by the advisor, Chief Investment Officer of Plancorp, and author of “Making Money Simple,” Peter Lazaroff shares practical advice on how to make smart investment decisions your future self with thank you for. A go-to source for top media outlets like CNBC, the Wall Street Journal, and CNN Money, Peter unpacks the clear, strategic, and calculated approach he uses to decisively manage over 5.5 billion in investments for clients at Plancorp.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.