A widely watched aspect of the yield curve has been making headlines recently. I want to help you better understand what everyone is talking about and how it impacts your investments.

Listen now and learn:

- What the yield curve is and what it means when the yield curve inverts

- The relationship between yield curve inversions and recessions

- How to think about your portfolio given the current environment

Listen to the show now or read the in-depth show notes below.

Listen Now

Show Notes

The yield curve is a line that plots interest rates for bonds with different maturity dates. You can plot the yield curve of corporate bonds, global bonds, municipal bonds, and so on…but the most common yield curve discussed among financial professionals is the US Treasury yield curve – and that will be the focal point for our discussion in this episode.

You’ve probably heard financial professionals and the media alike talk about interest rates rising or falling as if all bond yields are rising and falling in perfect tandem. But in reality, the yields for various bonds behave differently depending on their maturity and credit quality.

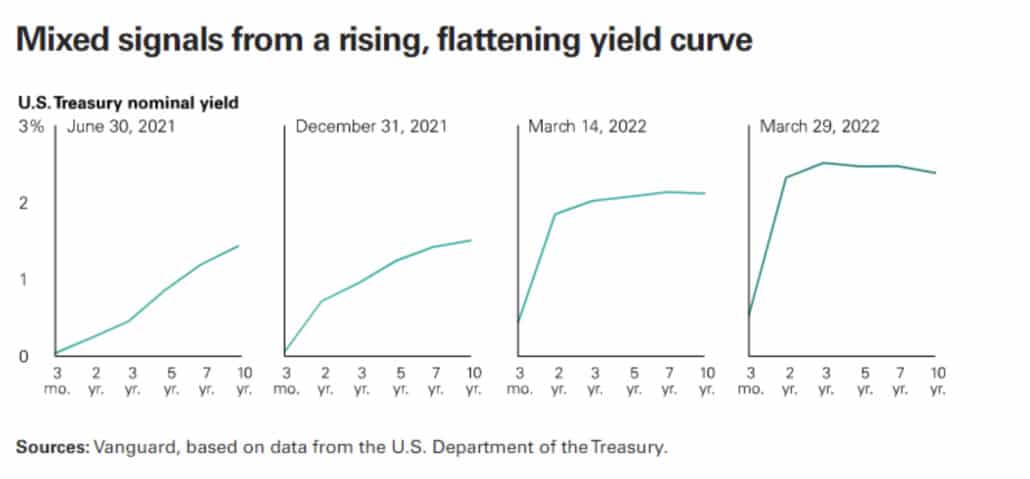

This means that when interest rates fluctuate, the shape of the yield curve changes too, which is simply a reflection of different maturities experiencing different interest rate changes.

The yield curve’s shape is often used as an indicator of how bond investors feel about the direction of the economy.

Yield curves normally slope upward because investors naturally demand a higher return for tying up their principal for longer periods.

- A steep yield curve signals that bond investors expect heightened economic growth and inflation. I’m not entirely sure who the arbiter of what qualifies as steep, but I generally see people say it’s when yields on 30-year Treasuries are 2.3 percentage points higher than 3-month Treasuries. This type of steepness is something that typically happens at the onset of economic expansion.

- A flat yield curve often signals economic transition. You can make your hand flatten so that it is parallel with the ground. Yields on long-term rates the same as yields on short-term rates.

- An inverted yield curve occurs when short-term bonds yield more than long-term bonds, which visually is represented by a yield curve line that slopes down and to the left. This yield curve shape is a sign that bond investors expect an economic slowdown if not an outright recession. In this situation, bond investors expect rates to be lower in the future.

One final thing to keep in mind with yield curve shapes is that different parts of the curve can steepen, flatten, or invert.

Today, the potential concerns among bond investors as short-term rates approach or overtake long-term rates are:

- The Federal Reserve causes a recession by quickly raising rates to combat inflation.

- Investors believe long-term economic prospects are poor and, thus, are accepting lower relative interest rates to hold longer-term government debt.

Naturally, the recent flattening of the US yield curve may have you wondering whether a recession is on the horizon and whether you should make a change to your portfolio in response.

Is a recession on the horizon?

Today, 2-year yields are higher than 10-year yields, which is the type of inversion that has occurred before seven of the past eight recessions without a false signal.

The gap between the 3-month and 10-year yields has a slightly better record as a recession prognosticator – calling all eight recessions without a false signal – and that spread remains positive and fairly steep today. In fact, this 3-month/10-year spread has actually widened in recent weeks, meaning the yield curve has steepened at the shortest end of the curve.

Yield curve inversions do not cause recessions.

I think people tend to get caught up in the fact that when yields on longer-term Treasury bonds is lower than short-term Treasury bonds, a recession has typically followed in the next year or two.

But the inversion isn’t the cause of the recession. The yield curve is not a crystal ball. It’s simply an aggregation of global investors’ expectations for the economy. And I believe the curve today suggests that the bond market expects the Fed to raise rates quickly in an attempt to fight off inflation and, in the process, dampen economic growth.

So instead of thinking about yield curve inversions as a recession precursor, perhaps it’s better to think of it as a sign of economic fragility. In this specific instance, if inflation doesn’t moderate, the Fed could have to tighten more, which could tip the economy into recession.

Is it even appropriate to compare the current yield curve to historical data?

Interpreting any one signal is challenging, but I think that’s particularly true today when there is so much uncertainty about inflation, Federal Reserve policy, the labor market, and now the war in Ukraine. Against this unusual backdrop, we need to be careful in drawing parallels to history.

For example, consider that real yields haven’t inverted yet. Real yields are the nominal bond yields minus inflation. In the prior three yield curve inversions – which were all followed by recessions – the real yield curve was fully inverted in 2019 and 2006, and almost perfectly flat in 2000. Today, the yield curve is very steep when using real yields.

Now, that doesn’t necessarily undermine the signal bond markets are sending today, but I think it’s an interesting point to share in the context of using one set of data to conclude that a recession is imminent.

With the Federal Reserve signaling its intent to aggressively raise rates, expecting weaker economic growth makes sense, but only within the context of everything else that’s going on.

What economists think about the likelihood of a recession.

Let’s look at professionals that theoretically have plenty of information and context about what’s going on…Bloomberg tracks the median probability estimate from 80 economists that the U.S. will enter a recession in the next 12 months.

The latest survey showed that economist think the risk of a recession is higher. The median estimate had been 10% and now it’s 25%.

But the long-term average for this number is about 19%, meaning that about a fifth of economists always think a recession is coming in the next 12 months.

The few times the median economist estimate spiked, recessions didn’t emerge. The one exception was prior to Covid, but I’m taking that with a grain of salt since I don’t want to assume economists somehow knew there would be a novel virus that would go on to start the first pandemic in over 100 years.

So why do I even bring up the median economist estimate?

It doesn’t seem like a reliable indicator, but I think the narrative of increasing recession predictions aligns with the yield curve flattening (and in some instances inverting) as well as the stock market selloff: people are worried that the Fed will choke off economic growth as they try to slow down inflation.

Even though I’m repeating myself, I’ll say it again: the yield curve as well as a variety of other economic indicators are pointing to an economic slowdown. Whether or not that slowdown turns into a recession is really anyone’s guess.

As I frequently say, predicting recessions or market downturns is not how you achieve financial success. Instead, the key is to plan on recessions and market downturns occurring in advance. If you plan for these things to happen in advance, then you can set up a plan that allows you to save, spend, and invest with confidence.

We never know when or why the next downturn will occur, but we know that recessions and market downturns will continue to happen with a similar frequency as they have in the past.

Should you make a change to your portfolio in response to the yield curve inversion?

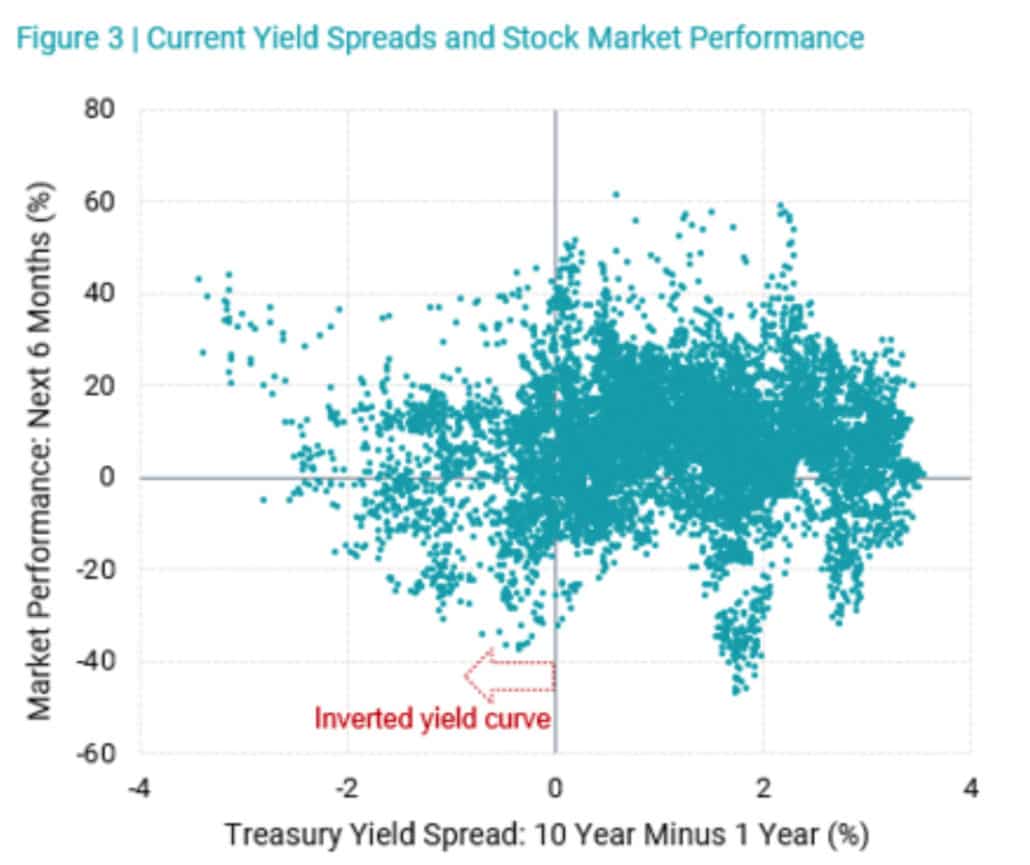

For stocks, Avantis recently published a study of the spread between 10-year and 1-year Treasuries versus U.S. stock market returns over the next six months, which showed there is no strong relation between the two.

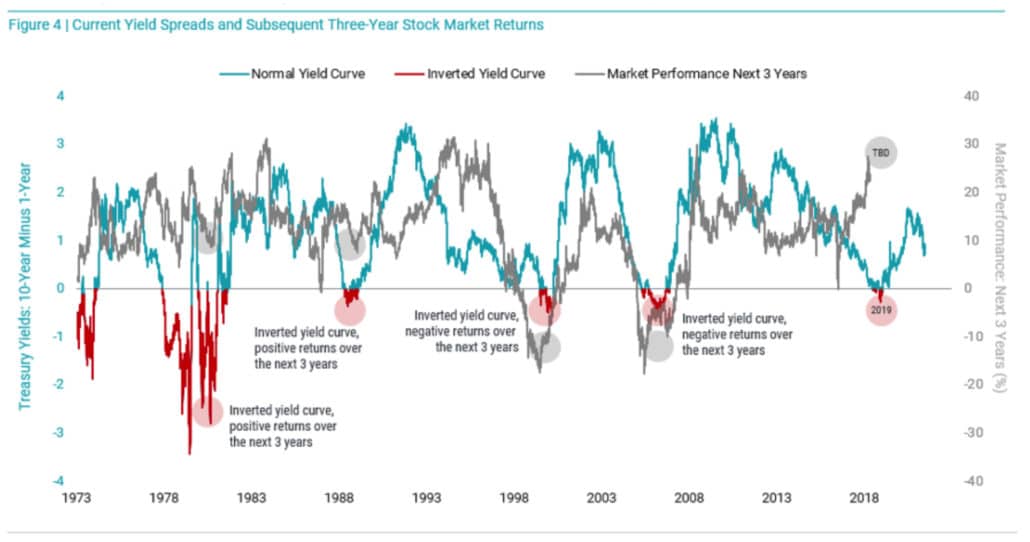

They also plot the yield curve spread over time against subsequent three-year U.S. stock market returns, and find that there isn’t a very strong relationship over the sample period going back to 1973.

Source: St. Louis Federal Reserve Bank (FRED) and Avantis Investors. Data from 10/31/1973-12/31/2021. Data. The CRSP U.S. Total Market Index represents U.S. stock market performance. Past performance is no guarantee of future results.

As is always the case with stocks, you are paid to accept uncertainty and periods of heightened volatility. Without these characteristics of stock investing, there would be no reason to expect higher returns than what you earn on bonds or cash.

As long as you invest in a portfolio born from a financial plan that takes regular downturns and recessions into consideration, then you shouldn’t need to make adjustments to your stock portfolio.

As for bonds, the same holds true, but I think it’s almost more difficult to stomach that advice because bond returns have been negative at a time when stock prices are declining. Even though bonds have experienced losses recently, they have still provided diversification benefits since the magnitude of losses is often significantly less than that of stocks.

Short-duration bonds have done relatively well in a diversified portfolio today because they are less sensitive to rising rates.

I personally find fixed income to be the most interesting area of the investment world these days because starting yields are historically low, which means that expected returns are so low that mistakes are arguably more costly than ever.

The mistakes people make with bonds are the same as the mistakes they make with stocks: people tend to chase performance. They want to invest in what’s doing best or what they think will do best.

People also feel the temptation to time the market. After all, interest rates have been rising on the long-end of the yield curve, and the Fed is telegraphing their intention to increase short-term rates – that makes it tempting to want to sell bonds to avoid losses and get back in when rates stop rising.

But how would you know that rates are done rising? Just like market timing with stocks, you have to get the call right twice: once on when to get out and once on when to get in.

But I’d strongly encourage you take the easier route of staying the course. After all, higher rates are a good thing for investors if their time horizon is greater than the duration of their portfolio.

It’s really just simple math. But I’ll say it one more time:

If your time horizon is longer than the duration of your fixed income holdings, then higher rates will actually improve your overall returns. This is a really important concept to understand.

In summary:

- Yield curve inversions signal an economic slowdown. Even though they historically been followed by a recession in the following 12-24 months, the 3-month/10-year yield spread still hasn’t inverted.

- Recessions are a normal part of investing, so you should plan on them. Planning on periods of lower returns and temporary losses is far better than trying to predict when and why they will occur.

- Finally, if you have solid financial plan in place, then you shouldn’t need to make changes to your portfolio in response to the latest market developments.

- If you don’t have a solid financial plan in place, then maybe this is the time to do so. Check out this free eBook called the 8 Essential Elements for a Complete Financial Plan. Whether you have an advisor or not, you’ll find it valuable.

Thanks for listening, and until next time…to long term investing!

Resources

- Free eBook: The 8 Essential Elements for a Complete Financial Plan

- Deeper Reading: What You Need to Understand About Bonds

Submit Your Question For the Podcast

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

If you enjoy the show, you can subscribe wherever you listen to podcasts, and please leave me a review. I read every single one and appreciate you taking the time to let me know what you think.

About the Podcast

Long-term investing made simple. Most people enter the markets without understanding how to grow their wealth over the long term or clearly hit their financial goals. The Long Term Investor shows you how to proactively minimize taxes, hedge against rising inflation, and ride the waves of volatility with confidence.

Hosted by the advisor, Chief Investment Officer of Plancorp, and author of “Making Money Simple,” Peter Lazaroff shares practical advice on how to make smart investment decisions your future self with thank you for. A go-to source for top media outlets like CNBC, the Wall Street Journal, and CNN Money, Peter unpacks the clear, strategic, and calculated approach he uses to decisively manage over 5.5 billion in investments for clients at Plancorp.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.