This is the second episode of the Investing by Age series.

Your 30s are the time to begin building lasting wealth to meet life’s growing demands.

Listen now and learn:

- Best practices for consolidating your investments

- How to prioritize paying down debt vs investing goals

- The 3 essential components to protecting you against the unexpected

Listen to the episode below or read the detailed show notes.

Listen Now

Show Notes

This is the second installment of the Investing by Age series.

Because people go through different financial stages at different ages, you’ll likely find useful information in the episodes outside of your age bracket.

If you’re in your late 20s, you might find this episode on investing in your 30s to be just as important. If you’re in your 50s, you might find aspects of investing in your 40s or investing in your 60s to be relevant.

One thing is for sure, the right investment strategy to reach your goals will shift as you age…

Once you reach your 30s, the looming worries of graduating, starting a career, and climbing out of the student loan debt hole probably have been replaced by more domestic concerns.

According to the U.S. Census Bureau, the median age that men get married is 29, and for women it’s 28. Additionally, the National Association of Realtors reports that the median age for first-time homebuyers is 33.

So if you’ve gotten married and/or bought a home—or have at least thought about those things—you also may start thinking about kids soon (if you haven’t become a parent already). That’s a lot of new responsibilities and costs to think about when planning for the future.

Your 30s are the time to begin building lasting wealth to meet life’s growing demands.

I’m going to assume that you have done the things suggested in Episode 57 on Investing In Your 20s…so with that in mind, here are six ways to focus your investing strategy as you navigate your 30s:

1. Consolidate Your Investments

If you started investing in multiple accounts in your 20s, your portfolio may be in disarray now. You might have 401(k) accounts with a few employers, a Roth IRA that you started right out of college, and some online investment accounts you’ve built up over time.

Now is the time to consolidate those investments. Pooling them in one place makes it easier to see the role each investment plays in achieving your financial goals. It also will help you avoid redundancies and manage your overall risk.

The natural question that might arise from this action item would be: Where should I consolidate my investments?

There is not a one-size-fits-all answer to this question, but I can say that you don’t want to incur costs or taxes from transferring accounts.

For example, some online investment platforms will force you to liquidate your prior holdings from accounts you transfer over, regardless of the tax consequences, so you definitely want to avoid that. Other platforms have account closure fees or transfer fees that you should avoid.

And if you decide to seek the help of a financial professional in order to consolidate and optimize your investments, the same rules apply.

2. Get Strategic with Your Debt

If you have debt, the strategies you put in place in your 30s can shape how quickly you can pay it off.

There’s no precise formula for getting out of debt quickly, and your financial situation will dictate your exact priorities. But in general, I recommend tackling your debt in this order:

- High-interest debt that isn’t tax-deductible (e.g., credit cards) or private loans

- Debt with private mortgage insurance attached.

- High-interest, tax-deductible debt (e.g., some student or business loans).

- Reasonable and low-interest-rate debt—4% or less—that’s tax-deductible (e.g., many student loans and mortgages).

It’s critical to get as much of this debt behind you as possible at this stage in life, but don’t neglect to invest while paying down debt. As we covered in Episode 56, the rewards of investing are enormous when you start now.

Related Articles:

3. Maximize Your Retirement Accounts

There are so many options for retirement investing and choosing the right ones can feel daunting. Here is what I believe is the mathematically optimal order for maximizing your retirement investments in this order:

- Invest the amount to get a full match on your company retirement plan.

- Contribute to a Roth IRA or deductible traditional IRA, if you’re eligible.

- Invest the maximum limit on your company 401(k) (do this before investing in the previous accounts if it’s a good plan with low fees).

- Contribute to a traditional nondeductible IRA, which offers tax-deferred compound growth.

And if it makes sense – and I say that because it doesn’t for everyone – don’t forget about investing your Health Savings Account (HSA). This account offers a triple tax benefit: a tax deduction on the contribution, tax-free investment growth and tax-free withdrawals when used to pay for medical expenses. If this strategy makes sense for you, then I’d argue it’s the top priority after getting your employer match.

4. Make the Most of Your Cash

Investing while covering expenses can be a delicate dance, especially at a stage in life where financial responsibilities seem to multiply. The trick is figuring out how much you can put away while still having enough liquid cash on hand to meet immediate needs.

I’m not a fan of keeping more than a full month of expenses in a primary checking account, mostly because those accounts typically don’t earn as much. For people with very predictable income, a cash cushion of between 25% and 50% of a month’s expenses is enough to cover fluctuations while minimizing the amount of money earning little to no interest.

People with irregular income and/or expenses, however, may need more than a full month in their primary checking.

Then you should keep at least three months’ of expenses in an emergency savings account,

preferably in an online where you earn a higher interest rate.

As for your portfolio, keep your cash to a minimum since holding too much of your assets in cash makes it difficult to stay ahead of inflation and generate sufficient returns to meet your retirement and other long-term goals.

5. Plan for The Unexpected

Over the course of your life, you and your family are bound to face some unplanned—and potentially unpleasant—moments. Some of these can be financially crippling if you’re unprepared.

It starts with proper life insurance coverage, and nearly everyone is are far better off getting term life insurance rather than a permanent insurance policy.

The Social Security Administration reports young workers have a 26.8% chance of being disabled for 12 months or longer before reaching retirement age, so you’ll also need some form of disability insurance.

Finally, you need an estate plan to protect you, your family, and your stuff.

6. Get Assistance

Research from Vanguard estimates that financial advisors can add roughly 3% in relative return for an individual investor. I explore the value of an advisor further in Episode 24: Do It Yourself or Hire an Advisor?

A lot of people want to know: when is it the right time to hire an advisor?

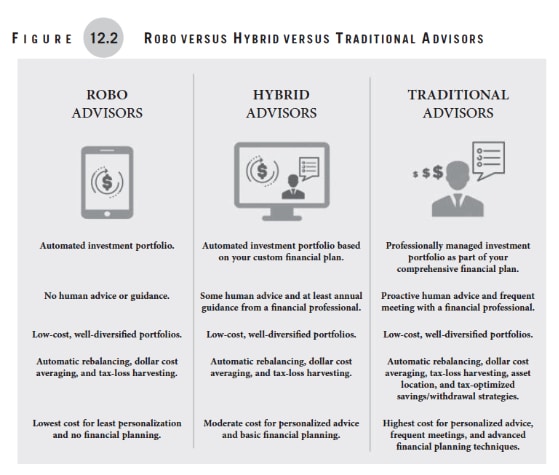

The cost of a human advisor generally becomes cost efficient once you have $500,000 across your various investment accounts. If you aren’t quite there, using a robo-advisor or hybrid advisor ought to be sufficient.

Here is a useful graphic with information about these different types of advisors:

When you’re at the point of hiring a human advisor, it’s important to choose someone that doesn’t simply offer investment advice. Instead, you want someone that provides comprehensive wealth management so that you can get your entire financial house in order and keep it that way forever.

That means proactively assisting in optimizing your savings plan, developing an estate plan, implementing tax-saving strategies, analyzing insurance, entitlement strategies, and more.

Perhaps most important of all, hiring a comprehensive wealth manager frees you up to do the things you love most in life and alleviates the stress that can come from managing your financial matters.

The financial decisions you make in your 30s will impact you for the rest of your life. With these strategies, you can plan for a successful retirement long before you near the end of your career.

Resources

- Pay Off Student Loans or Invest? Here’s How to Decide

- Invest or Pay Down Debt?

- What You Need to Know About Estate Planning

- Episode 24: Do it Yourself or Hire an Advisor?

- How an HSA Can Boost Your Retirement Savings

- How to Set Up Your Emergency Fund

- The Case Against Permanent Life Insurance

- Should You Use a Traditional IRA or Roth IRA For Retirement Savings?

Submit Your Question For the Podcast

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

If you enjoy the show, you can subscribe wherever you listen to podcasts, and please leave me a review. I read every single one and appreciate you taking the time to let me know what you think.

About the Podcast

Long-term investing made simple. Most people enter the markets without understanding how to grow their wealth over the long term or clearly hit their financial goals. The Long Term Investor shows you how to proactively minimize taxes, hedge against rising inflation, and ride the waves of volatility with confidence.

Hosted by the advisor, Chief Investment Officer of Plancorp, and author of “Making Money Simple,” Peter Lazaroff shares practical advice on how to make smart investment decisions your future self with thank you for. A go-to source for top media outlets like CNBC, the Wall Street Journal, and CNN Money, Peter unpacks the clear, strategic, and calculated approach he uses to decisively manage over 5.5 billion in investments for clients at Plancorp.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.