Watch Now

Listen Now

Show Notes

In this episode, I’m joined by Derek Jess, a Senior Wealth Manager and Shareholder at Plancorp with extensive experience helping individuals make the most of their equity and executive compensation plans.

Our discussion dives deep into the various aspects of compensation plans and their integration into comprehensive financial strategies, but first, we start with laying the groundwork with key terms and definitions for the basics of deferred compensation plans.

Here are my notes from our conversation…

Sign up for my newsletter so you can easily reply to my emails with your thoughts or questions for the podcast:

Understanding Deferred Compensation [00:45]

Deferred compensation plans aren’t just for C-suite executives, but also for highly compensated employees, offering a way to defer income for tax benefits.

As Derek explains, “It’s more of a way to get the most out of your compensation.” Whether it’s deferring a bonus or salary, these plans offer a strategic method for managing high incomes, particularly from a tax perspective.

Equity Compensation and Vesting Schedules [02:11]

Equity compensation is simply compensation awarded to an employee in the form of company stock instead of cash. Each award is known as a grant of company stock.

The grant date is the date an equity compensation grant is issued by the employer to the employee and the vesting date in which an employee receives full control/possession of the equity compensation grant.

The vesting schedule outlines conditions that must be met prior to investing. That includes one or more of the following features that each has distinct implications for how and when employees can access their equity compensation:

- Time-based: cliff and/or graded vesting

- Performance-based: company metrics, stock price targets, etc.

- Liquidity-event-based: M&A/IPO event for a private company

Restricted Stock vs. Stock Options [04:29]

Restricted stock units (RSUs) are the most common form of equity compensation.

They represent a promise to receive an award of company stock in the future based on current stock price. Shares are not received until vesting conditions have been met. No voting rights or dividends. May receive dividend equivalents, but less common.

Restricted stock awards (RSAs) are an award of company stock based on the current stock price.

With these, shares are received on the grant date, but employees are unable to sell or transfer shares until vesting conditions have been met. With RSAs, employees have voting rights and received dividends prior to vesting.

Stock options, on the other hand, provide the right to buy stock at a predetermined price known as the strike price. Options must be exercised prior to the expiration date. Unexercised options remaining after this date are forfeited.

The intrinsic value of an unexercised stock option is determined by the difference between the current fair market value and strike price, known as the spread.

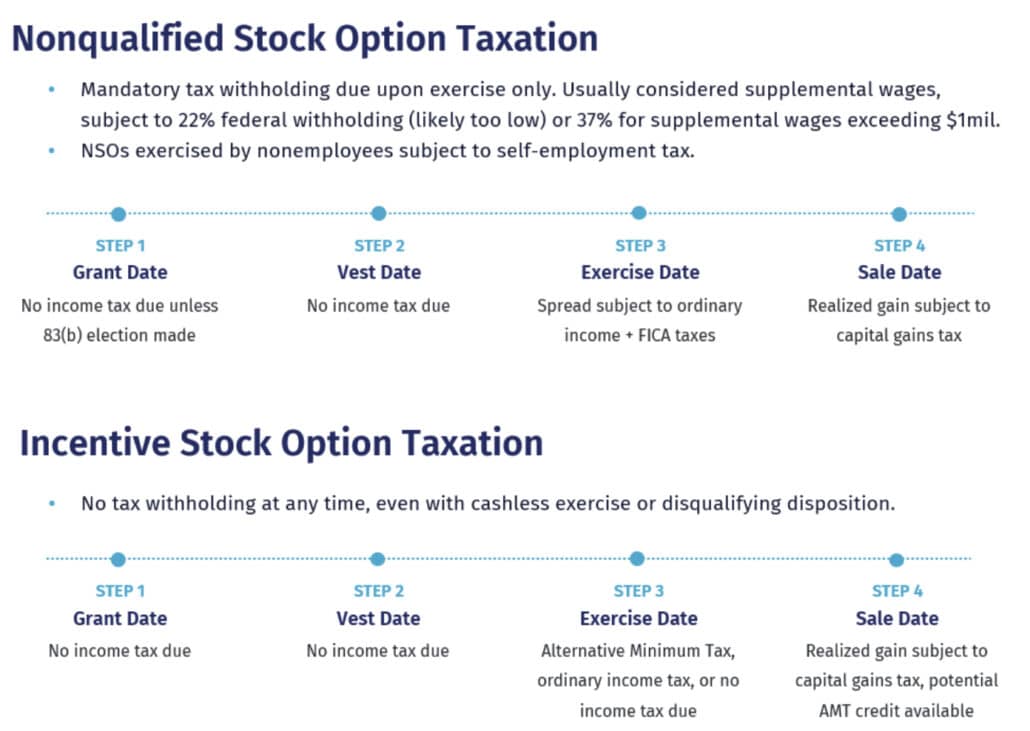

They can be issued as Nonqualified Stock Options (NSOs) or Incentive Stock Options (ISOs).

In both instances, the critical decision lies in knowing when to exercise these options. Understanding the taxation and timing of these exercises is crucial for optimal financial benefit.

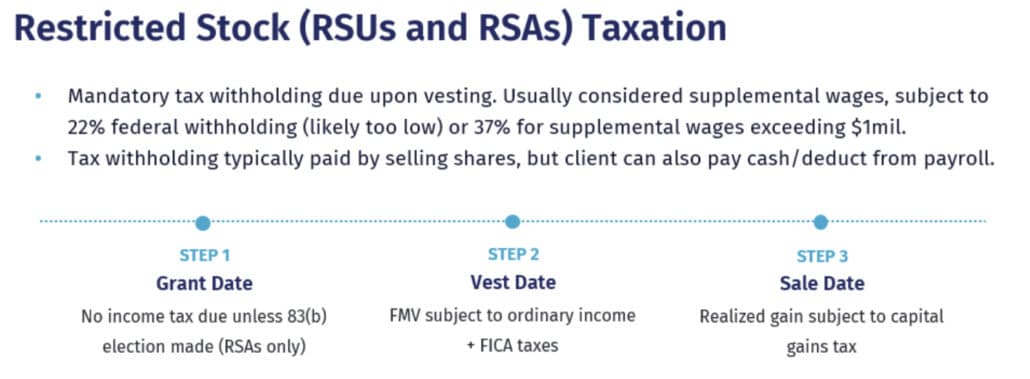

Tax Implications of Stock Options [07:49]

Diving deeper into stock options, Derek discusses the significant differences in tax treatments between non-qualified and incentive stock options. With NSOs, the focus is on ordinary income tax at the exercise date.

However, ISOs introduce a number of complexities that necessitate careful planning to avoid cash flow issues. Some key features of ISOs include:

- Annual Vesting Limits: The aggregate value of all ISO grants vesting in a calendar year cannot exceed $100,000. Excess grants are automatically converted to NSOs.

- Special Tax Treatment: Not subject to FICA tax. If certain conditions are met, the difference between the strike price and fair market value on sale date are taxed at long-term capital gains rates.

- Qualifying Disposition: Shares held for more than two years after the grant date AND more than one year after the exercise date.

- Disqualifying Disposition: Shares held two years or less after the grant date OR one year or less the after exercise date.

- Potential AMT Exposure: If shares acquired through the exercise of ISOs are held through the end of a calendar year, the spread is considered AMT income.

Employee Stock Purchase Plans (ESPPs) [12:33]

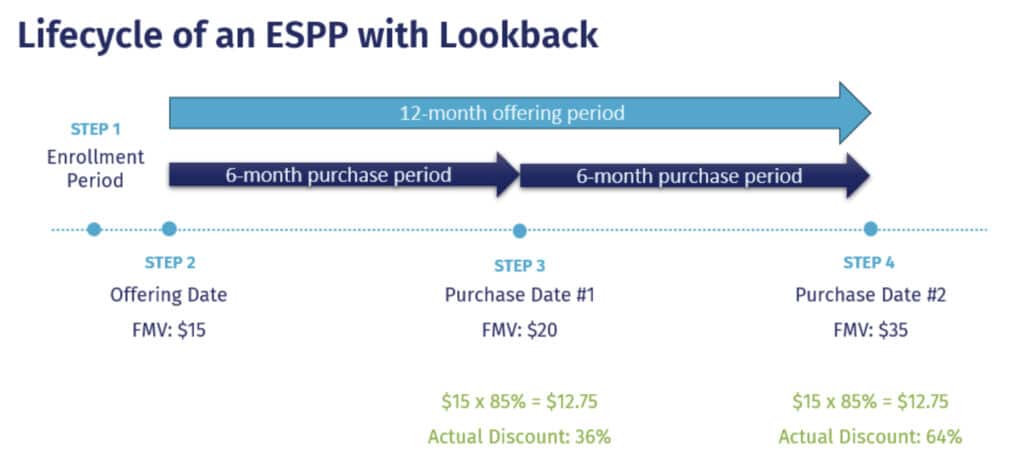

Derek clarifies that ESPPs are available to a broader range of employees, not just executives. These plans allow employees to purchase company stock at a discount, typically ranging from 5% to 15%, which can be a valuable benefit.

The maximum acquisition of company stock is limited to $25,000 per year.

Contributions are made via payroll deductions to purchase stock every three to six months. Some plans offer lookback provisions that apply the ESPP discount to lower the purchase date share price or another date in the past.

With ESPPs, no tax is due until the stock is sold, at which point the discount is taxable as ordinary income and additional realized gains are subject to capital gains tax.

Derek also highlights the special tax treatment for a qualifying disposition.

Concentrated Stock Positions and Risks [16:04]

The conversation takes a turn towards the risks associated with concentrated stock positions, especially when it involves stock from one’s employer.

Owning more than 5-10% in any individual stock exposes you to unnecessary risks, but the risk is even greater when you are an employee of that company as well.

If a company’s stock tanks, then your job security and income are probably going to be at greater risk, too. That makes diversification a key strategy for financial stability.

In my experience working with clients, I never feel like people appreciate just how risky owning a lot of employer stock can be.

Episode 63: Should You Invest in Individual Stocks? Takes a deep dive into whether people should own individual stocks at all, leaning heavily on a study from JP Morgan.

A couple of the statistics from that study that I shared in this episode:

- Using a universe of the Russell 3000 companies, which represents about 98% of the investable US stock market, roughly 40% of all stocks have suffered a permanent 70%+ decline from their peak value.

- The return on the median stock since its inception vs an investment in the Russell 3000 Index was -54%.

- Two-thirds of all stocks underperformed vs the Russell 3000 Index. And for 40% of all stocks, their absolute returns were negative

Integrating Company Stock in Financial Planning [19:33]

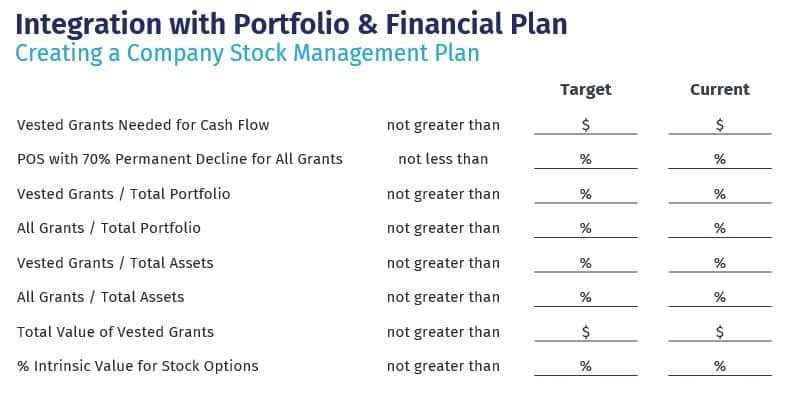

Derek emphasizes the importance of integrating company stock into a broader financial plan.

He suggests a comprehensive approach that considers the quantity and type of equity compensation, vesting schedules, personal sentiments towards the stock, and the alignment of these factors with individual risk tolerance and financial goals.

Derek shared a great deal of anecdotes to explain how we incorporate company stock in a financial plan. Below are a number of questions and key considerations we like to use:

- How much and what types of equity compensation do you have? What are the vesting schedules for each grant?

- What percentage of your portfolio is currently held in company stock?

- What do you expect to receive in equity compensation grants each year moving forward?

- What rules and limitations are in place that may restrict your ability to buy or sell company stock?

- In general, how strongly does you wish to sell/hold/accumulate company stock? What are the key drivers behind this sentiment?

- Would you be more emotionally distressed by hanging onto a company stock position that dropped by 70% or by selling out of company stock that increased in value by 70%?

- What specific goals are you using company stock to fund? What is the time horizon and how much money will be needed for each?

- How does your financial trajectory change if the company stock appreciates substantially, underperforms the stock market, or experiences a catastrophic loss and never recovers?

- What are the tax implications of selling company stock across various equity compensation plans?

- How much and what types of additional income can you recognize from equity compensation grants in current and future tax years before being subjected to higher marginal rates, reduced tax credits, and/or lost deductions.

- How much of your portfolio should be allocated to company stock given your risk tolerance, current financial position, and future goals?

- If you have too much company stock, how quickly should they plan to unwind some of this position? Which shares of company stock should be sold out of first?

A Systematic Approach to Managing Company Stock [31:34]

In concluding the episode, Derek advocates for a systematic and disciplined approach to managing company stock. He introduces the concept of a company stock management plan, a strategic framework that guides decision-making around company stock.

This plan is rooted in an individual’s financial goals, risk tolerance, and broader investment strategy, ensuring that emotions don’t drive critical financial decisions.

Looking Ahead [37:35]

In our next episode, Derek will return to delve into more advanced topics in executive compensation planning. We’ll explore advanced deferred compensation strategies, intricate equity compensation planning, AMT planning for incentive stock options, and the specialized area of 10b5-1 plans.

Join us next week for another insightful discussion with Derek Jess on The Long Term Investor.

For those seeking to navigate the complex landscape of executive and equity compensation, you won’t want to miss it.

Resources:

The Long Term Investor is edited by the team at The Podcast Consultant

Submit Your Question For the Podcast

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

I read every single one and appreciate you taking the time to let me know what you think.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.