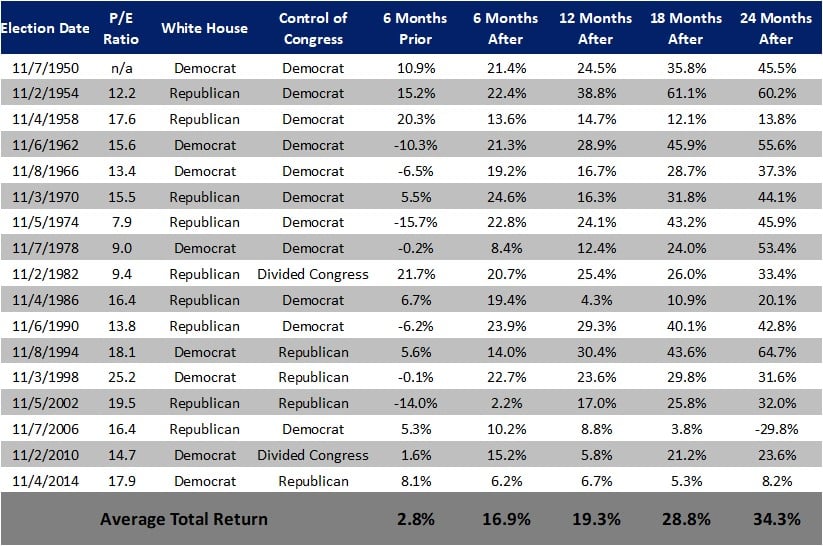

For whatever reason, midterm elections have tended to be a good time to buy equities. The table below outlines the S&P 500 return in periods prior to and following the past 17 elections.

There are a some theories that explain strong market performance following midterm elections, but they are rely heavily on narratives and ignore the complexity of financial markets. As I expressed recently on CNBC, election outcomes are less important to long-term returns than many people would like you to believe.

Investing in stocks is a bet on capitalism. As long as corporations remain interested in being profitable, markets should continue to trend upwards over time. Sure there will be bear markets and recessions along the way, but investors should continue to be compensated for taking market risk over long periods of time.

If you’re feeling uneasy about the market for any reason, check out the note I wrote to Plancorp clients last week. Remember, losses are the price you pay in exchange for the stock market’s higher expected returns relative to safer assets like bonds or cash.