Watch Now

Listen Now

Derek Jess, Senior Wealth Manager and Shareholder at Plancorp, returns to dive deeper into the nuances of executive compensation.

Last week, Derek Jess shared his extensive experience and knowledge in helping individuals make the most of their equity and executive compensation plans. Be sure to check out that episode for equity compensation essentials and helpful graphics Derek created.

This episode is a more intricate exploration of deferred compensation plans, stock options, and unique strategies for managing them effectively.

If you’re interested in learning more about working with Derek, you can schedule a call with him here.

Here are my notes from our conversation…

Sign up for my newsletter so you can easily reply to my emails with your thoughts or questions for the podcast:

Advanced Deferred Compensation Planning Strategies [2:00]

Deferred compensation plans, similar to 401(k)s in their tax-deferral benefits, offer a unique avenue for highly compensated employees to manage their income and taxes more effectively.

Derek sheds light on the critical distinctions between these plans and traditional 401(k)s, emphasizing the rigid structure of deferred compensation plans.

Unlike 401(k)s, where withdrawals can be flexible, deferred compensation plans require upfront decisions about contributions and distributions, making long-term financial and tax planning essential.

Derek stresses the importance of thoughtful planning when deciding how much to contribute to these plans. The goal isn’t just to minimize taxes today but to optimize tax savings over your lifetime.

He warns against the common pitfall of over-contributing, which can lead to higher taxes in the future, especially post-retirement.

One commonly missed opportunity with deferred compensation is the flexibility to adjust contribution percentages annually to align with your changing financial goals and tax brackets.

Another little-known opportunity within deferred compensation plans is the ability to change your distribution election. Your limited to making a change once at least 12 months prior to the first distribution, but doing so means the first distributions is delayed for five years.

Advanced Strategies for Exercising Stock Options [11:35]

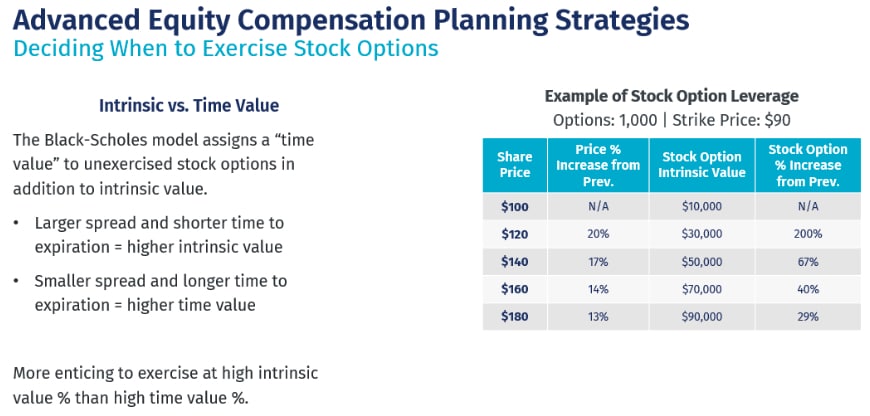

Moving to stock options, Derek talks about the decision-making process for exercising them, focusing on balancing intrinsic value and time value.

Using the Black-Scholes Model, he explains how to determine the most opportune time to exercise options, considering the leverage potential and the real value of the options.

For employees in private companies, exercising NSOs and ISOs presents unique challenges due to the lack of liquidity. Derek introduces the idea of using a specialized lenders that extend loans to pay for the cost of exercising stock options plus the amount of tax due.

These loans are often non-recourse, giving borrowers the added benefit of risk reduction. If the company is never acquired or does not go public, the loan is not repaid. As a result, the tradeoff is giving up some of your upside if a transaction does happen.

Understanding AMT Planning for Incentive Stock Options [16:20]

Addressing the complexity of the Alternative Minimum Tax (AMT) in relation to Incentive Stock Options (ISOs), Derek offers strategic advice for managing potential AMT implications.

He suggests timing the exercise of ISOs early in the year to provide flexibility for covering AMT liabilities and outlines the benefits of conducting an “AMT budget” towards the year’s end to maximize the exercise of options without triggering additional taxes.

We also touch on the impact of potential tax law changes on AMT planning, which suggest that it might make sense to take advantage of the current and more favorable AMT rules.

The Importance of Setting a 10b5-1 Plan [21:25]

A 10b5-1 plan is an advanced trading plan used to facilitate trading of securities, including company stock.

These plans were originally adopted by the SEC in 2000 to provide an affirmative defense against insider trading. 10b5-1 plans allow trades to be placed during blackout periods where trading would be otherwise restricted.

They are highly customizable with the ability to create multiple layers of time and/or price-based triggers to meet client’s needs. You’re also able to include specific tax lots of multiple grants from multiple grant types, including unvested shares that will vest prior to the termination of the plan.

In short, 10b5-1 plans allow you to make smart financial decisions and put them on auto pilot. And contrary to common belief, they are broadly available to more than just executives.

Derek outlines a detailed process for establishing a 10b5-1 plan, which involves coordination with the company and the plan administrator. He stresses the importance of setting up these plans when not in possession of insider information and highlights the restrictions and cooling-off periods associated with these plans.

Plans can be terminated early, but many legal experts recommend against doing this unless absolutely necessary.

Closing Thoughts

As you explore the unique opportunities discussed in this executive compensation deep dive, I’d encourage you to revisit the first conversation for a foundational understanding of equity and executive compensation.

If you’re interested in learning more about Derek helps individuals navigate these issues, you can schedule a call with him here.

Resources:

- Part 1 With Derek: Equity Compensation Strategies: Everything You Need to Know.

- How to schedule a call with Derek

The Long Term Investor is edited by the team at The Podcast Consultant

Submit Your Question For the Podcast

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

I read every single one and appreciate you taking the time to let me know what you think.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.