U.S. inflation accelerated to 7.5% over the last 12 months. You don’t need to be an economist to realize that this headline number is a big deal for Wall Street and Main Street.

But as someone who works on Wall Street and lives on Main Street, I’m here to tell you why I’m not particularly worried about the recent uptick in inflation.

Listen now and learn:

- The components driving inflation metrics higher

- 7 reasons you can feel optimistic about inflation

- A framework for thinking about inflation with your investments

Listen Now

Show Notes

Inflation is everywhere in the media and for good reason.

Inflation erodes the purchasing power of money over time. Historically U.S. inflation average about 3% a year. That average number includes periods of higher inflation and periods of lower inflation, but if we assumed a flat 3% rate of inflation every year, our purchasing power would be cut in half roughly every 27 years.

In my opinion, the primary reason someone is a long-term investor to begin with is to grow their savings at a rate greater than inflation. Growing savings at a rate greater than inflation has been fairly easy the past two decades since inflation has been well below its historical average, and barely ever reaching 2% in most years since the Financial Crisis.

But we all know inflation has picked up quite a bit since the pandemic.

On February 10th, the Labor Department reported that U.S. inflation accelerated to 7.5% over the last 12 months, as strong consumer demand and pandemic-related supply constraints continued to push prices higher.

You don’t need to be an economist to realize that this headline number is a big deal for Wall Street and Main Street.

But as someone who works on Wall Street and lives on Main Street, I’m here to tell you why I’m not particularly worried about the recent uptick in inflation.

But as someone who works on Wall Street and lives on Main Street, I’m here to tell you why I’m not particularly worried about the recent uptick in inflation.

In today’s episode, I’m going to…

- Start by explaining the inflation number being reported and what categories of the economy are driving it higher

- Then, give you 7 reasons why you can feel optimistic

- Finally, I’ll share with you a framework for thinking about inflation going forward in your portfolio

Let’s dive in…

How Inflation Is Reported

The gauge used to report inflation is the Consumer Price Index (CPI). CPI is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

It’s easy to find flaws in the basket of goods methodology, or the shortcomings of measuring only urban consumers without considering the wide range of consumer demographics. But overall, CPI does a reasonably good job of showing us the trend in prices for goods and services.

And there is no question that prices are going up.

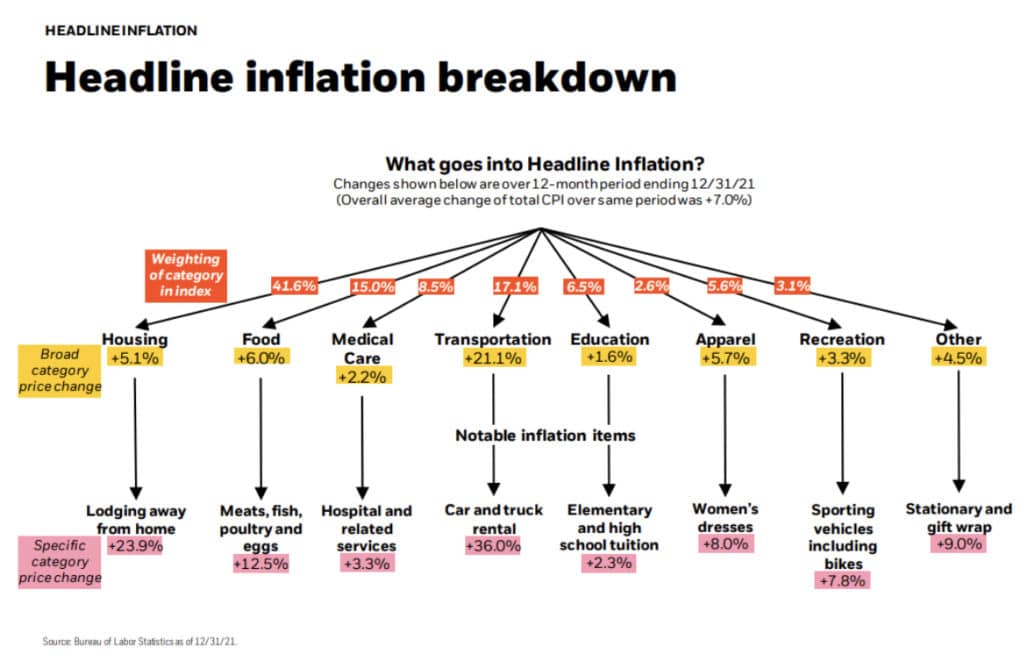

BlackRock has a really nice graphic from the prior month’s inflation report that shows the different weightings of goods and services within CPI along with what categories drove prices higher.

Looking at the data for the 12-month period ending on December 31, 2021, there are a few things that stand out.

- Housing carries a 41.6% weight in the Consumer Price Index (CPI) and that category increased 5.1%, with a notable 23.9% increase in the “lodging away from home” subcategory.

- Transportation has a weight of 17.1% in the Consumer Price Index, with a particularly notable increase within the category for car and truck rentals, which increased a whopping 36%.

- Food makes up 15% of the Consumer Price Index. It was up 6%. Within the food category, meats/fish/poultry/eggs were up 12.5%.

The point I’m trying to make here is that inflation impacts everyone differently.

Keep these categories in mind as I go through these 7 reasons that I’m not particularly concerned about the inflation we’ve seen recently. I realize that these points won’t apply to everyone, but they do apply for our clients at Plancorp as well as my average follower based on past feedback.

1. Averages Are Made of Highs and Lows

Inflation’s historical average of 3% includes times when readings fall below that level (as it has for most of the past two decades) and times when it’s higher than average (as it is today).

This is simply the winding path inflation takes to an average outcome. Its path takes far fewer twists and turns than, say, stocks do on their path to an average outcome, so it’s easy to notice big shifts like we’ve experienced during the pandemic.

But there is no reason to panic.

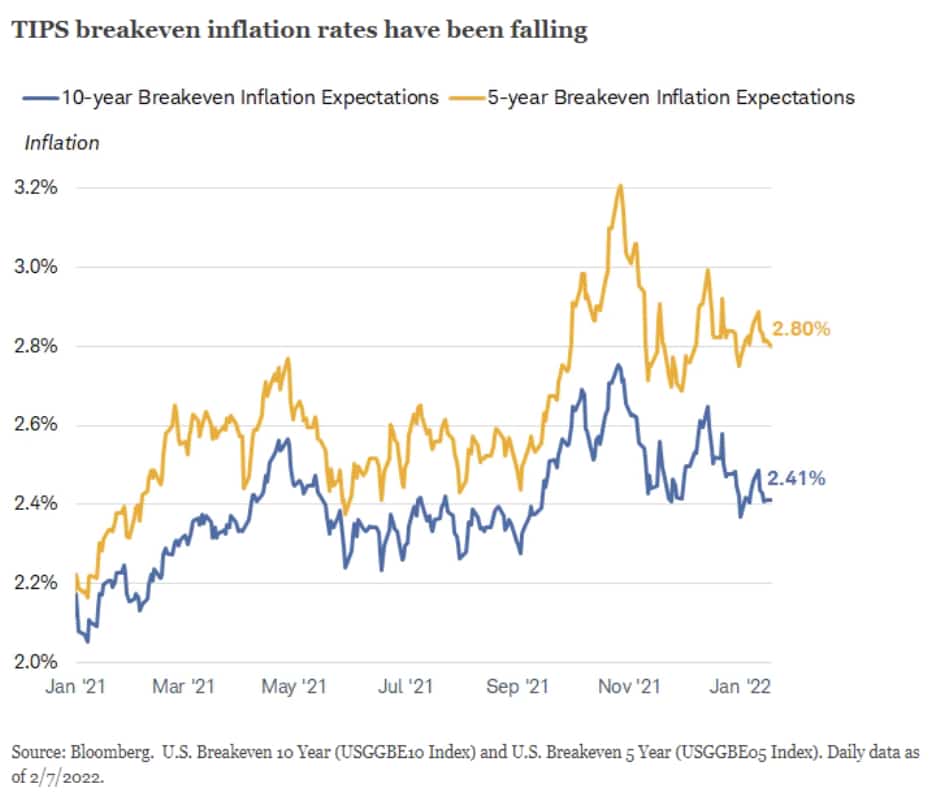

Even with the large uptick for inflation over the past 12 months, 5-year inflation is still just 2.92% through the end of 2021 and 10-year inflation is only 2.14%.

There is no doubt that inflation at this high of a level for an extended period would be harmful to the economy, but the Federal Reserve is already showing a willingness to tighten monetary policy to make sure that doesn’t happen.

Bond market prices, which reflect the opinions of all market participants, are showing expectations 2.80% average inflation over the next five years and 2.14% average inflation over the next 10 years.

Even though it does appear that the rate of inflation will remain elevated for a period of time, let’s not forget that it’s all part of a long-term average rate of inflation that is ideally included in your financial planning analysis and modeling to begin with.

2. Inflation Is Good For The Economy

Inflation isn’t a bad thing. In fact, it’s a sign of a healthy, growing economy.

But here’s what happens in an inflationary environment: When prices are going up, people expect prices to continue rising, so they want to buy now rather than pay more later. This increases demand in the short term. As a result, stores sell more and factories produce more. They are more likely to hire new workers to meet demand. And thus starts a virtuous cycle, boosting economic growth.

The alternative to rising prices is falling prices, or deflation, which is far worse. Here consumers and businesses hold off spending to wait and see if prices will drop more before buying (why purchase something today if it will be cheaper in a few months?).

Inflation isn’t a bad thing. In fact, it’s a sign of a healthy, growing economy.

Peter Lazaroff

This cuts back demand, and businesses reduce their inventory. As a result, factories produce less and lay off workers, which reduces demand even more. Businesses lower their prices, which makes the deflation even worse – and the negative feedback loop continues.

Historically it’s been very difficult to break a deflationary cycle, and it’s really been deflation that the Fed has been fighting for the past decade plus so that prices are finally rising this way could be viewed as a victory of sorts for the economy.

3. Inflation Leads to Higher Wages

One of the key ingredients to an inflationary environment is wage growth. Most successful professionals get raises each year that at least keep up with the rate of inflation.

Your human capital, or your capacity to earn, is arguably the most effective inflation hedge. If your wages keep up with inflation over the long-term, then your ability to purchase goods and services remains intact.

I’m still working, so this trend works in my favor.

Higher wages provide a boost when you have fixed costs like a mortgage, which brings me to my next point.

4. Inflation Is Good For Borrowers

Inflation makes debt less costly. So if you have a mortgage or commercial loan, you’re paying back debt with dollars that are worth less now than the dollars you received from the lender in the first place.

When inflation exceeds the cost of debt (i.e. the interest rate), it’s often referred to as “free money” because I’m repaying the bank with dollars that are worth less than the cost of the loan.

When the debt is a fixed rate the benefit is even better. Because I have a mortgage and commercial loan, inflation benefits those liabilities on my balance sheet. And reason number 5 is related to how inflation benefits the asset side of my balance sheet.

5. Inflation Is Good For Homeowners

If you remember the statistics I read at the start of the episode, one of the biggest areas contributing to the recent uptick in inflation is housing. I happen to own a home and don’t need to buy another home, so I’m benefiting from the increase in property value.

And as I just stated before, I’m also benefiting from the falling cost of the debt associated with my home, so inflation strengthens my financials as a result of being a homeowner.

So if you own a home, then this is a reason to be optimistic about the higher inflation.

6. Stocks Protect Against Inflation

If the vast majority of your savings are in cash, then high inflation is particularly harmful. But for me, nearly all of my savings are in stocks, which have historically outpaced inflation by a wide margin in the long run.

During inflationary environments, corporations pass on higher prices (wages, input costs, etc) to consumers, which in turn boosts revenue and earnings. Going back to 1928, both U.S. dividends and earnings have grown roughly 5% a year while inflation has averaged about 3% a year.

If you have less than 50% stocks in your portfolio, it might make some sense to have some additional inflation hedge in your fixed income and cash allocation.

7. Inflation Is Already Here And There’s Nothing You Can Do About It

Here’s the thing: Inflation is already here and there’s nothing you can do about it. Trying to hedge against something that has already happened doesn’t make a lot of sense. It’s like buying home insurance while your roof is on fire.

So if you are looking to do something in your portfolio to protect against inflation, you’re too late.

Owning TIPS or CPI swaps to hedge inflation in advance of a major inflationary event is one thing, but I’d say that even that isn’t necessary if you have at least half of your savings in stocks, which comfortably outpace inflation in the long run.

Inflation is already here and there’s nothing you can do about it. Trying to hedge against something that has already happened doesn’t make a lot of sense. It’s like buying home insurance while your roof is on fire.

Peter Lazaroff

That’s why it’s so important to have a financial plan and portfolio in place that takes into consideration all possibilities in advance. If you can completely remove prediction from your process, then you can focus on things within your control, which are the things that make the biggest difference in the end.

That’s all I have for today. Please be sure to subscribe to the show on your favorite podcast platform and remember that all show notes are posted to TheLongTermInvestor.com.

Until next time, to long term investing.

Resources

- Submit your question for the show through my “Ask Me Anything” form

Get Your Finance Questions Answered

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

If you enjoy the show, you can subscribe wherever you listen to podcasts, and please leave me a review. I read every single one and appreciate you taking the time to let me know what you think.

About the Podcast

Long term investing made simple. Most people enter the markets without understanding how to grow their wealth over the long term or clearly hit their financial goals. The Long Term Investor shows you how to proactively minimize taxes, hedge against rising inflation, and ride the waves of volatility with confidence.

Hosted by the advisor, Chief Investment Officer of Plancorp, and author of “Making Money Simple,” Peter Lazaroff shares practical advice on how to make smart investment decisions your future self with thank you for. A go-to source for top media outlets like CNBC, the Wall Street Journal, and CNN Money, Peter unpacks the clear, strategic, and calculated approach he uses to decisively manage over 5.5 billion in investments for clients at Plancorp.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.