How much do you need to retire?

People are living longer. Healthcare costs are rising. And we have no idea what Social Security will look like in the future. So it’s no surprise that even the best savers have uncertainty around whether they are doing enough.

Listen now and learn:

- How to measure your current savings progress based on your age and income

- An easy calculation to estimate how big your portfolio needs to be to retire

- The process Peter and his team use to answer this important question

Listen to the episode below or read the detailed show notes.

Listen Now

Show Notes

How much money do you need to retire?

That’s the million-dollar question. Or is it the $2 million dollar question? Maybe it’s $5 million or $10 million.

Regardless, it’s an important question…But it’s also a highly personal one.

The personal nature of this question is a big reason that there aren’t many resources online to help you.

Whereas there is no shortage of articles and podcasts on how much to save on a regular basis, and where to put those savings to optimize growth.

But even if you’re a high earner who is maxing out all the right retirement accounts and also contributing savings to taxable investments, you still may theoretically not be doing enough to replace your income in retirement.

In this episode, I’m going to walk through two different retirement savings benchmarks to measure your current progress against and explain how you can apply them to your situation.

Then, I’m going to share how we answer this question for clients of Plancorp.

Retirement Savings as a Multiple of Your Income

The benefit of this benchmark is that it’s extremely easy to use. But it’s really important that you recognize how the assumptions for these models differ from your life.

There are two savings multiples I’m going to talk about. The first is from Fidelity, which simply suggests you should aim to have at least 1x your salary by age 30, 3x by age 40, 6x by age 50, 8x by age 60, and 10x by age 67.

So the assumptions that Fidelity is using for these benchmarks include an age-based asset allocation consistent with their Fidelity target date retirement funds, a 15% savings rate, a 1.5% constant real wage growth rate, and a retirement that lasts from age 67 through age 93.

Right away, you might be able to assess some differences between your situation and the assumptions I just listed.

But Fidelity’s biggest assumption that will likely be different for everyone, however, is the assumed income replacement rate of 45%, which means that they assume you only need to replace 45% of your current income to meet your retirement needs once factoring in Social Security.

Income replacement rate is highly variable from person to person, which I explain in more detail in a little bit…But first I want to share the income multiples that JP Morgan publishes in their regularly updated Guide to Retirement.

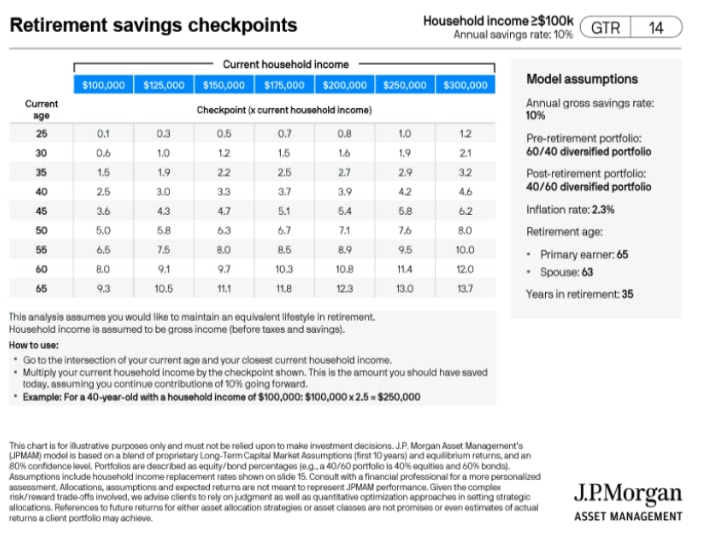

JP Morgan’s checkpoints span across a range of ages and income levels, which makes them more applicable to a larger set of people. The underlying assumptions of these income multiples are fairly different. JP Morgan assumes a 60/40 pre-retirement portfolio and a 40/60 post-retirement portfolio, a 10% savings rate, inflation of 2.3%, and a 35-year retirement.

Again, the primary benefit of using these retirement benchmarks is ease of use, but there are likely to be substantial differences between your personal circumstances and the underlying assumptions being used to model these results.

So I’d like to answer this question of how much you will need in retirement using a more personal process based on an estimate of your income-replacement rate for a portfolio and a hypothetical withdrawal rate.

How to Determine Your Income-Replacement Rate and Withdrawal Rate in Retirement

While the age-based benchmarks are a decent starting point, the next step would be taking a closer look at your planned retirement spending. The most common concept in retirement planning is the income replacement rate, which is simply how much of your working income will you need to replace in retirement.

A common rule of thumb you might see retirement experts using is 75-80% of your current income, which is primarily derived by reducing gross income by taxes and savings.

But in reality, there is a huge degree of variability in this number.

In fact, there is a paper from David Blanchett who is Morningstar’s head of retirement research. He concludes that income-replacement rates typically range from 54% to 87%, which really emphasizes that the amount of income someone needs to replace in retirement is highly personal.

The key factors in this wide range of differences are pre-retirement income and savings rate. The research suggests that higher-income, higher-savings households may need just 60% or less of their pre-retirement income during retirement income; while lower-earning, lower saving households may need closer to 90%.

Other important factors are non-portfolio income sources such as a pension or Social Security.

For our purposes of determining how much money you should have in your portfolio to retire, you can calculate a modified replacement rate that your portfolio will need to cover.

To do this, start with your gross annual salary and subtract out the amount you annually save for retirement. Next, subtract out the difference in taxes you’d expect from having a lower income in retirement. Finally, subtract out any nonportfolio income you’d expect from things like a pension or Social Security.

What you’re left with is a very rough estimate of how much income your portfolio will need to replace in retirement. Now you can apply a withdrawal rate to come up with a number for how much you need to have saved to comfortably retire.

The most commonly used withdrawal rate is 4%. Most of the more recent research suggests that this is no longer a safe withdrawal rate and that the number ought to be 3% to 3.5%. But that’s a debate for another time.

To keep things simple, let’s take a look at a few of the underlying assumptions made in the research suggesting a 4% withdrawal rate.

First, the 4% spending guideline assumes no variability in lifestyle, which probably the most unrealistic assumption as retirees spend more in some years and less than others. In fact, most research indicates that retirees tend to spend more early in retirement and less later on, before spending tends to pick up again toward the end of life as escalating healthcare costs come into play.

This doesn’t mean that we need to completely throw out the analysis supporting the 4% rule, but I think it’s worth highlighting the gaps for any of these quick retirement benchmarks.

The other big assumptions to know is that the spending rate rises to keep up with inflation, the asset allocation is 60% stocks and 40% bonds, and retirement spans a 30-year time horizon.

So back to our exercise. Start by multiplying your gross income today by the income-replacement rate you calculated earlier for your portfolio. Then divide that number by the 4% withdrawal rate, which then gives you an estimate for your necessary savings required to retire.

For example, if you have a $250,000 income and assume an 80% income-replacement rate for your portfolio, then you need to withdraw $200,000 a year from your portfolio. Dividing that $200,000 by 4% gives you the estimate of $5 million necessary to retire. If you opted to use a 3% withdrawal rate, the necessary portfolio to support 30 years of your spending jumps to $6.67 million.

For reference, the earlier multiples of earnings from Fidelity assumed that you need $2,500,000 today at age 67 for a 30-year retirement. JP Morgan’s analysis says the need is $3.25 million for a 65-year-old earning the same amount and funding a slightly longer 35-year retirement.

So, as you might expect, retirement benchmarks and rules of thumb result in a wide range of estimates. And that is perhaps why I’m not super comfortable using them in the first place.

Hopefully you also see how your personal circumstances make these rules of thumb an incomplete estimate for something as important as retirement.

Your savings rate, taxes before and after retirement, how long you work, how long you live, variability in your retirement spending and lifestyle goals…these are just a few of the variables that require fine tuning to reach a better estimate.

Which brings me to the final item I promised at the start of the episode, which is describing the process we use at Plancorp to determine retirement readiness.

The Essential Elements Of a Complete Financial Plan

Our process for answering this question relies on Monte Carlo simulations, which run thousands of scenarios to generate a probability that your plan will be successful. Generally speaking, we consider a plan to be “On Track” when 85% of the scenarios provide or exceed the value required to meet all your life goals.

The information that fuels these simulations is gathered through a discovery process where we gather a great deal of personal information on your family make-up, your values, your fears, your interests and hobbies, your personal and professional goals, etc.

Gathering this information allows us to make suggestions as we go through the objective inputs of your plan, which include your: income, cash savings, investments, real estate, any business ownership, your debts, insurance coverage, estate plan, and other details to create a personalized wealth management strategy.

From there we begin to hone in on the timing and prioritization of your goals. While retirement is the focal point here, it’s rare that people don’t have other objectives beyond their retirement date, and those other goals are important too, so we want to focus on those as well along with the timeline desired for meeting them.

Then we put all those inputs into the Monte Carlo simulation along with our estimates on the potential returns and volatility of your investments, rebalancing parameters, taxes, and inflation.

Once we see what the probability of successfully meeting all your goals in that base case scenario, we can start changing inputs to the plan so that you can see how they affect your likelihood of success.

That’s the power of Monte Carlo simulations: They give you a framework to translate chances into choices.

People are living longer. Healthcare costs are rising. And we have no idea what Social Security will look like in the future. So it’s no surprise that even the best savers have uncertainty around whether they are doing enough.

As you can tell from a few popular retirement benchmarks, answering this question truly depends on your personal situation.

Resources

- Estimating The True Cost of Retirement by David Blanchett of Morning Star

Submit Your Question For the Podcast

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

If you enjoy the show, you can subscribe wherever you listen to podcasts, and please leave me a review. I read every single one and appreciate you taking the time to let me know what you think.

About the Podcast

Long-term investing made simple. Most people enter the markets without understanding how to grow their wealth over the long term or clearly hit their financial goals. The Long Term Investor shows you how to proactively minimize taxes, hedge against rising inflation, and ride the waves of volatility with confidence.

Hosted by the advisor, Chief Investment Officer of Plancorp, and author of “Making Money Simple,” Peter Lazaroff shares practical advice on how to make smart investment decisions your future self with thank you for. A go-to source for top media outlets like CNBC, the Wall Street Journal, and CNN Money, Peter unpacks the clear, strategic, and calculated approach he uses to decisively manage over 5.5 billion in investments for clients at Plancorp.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.