2022 has been a challenging time for global investors. Gargi Pal Chaudhuri, Head of iShares Investment Strategy and Markets Coverage, joins to share insight on everything that’s been happening and what to look out for in the future.

Listen now and learn:

- Whether or not we are in a recession

- When we can expect inflation to begin cooling

- Where attractive opportunities exist today

Watch the interview, listen to the show, or read my detailed show notes below.

Watch Now

Listen Now

Show Notes

Gargi Pal Chaudhuri is a Managing Director and Head of iShares Investment Strategy and Markets Coverage. Based in New York, she and her team focus primarily on delivering global macro thought leadership, investment insights, ETF implementation, education, and trading guidance to both retail and institutional clients of the firm.

With over two decades of experience in the financial services industry, Gargi has built her career around portfolio management in the fixed income markets, trading, and macro strategy.

Prior to joining BlackRock, she spent nine years on the sell side at Jefferies & Co. and Merrill Lynch. As a VP at Jefferies & Co., she ran the US inflation trading desk, built the Treasury Inflation Protected Securities (TIPS) franchise and provided liquidity in TIPS to institutional clients. She began her career in 2001 on the government bond trading desk at Merrill Lynch, focusing on providing liquidity and market making in TIPS and treasury securities.

Gargi graduated magna cum laude with a bachelor’s degree in accounting and psychology from Ohio Wesleyan University in 2001. Outside of BlackRock, Gargi is an avid runner, hiker, and a triathlete and has completed multiple marathons, ultra-marathons, half Ironmans, and the New York Ironman.

My most loyal listeners and viewers will know that I generally tell them it’s best to ignore the day-to-day news cycle of market and economic news. A big reason is that it’s easy for investors to lose sight of the big picture as their mental time horizon shortens to match the frequency of feedback rather than that of their planning time horizon.

It also causes people to check their portfolios more frequently, and the more frequently we evaluate our portfolios, the higher our chance of seeing a loss and, thus, the more susceptible we are to loss aversion.

There’s pretty good research out there (such as this and this) showing that investors who get the most frequent feedback also take a less than optimal amount of risk and earn less return. On the other hand, investors that check their portfolios less frequently are more likely to find gains and less likely to make bad decisions stemming from loss aversion.

So as you are listening to the conversation on the podcast or reading my show notes, those of you with a thoughtful financial plan and long-term asset allocation should remember if you’re nervous about the market or economy, you are usually going to be better off revisiting the assumptions of your financial plan than you would be actively adjusting your portfolio in response to the current market environment.

For what it’s worth, I’m actually seeing more and more reasons to become bullish (perhaps a potential solo episode in the future), so I was very excited to have Gargi with me to talk about what’s going on in the market.

Here are my notes from our conversation, recorded on September 7, 2022…

What’s Going on in the Market Today? (1:01)

2022 has been a pretty challenging time for global investors. The S&P 500 was down more than 20%, which people refer to as a bear market, but then we had somewhat of a relief rally in the early summer months. But ever since Jerome Powell Fed Chairman Jerome Powell spoke at Jackson Hole, market volatility has spiked and prices have trended downwards.

Gargi thinks we’ve had a regime change this year. Everything that drives stock market performance is about the expectations for growth and expectations for inflation. She points out that those drivers have been a lot more volatile this year, suggesting that they will probably be more volatile in the future.

Why has that happened?

One big reason is that starting in the middle of 2021, inflation started rising. Historically, inflation has been very stable in the U.S. and in most of the developed markets. When inflation started moving significantly above the Federal Reserve’s 2% target rate of inflation, they had to respond with extremely aggressive interest rate hikes.

We haven’t seen a rate hiking cycle like this in 40 years – going from zero to what is soon going to be 300 basis points, and even by the end of the year 375 basis points in BlackRock’s estimate – and that has spooked equity markets.

Meanwhile, investors look to bonds to help offset some of that risk from the stock market, but bond prices have fallen as interest rates have risen (bond prices and interest rates have an inverse relationship).

So looking back on what’s happened, a lot of it is related to inflation. That’s what has driven the Fed and many other central banks. That’s what has driven stock prices. That’s what has driven bond prices. And in Gargi’s view, there’s a little more volatility ahead of us. She doesn’t think we are in a recession, but there are some concerns about a real slowdown in growth in the U.S. because we can certainly see some areas of the economy slowing down already.

Opportunities in the Bond Market (4:57)

Fed is saying rates are going to stay higher for longer than what the market had been pricing in. It started with Jerome Powell in Jackson Hole and other Fed Presidents have echoed that sentiment.

Interest rates have already moved significantly higher to price in a Fed Fund Rate of 375 basis points, so investors have experienced a lot of pain in their statements. But now we’re getting to some interest rate levels that actually make fixed income attractive again. For the last decade, there hasn’t been a whole of income in fixed income.

Gargi explains that when you consider something like U.S. Treasuries – obviously very safe assets because they’re backed by the U.S. government – getting something like 3.5% on two-year Treasuries is tremendously exciting.

But if you look to investment grade corporate bonds – really highly-rated companies that have a very low probability of default – you can earn close to 5%. Compare that to five years ago when you’d need to really lower the quality (and increase the risk) of your portfolio to earn 5%. There is a lot of excitement around what Gargi refers to as the “yield of dreams” in the fixed income markets today.

Not only does fixed income offer what Gargi refers to as the “yield of dreams,” fixed income is better positioned to be that ballast for your portfolio, offering you a little bit of upside protection in periods of equity market losses. That obviously hasn’t been the case recently, but Gargi thinks we’re nearing levels where bonds will be a ballast again.

In our conversation, I re-emphasize that Gargi is talking about investment-grade bonds specifically, but left out high-yield from that conversation.

As I noted in an earlier episode on Where to Invest For Yield, the premium you receive for owning riskier, high-yield corporate bonds is lower than its 10-year average and the yield curve for those riskier bonds is shaped such that you aren’t being compensated for taking interest rate risk (meaning that parts of the curve are flat or inverted).

Lessons Investors Should Learn from the Market Downturn (8:44)

First of all, volatility in the markets isn’t new. We’ve all experienced them. This is something that is always going to be with us. But our reaction to the volatility is what we can control. You must stay invested and not move to cash entirely at the hardest times, otherwise, you are likely to miss the eventual bounce back.

Even though we’ve had a bit of a bounce back in markets, going ahead there could be more volatility. Of course, you can make your portfolio more resilient by turning to sectors of the market that do better in down periods and downturns. But moving away from the market, especially now when markets are down so much, is probably not a move that I would recommend.

One thing to think about is that cycles usually last multiple years, but this time COVID completely shut off the economy, and then we suddenly restarted – so expect things to happen much more quickly.

Gargi doesn’t think this will be a traditional credit cycle. Instead, she sees this playing out in months as opposed to quarters or years. It’s fine and maybe even good to be nimble, but stay invested because things might happen more quickly than a normal cycle this time around and you don’t want to miss out.

Are We in a Recession? (11:57)

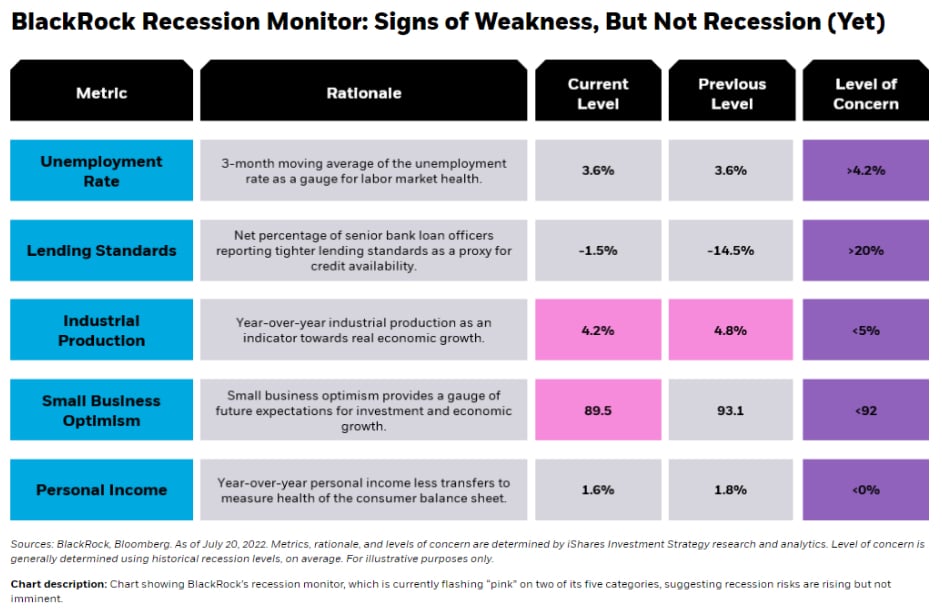

Gargi and her teams spend a lot of time building out our own recession dashboard because there are so many contradicting signals out there, and what might have worked in a previous cycle might not necessarily hold the same signal value this time around.

At the end of July, we learned that there were two negative quarters of GDP growth in the US. Many people think of that as being a recession, but it’s technically not. A recession is a broad-based slowdown in the economy.

BlackRock’s recession dashboard monitors several sectors of the economy.

Positive data points that suggest we aren’t in a recession include:

- In the labor market, lots of jobs are being created to the tune of 11.2 million open jobs right now. And unemployment is extremely low at about 3.7%, which is very near its all-time lows.

- Wages are still going up and people are still able to change jobs to capture those higher wages, that’s another positive signal.

- As for the consumer, which makes up a very big chunk of the economy, we see very positive personal income and personal spending data.

Negative signals Gargi notes in the data include:

- There is a slowdown in manufacturing and industrial production. Gargi explains that those are worrisome because it’s signaling a slowdown near recessionary levels.

- Gargi also expresses concern over the slowdown in credit creation or the growth of credit in the economy.

But when Gargi looks at the entire economy, she sees that some signals are flashing red, but not all – so she isn’t willing to call this a recession yet. However, she thinks it’s possible if the Fed keeps raising rates beyond what is priced in by the market – to say, four or five percent – but that’s not her base case.

Gargi points out that the European story is completely different and she feels they are most certainly going into recession because of the natural gas energy price shock coming their way. Fortunately, the U.S. doesn’t have that problem, so Gargi doesn’t see a recession for the U.S. in 2022, but could see one in 2023 if certain conditions change (like Fed raising rates more than expected).

Inflation (15:50)

Recognizing that inflation is going to be stickier for a longer period of time is really important.

Looking at inflation from now to the end of 2023, Gargi thinks inflation will be higher than what the market is pricing in (2.5% over the next five years) and the pre-pandemic levels when inflation averaged about 1.8% from 2000 to 2020.

Gargi thinks we potentially get back to 5.5% and then closer to 3% by the end of 2023. still lower than today’s levels, but significantly higher than (1) what the market is pricing in and (2) the pre-pandemic levels.

It’s also interesting to look at where the inflation is coming from. Right after COVID, we experienced disruption inflation. It started with goods inflation (we all sat at home and ordered things because we couldn’t go anywhere) and now we are transitioning to inflation coming from services inflation (paying rent, airfare, entertainment, etc). The transition has already happened in a meaningful way and Gargi feels it will persist at least until the end of this year.

Looking at food and energy prices, the Russia and Ukraine war has been a big disruption. We’ve seen energy prices come back from the highs that we had in the spring and early summer, which is good news. But the energy disruptions will stay in place for some time, so it’s hard to see oil prices going back to the $60-$70 level.

But we’re certainly not going back to sort of a $60 or $70 price level, because there are those disruptions that are going to stay in place for some time. Investors should think about the longer-term impacts of supply shifts, supply shortages, and supply chains that have moved.

With food, anyone going to the grocery store can certainly see the food inflation. Gargi talks about BlackRock’s focus on agricultural products and companies focused on the future of food.

Emerging Markets Outlook (22:33)

Thinking about an idea around shifting supply chains. We’ve heard Janet Yellen talk about a concept called “friend shoring.” This is the idea that we’ve seen so much supply chain disruption, that companies are no longer going to focus just on the cheapest place where they can get goods from, but actually on the most resilient place.

So as supply chain resilience becomes the focus, there are countries that can naturally benefit. So For example, Latin America is a huge beneficiary of friend shoring. Mexico actually, is an example of an EM country that could benefit from both the equity side and debt side.

A few of the big drivers of emerging markets has been nominal and real interest rates rising significantly and the strength of the US dollar. Because much of Emerging Market (EM) debt is priced in dollars, a strong dollar makes their debt harder to pay back and is a burden to EM countries. However, Gargi still feels there are pockets of opportunity in both EM bonds and equities.

Gargi also notes that the dollar has obviously risen significantly this year. But in as soon as four months from now, Gargi thinks we could the dollar stabilize a little bit when the Fed completes their hiking cycle. Dollar stabilization would make Emerging Markets really attractive on the bond side and then on the equity side you would still see beneficiaries from friend shoring.

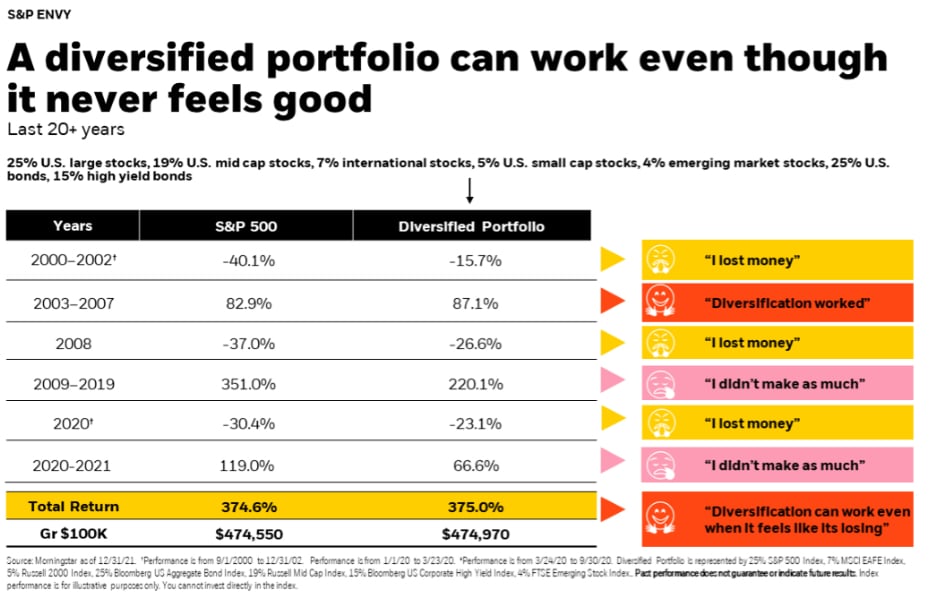

One side note that I brought up is that one of my favorite graphics from BlackRock is on diversification. Here it is:

U.S. Stock Market Outlook (27:00)

When you talk about outlook, it depends on your timeframe. While Gargi thinks the next six months might see more volatility. But when you’re investing for the next 15 to 25 years, stay invested in equities

Equities are one of the best inflation hedges.

Most investors aren’t investing for the next six months, they’re investing for the next 15 to 25 years, or even longer, stay invested in equities.

They are perhaps one of the best inflation hedges. And even if we do go into a recession, it probably will not be a Great Financial Crisis type recession, it is most likely to be a Fed-led recession. So staying invested should remain your North Star.

So even though we might see some turbulence ahead for the US equity markets over the next few months. And even if we do go into a recession, it will probably not be a GFC type recession, it will probably not be a balance sheet recession, it is most likely to be a Fed-led recession. And that’s why I think staying invested should remain your Northstar.

Resources

- Podcast Episode 64: Where to Invest For Yield Today

- The Effect of Myopia and Loss Aversion on Risk Taking: An Experimental Test

- Nyber Working Paper Series: Myopic Loss Aversion

Submit Your Question For the Podcast

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

If you enjoy the show, you can subscribe wherever you listen to podcasts, and please leave me a review. I read every single one and appreciate you taking the time to let me know what you think.

About the Podcast

Long-term investing made simple. Most people enter the markets without understanding how to grow their wealth over the long term or clearly hit their financial goals. The Long Term Investor shows you how to proactively minimize taxes, hedge against rising inflation, and ride the waves of volatility with confidence.

Hosted by the advisor, Chief Investment Officer of Plancorp, and author of “Making Money Simple,” Peter Lazaroff shares practical advice on how to make smart investment decisions your future self with thank you for. A go-to source for top media outlets like CNBC, the Wall Street Journal, and CNN Money, Peter unpacks the clear, strategic, and calculated approach he uses to decisively manage over 5.5 billion in investments for clients at Plancorp.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.