This is the first episode in the Investing by Age series.

The financial decisions you make in your 20s are arguably more impactful than any other time in your life because of the time your decisions have to compound.

Listen now and learn:

- Why it’s important to start investing now

- The essential elements to investing in your 20s

- The most important thing to avoid in your investments

Listen to the episode below or read the detailed show notes.

Listen Now

Show Notes

This is the first episode of the Investing by Age series.

People go through different financial stages at different ages, so you will likely find useful information in the episodes outside your age bracket.

If you’re in your late 20s, you might find the episode on investing in your 30s to be just as important. If you’re in your 50s, you might find that aspects of episodes on investing in your 40s and investing in your 60s are relevant.

With that in mind let’s dive into the essential aspects for investing in your 20s….

The financial decisions you make in your 20s are arguably more impactful than any other time in your life because of the time your decisions have to compound. While I have five specific financial actions to take in your 20s, there is no more important decision you can make than choosing to start now.

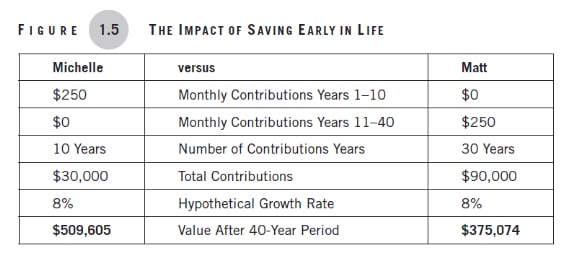

There’s an example I use in my book of two college graduates with access to tax-deferred investment accounts earning 8% per year.

The first investor saves $250 a month for ten years (for a total of $30,000) and then doesn’t make another investment for the next 30 years. At the end of the 40 years, her portfolio amounts to $509,605.

The second investor doesn’t invest for the first ten years of the same 40-year period. Instead, he contributes $250 a month for the next 30 years for a total contribution of $90,000. But despite saving more money over a longer period of time, the second investor ends up with only $375,074.

This goes to show that the most potent combination for wealth creation is time and the power of compounding.

Whether you’re saving early and often, systematically adding to your investment portfolio, or staying the course through periods of uncertainty and market losses, time has the power to turn small decisions into incredible results.

With that in mind, here are the five most important things you should do in your 20s:

1. Set Goals

Before investing, it’s important to understand what you want to do with the wealth you create. Creating a reverse budget is a good framework for setting goals and establishing a plan to meet them.

You can download my Reverse Budgeting Worksheet here.

If you’re not familiar with the concept of reverse budgeting, start by listing out your short-term goals of 5 years or less. Then you total up the expected cost of the various goals and divide by 60–because there are 60 months in 5 years—and what you’re left with is how much you need to save every month.

If you have capacity to save more, then you start applying the extra cash flow to your intermediate term goals that are 5-15 years away or your long-term goals of 15+ years.

One call out is that your annual retirement savings goals—like contributing to a 401(k) or IRA—should be listed among your short-term goals since need to be contributing to your retirement savings every year.

Investing your retirement savings in a mix of stocks and bonds will be essential to growing your wealth. If your portfolio lacks sufficient exposure to riskier assets like stocks, then you may not generate enough returns to meet your long-term goals.

But savings for your other short-term goals of less than five years should be kept in cash rather than invested in the stock market.

Market volatility is inevitable—it’s the cost of higher expected returns in stocks versus bonds or cash—so it’s unwise to accept the risk of market losses for your short-term goals because they have less time (and sometimes no time) to recover.

2. Max Out Your Retirement Accounts

There are a variety of retirement accounts that offer tax-free compounding of earnings, income, and capital gains.

The best place to start is investing enough in your employer-sponsored retirement plan (401(k), 403(b), 457, etc) to earn a match.

For example, if your employer has a 3% match and your salary is $100,000, you’ll need to contribute at least $3,000 to your retirement plan to be entitled to your employer’s full matching contribution. Failing to make this contribution is like leaving free money on the table.

From there, this is the order you should follow in maxing out retirement accounts.

I dedicated an entire podcast episode to this topic as well (Episode 11: Where to Save for Retirement).

3. Build Up a Cash Reserve

Having money available for unexpected expenses, regardless of your financial position, is extremely important. In fact, allocating some portion of your excess savings to what most people will refer to as an emergency fund takes priority over extra debt repayments or additional investing.

In general, an emergency fund should contain three to 12 months of expenses. If your emergency fund is starting from zero, then allocate at least 10% of your excess savings each month to this account. If you have a high degree of job security and income predictability, then you can probably build this account up more slowly.

Consider keeping your emergency fund in an online account to earn a higher interest rate than you would in your primary checking account. As an added bonus, keeping your emergency savings separate from your primary checking reduces the temptation to access those funds for non-emergency purposes.

Even if you don’t have an emergency or cash shortfall at some point in your 20s, this emergency fund might transform into more of a Cash Reserve that you can use opportunistically as you get older.

4. Automate Your Finances

Finances have a way of getting increasingly complicated as you age. Putting your savings, bills, and investments on autopilot can simplify things.

For your investments, automating a dollar cost averaging (DCA) plan removes the need for determining the best time to invest by regularly contributing a set amount to your portfolio.

For example, you could contribute $1,000 to an investment account on the 15th of the month for a long period of time. This allows you to diversify not only across asset classes, but time. Making equal dollar purchases over time can potentially lower your average purchase prices because you buy fewer shares when prices are high and more shares when prices are low.

While a lower average purchase price isn’t always guaranteed, DCA is still behaviorally advantageous because investing at regular intervals reduces the risk of buying at the worst times and experiencing an immediate loss in value.

DCA is also the simplest way to invest paycheck to paycheck. You don’t have to do anything beyond setting up automated monthly contributions to your accounts.

Everything thus far has been things you should do, but this last item is something you shouldn’t do.

5. Don’t Try To Beat The Market

Investing is a complex activity, but successful investing is surprisingly simple. The problem for most investors, particularly in their 20s, is they get in their own way by unnecessarily meddling in their portfolios.

Sometimes people wouldn’t characterize what they’re doing as “trying to beat the market,” so let me give a few examples of things you shouldn’t do. Trading individual stocks or options, buying sector or thematic ETFs, investing in actively managed funds…this type of behavior a recipe for poor long-term performance.

If you’re doing this and feel like you’re experiencing success, don’t be fooled. Most people aren’t benchmarking their returns appropriately (which basically means that they aren’t doing any better or perhaps even worse than a simple index portfolio), but even for people who are actually doing well, a handful of good years of returns does not mean you should expect to do well over the course of a lifetime.

There is an overwhelming amount of empirical evidence that professional investors can’t consistently beat the market for an extended period of time. If professionals can’t earn returns above the market, why would you expect to be able to do so?

While it’s natural to want investments that beat the market, most investors taking this route underestimate the competition they face and the opportunity for success.

There is an overwhelming amount of research showing that both individuals and professional investors routinely underperform the market, but that doesn’t mean you shouldn’t invest.

Instead, it simply suggests a low-cost strategy that doesn’t rely on predicting market movements will improve your chances for success.

To recap the important elements of investing in your 20s, the single most important thing you can do is start now. Once you get started, you should:

- Set goals

- Max out retirement accounts

- Build up a cash reserve

- Automate your finances

- Avoid trying to beat the market

Start making these changes now. The good decisions you make early in life will have more time to compound in your favor and set you on the path for financial success.

In our next episode, we will look at the Investing in your 30s.

Resources

- Download My Reverse Budgeting Worksheet

- Read: What Order to Save For Retirement: Where to Save for Retirement: 6 Important Accounts

- Listen: What Order to Save For Retirement: EP 11: Where to Save for Retirement

- How to Set Up Your Emergency Fund

- Market Prediction is Harder Than You Think

Submit Your Question For the Podcast

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

If you enjoy the show, you can subscribe wherever you listen to podcasts, and please leave me a review. I read every single one and appreciate you taking the time to let me know what you think.

About the Podcast

Long-term investing made simple. Most people enter the markets without understanding how to grow their wealth over the long term or clearly hit their financial goals. The Long Term Investor shows you how to proactively minimize taxes, hedge against rising inflation, and ride the waves of volatility with confidence.

Hosted by the advisor, Chief Investment Officer of Plancorp, and author of “Making Money Simple,” Peter Lazaroff shares practical advice on how to make smart investment decisions your future self with thank you for. A go-to source for top media outlets like CNBC, the Wall Street Journal, and CNN Money, Peter unpacks the clear, strategic, and calculated approach he uses to decisively manage over 5.5 billion in investments for clients at Plancorp.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.