When I look through the funds that investors use – be it an individual, institution, or 401(k) plan – I’m always amazed by the high fund expenses.

People are more fee aware than ever, but they still don’t give fees as much weight in their decisions as they do past performance, which is ironic because investment fees are a strong predictor of future returns.

The most commonly used gauge of fund expense is the expense ratio. The expense ratio measures operating expenses relative to the total value of the fund. Operating expenses consist of the fund manager’s fee, marketing costs (also known as a 12b-1 fee), custodial services, recordkeeping, taxes, legal expenses, accounting fees, etc.

Shareholders pay these operating expenses on a daily basis through an automatic reduction in the price of the fund. That’s right, you aren’t ever sent a bill, but you pay fund expenses every day!

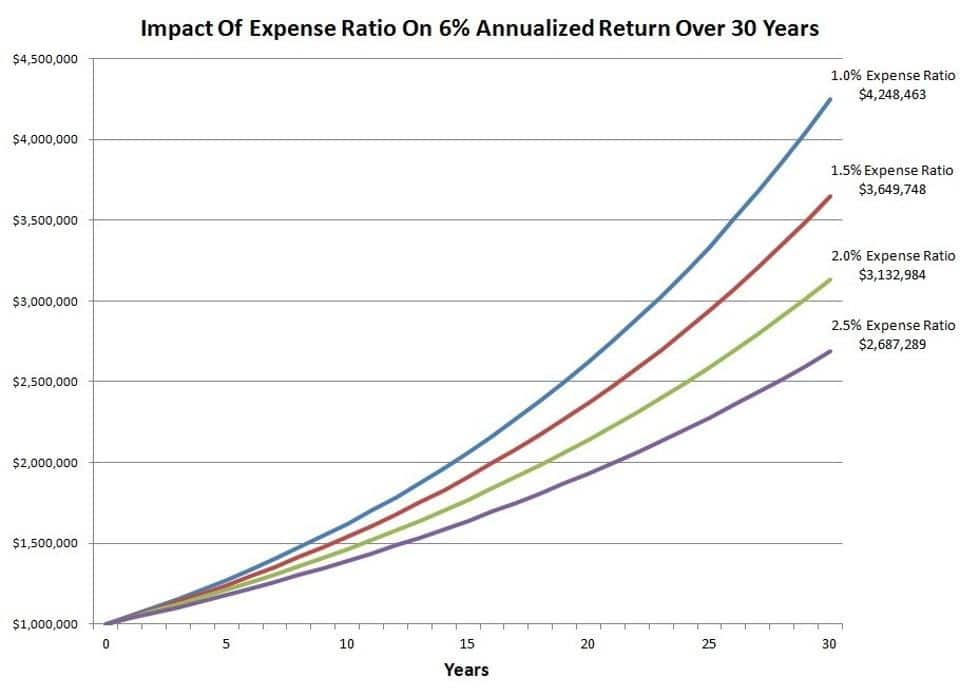

Automatic reductions in the price of the fund each day is a big reason expensive funds go unnoticed. As you can see in the graph below, fund expenses can be a significant drag on your portfolio in the long run.

Investment fees matter and can dramatically reduce returns, particularly over long time horizons as the impact of fees compound.

To borrow a line from Nobel Laureate William Sharpe: “the smaller a fund’s expense ratio, the better the results obtained by its stockholders.”

According to Morningstar’s 2015 Fee Study, asset-weighted expense ratios across all mutual funds and exchange-traded products have fallen from 0.76% in 2009 to 0.64% in 2014. This asset weighted measure reflects what investors are paying in aggregate, whereas a simple equal-weighted average of all funds in 2014 was 1.19%.

The Morningstar study points out that just 9% of total investor assets at the end of 2014 were in funds paying greater than 1.19%. If you are wondering if you are paying too much for your investment funds, let this serve as a simple baseline for being a fund that is too costly.

In reality, you shouldn’t need to pay more than 0.30% in fund costs for a properly diversified portfolio. If fund costs continue to fall, then the acceptable expense ratio for a portfolio should shrink as well.

Although I’ve focused attention on expense ratios, other areas to explore are fund costs related to taxes and trading.

Good article. I spent 42 years in the investment business and was always appalled when asked to look over a prospect’s account statement by the fees they were paying. They seldom had any real idea what they were paying, or thought their brokerage account was “free.” Your chart makes clear the impact of fees on long term returns. A good follow-on article might be to dissect the specific fees people can end up paying in a typical wrap arrangement.