Now that yields are high enough to warrant our attention, what is the right way to measure yield?

Listen now and learn:

- The pros and cons of 4 popular yield metrics

- 3 reasons to avoid tactically shifting your bond allocation to cash and short-term bonds

Listen Now

Show Notes

For the first time since the Great Financial Crisis, yields are worth paying attention to and, as a result, I’ve noticed more people asking questions about various yield quotes from online savings accounts and fixed-income products.

The questions are usually within the context of noticing that yields on cash are similar if not higher than yields on many bond funds, which is something I’m going to address at the end of this short episode, but first I want to answer something more fundamental:

What’s the right way to measure yield?

SEC Yield

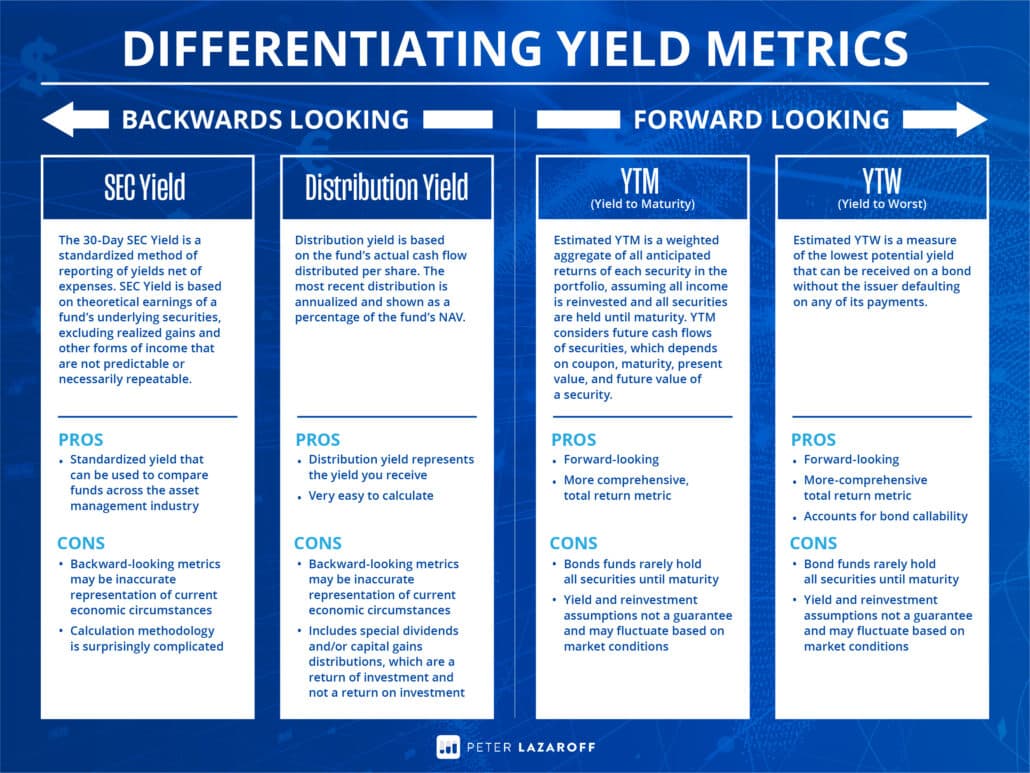

The 30-Day SEC Yield is a standardized method of reporting of yields net of expenses. SEC Yield is based on theoretical earnings of a fund’s underlying securities, excluding realized gains and other forms of income that are not predictable or necessarily repeatable.

So when you look at a fund’s SEC Yield, you can get a general idea of the yield you’d expect to earn net assuming that income from the portfolio is reinvested and the underlying holdings are held to maturity.

The benefit of this metric is that it’s standardized, so it can be used to compare funds across the asset management industry.

But there are a few downsides…

Like all backward-looking metrics, the SEC Yield doesn’t necessarily inform you on what to expect going forward – and because markets change rapidly, this metric can become dated pretty quickly.

The calculation method is also surprisingly nuanced, which you could maybe argue doesn’t matter if you’re getting the metric directly from a fund company, but fund companies tend to publish these yields at different times and it’s easy to make mistakes comparing them.

If you did go down the road of trying to calculate the SEC Yield yourself, you’d need interest and dividends received over the last 30-day period, accrued expenses over the last 30-day period (excluding reimbursements), the average number of shares outstanding on a daily basis that were entitled to receive distributions, and the maximum price per share on the day of the calculation.

It’s a lot to do on your own…which is why I point out that you really must be careful to ensure you’re comparing these yields across the same reporting months.

Distribution Yield

Distribution yield is based on the fund’s actual cash flow distributed per share in which the most recent distribution is annualized and shown as a percentage of the fund’s NAV.

The obvious benefit of this approach is that it’s very easy to calculate and understand – what you see is what you get. Now, of course, this is a backward-looking metric – much like SEC yield, the Distribution Yield may be an inaccurate representation of current economic circumstances.

But the bigger downside of distribution yield is that it includes special dividends and/or capital gains distributions, which are a return of investment and not a return on investment.

One of my good friends, Rubin Miller, who was on the podcast last week, wrote this great blog post on the difference.

Even beyond that nuanced point, when a distribution yield includes a single payment such as a special dividend or capital gain distribution, it can potentially extrapolate bigger payments into the yield than what is representative of expectations.

In my opinion, this sort of distortion is hard to catch when viewing the distribution yield in isolation, so it’s important to be cognizant of what payments are included in the distribution yield when comparing different funds or products.

Yield-To-Maturity (YTM)

Estimated YTM is a weighted aggregate of all anticipated returns of each security in the portfolio, assuming all income is reinvested and all securities are held until maturity.

YTM considers future cash flows of securities, which depends on coupon, maturity, present value, and future value of a security.

Forward-looking metrics are often more useful when comparing different bond products. I also like that YTM is a more comprehensive, total return metric, but there are some things to keep in mind.

For starters, bond funds rarely hold all securities until maturity as assumed in the calculation. But the bigger assumption in the YTM calculation are the yield and reinvestment assumptions that can’t possibly be known in advance and should be expected to fluctuate based on actual market conditions.

This isn’t to say the metric shouldn’t be used. In fact, this is probably the metric I use most, but I think calling out this information makes it more obvious that YTM is an estimate.

Yield-To-Worst (YTW)

Estimated YTW is a measure of the lowest potential yield that can be received on a bond without the issuer defaulting on any of its payments.

The calculation is basically the same as YTM except that it accounts for instances when a bond has provisions allowing the issuer to close it out before maturity.

The pros and cons of using YTW are very similar to YTM, but the benefit of this metric is simply that it accounts for bond callability. That may not always be the most relevant consideration for bond funds in a long-term, strategic asset allocation…but YTW can be relevant from a more tactical risk management perspective.

Should you rotate out of your bond funds into cash or short-duration bonds?

Most of the yield questions I’m receiving these days are driven by the underlying question of whether you should sell your bonds for higher-yielding cash, so I’ll close out the episode by sharing three simple reasons that isn’t a good idea:

- Rotating out of your existing bonds and into cash or short-duration bonds (like a 3-month Treasury bill, for example) is a market timing move.

- Accepting lower yields today can help reduce the risk of even lower yields down the road.

- Not all yield curves are inverted, so investors can look to corporate and muni bond curves that are more upward-sloping.

Resources

- Rubin Miller’s article on the difference between return of investment and return on investment

- Deeper Reading: What You Need to Understand about Bonds

- Ep: 84: CIO Roundtable with Rubin Miller and Phil Huber

Submit Your Question For the Podcast

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

If you enjoy the show, you can subscribe wherever you listen to podcasts, and please leave me a review. I read every single one and appreciate you taking the time to let me know what you think.

About the Podcast

Long-term investing made simple. Most people enter the markets without understanding how to grow their wealth over the long term or clearly hit their financial goals. The Long Term Investor shows you how to proactively minimize taxes, hedge against rising inflation, and ride the waves of volatility with confidence.

Hosted by the advisor, Chief Investment Officer of Plancorp, and author of “Making Money Simple,” Peter Lazaroff shares practical advice on how to make smart investment decisions your future self with thank you for. A go-to source for top media outlets like CNBC, the Wall Street Journal, and CNN Money, Peter unpacks the clear, strategic, and calculated approach he uses to decisively manage over 5.5 billion in investments for clients at Plancorp.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.