The stock market has fallen from it’s high. Even though these types of drawdowns are completely normal, some people SHOULD be more concerned, especially if any of the reasons discussed in this episode are true.

Listen now and learn:

- The history of market losses

- 4 reasons someone should worry about recent volatility

- Details of a free book giveaway

Listen Now

Show Notes

Welcome to The Long Term Investor. Today’s episode is on the shorter side because I want everyone to stay tuned for a special book giveaway announcement at the end of the episode.

But first, I’m going to give you four reasons you SHOULD be worried about the recent market volatility.

Last week S&P 500 was down nearly 10% from its highs. People usually use the term “correction” to define a 10% drawdown, and that’s usually the point I send out a communication that emphasizes the importance of staying the course and NOT worry about the volatility.

Now, I know I said I’m going to give you four reasons you SHOULD be worried, and I promise I will, but first, it’s important to recognize these types of drawdowns are incredibly normal.

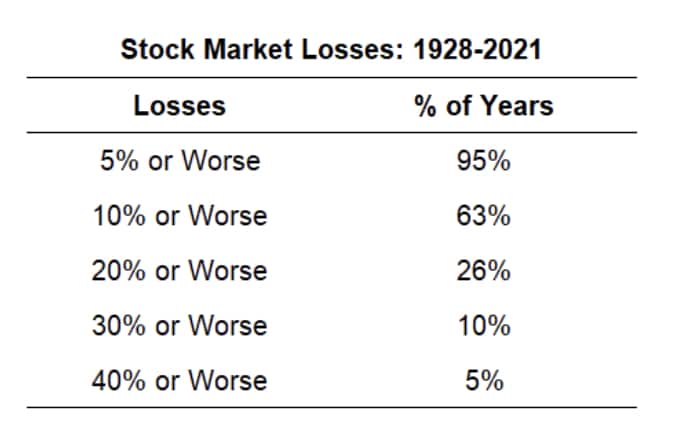

Ben Carlson had a nice blog post that provides data on how often we should expect a stock market correction. There is a table that goes back to 1928 and shows that the stock market loses 5% or more in 95% of years, 10% or more in 63% of years, and 20% or more in 26% of years.

Now, as Ben points out in his blog post, these averages are a bit skewed by all the crashes of the 1930s, so he goes on to look at data since 1950 and here’s what he finds:

- The average drawdown was 13.6% over the course of a calendar year

- Over the entire 72-year period, there have been 36 double-digit corrections of 10% or more, 10 bear markets of 20% or more, and 6 crashes of 30% or more.

But even though these types of drawdowns are completely normal, you might be feeling a bit uneasy.

And you know what? Some people should be more concerned than others, especially if any of the following four things are true:

1. You went to cash.

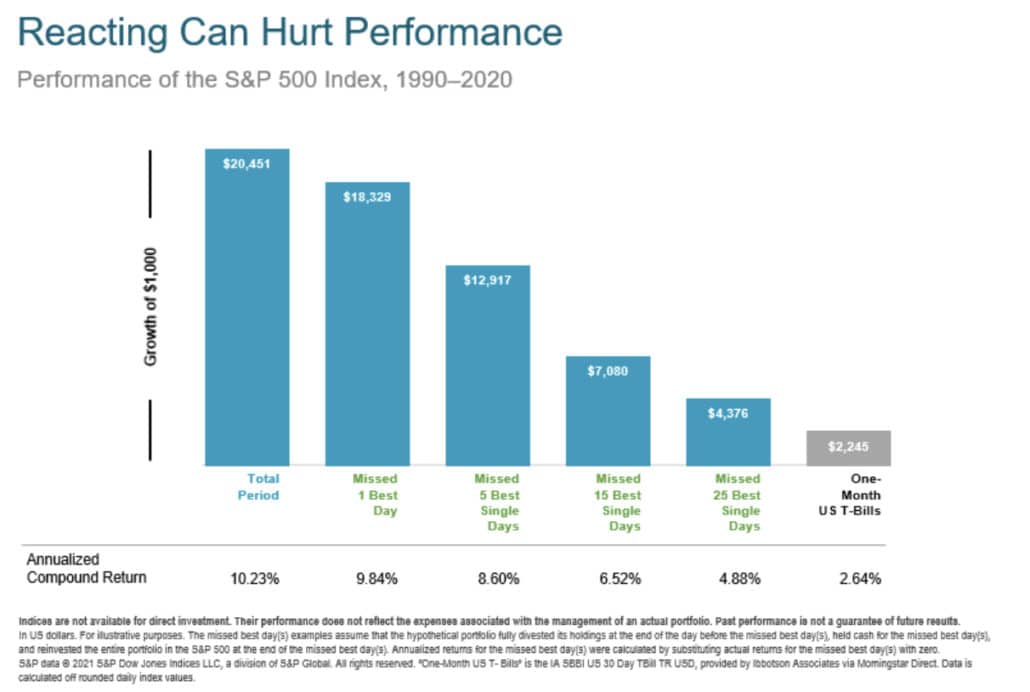

Even if you could accurately predict the future, knowing how the market will react is impossible. Going to cash requires you get it right twice — once when you sell stocks and once when you buy back in — making an already tall task insurmountable.

Plus, the best days for the stock market historically follow the worst days. Missing out on those returns from the best days basically locks in permanent underperformance versus the overall market.

There’s a chart I have in a blog post from last week that shows the financial impact of missing the best days in the market.

The takeaway here is if you’ve already gone to cash for some reason, then there’s definitely cause for concern.

2. You own concentrated individual stock positions.

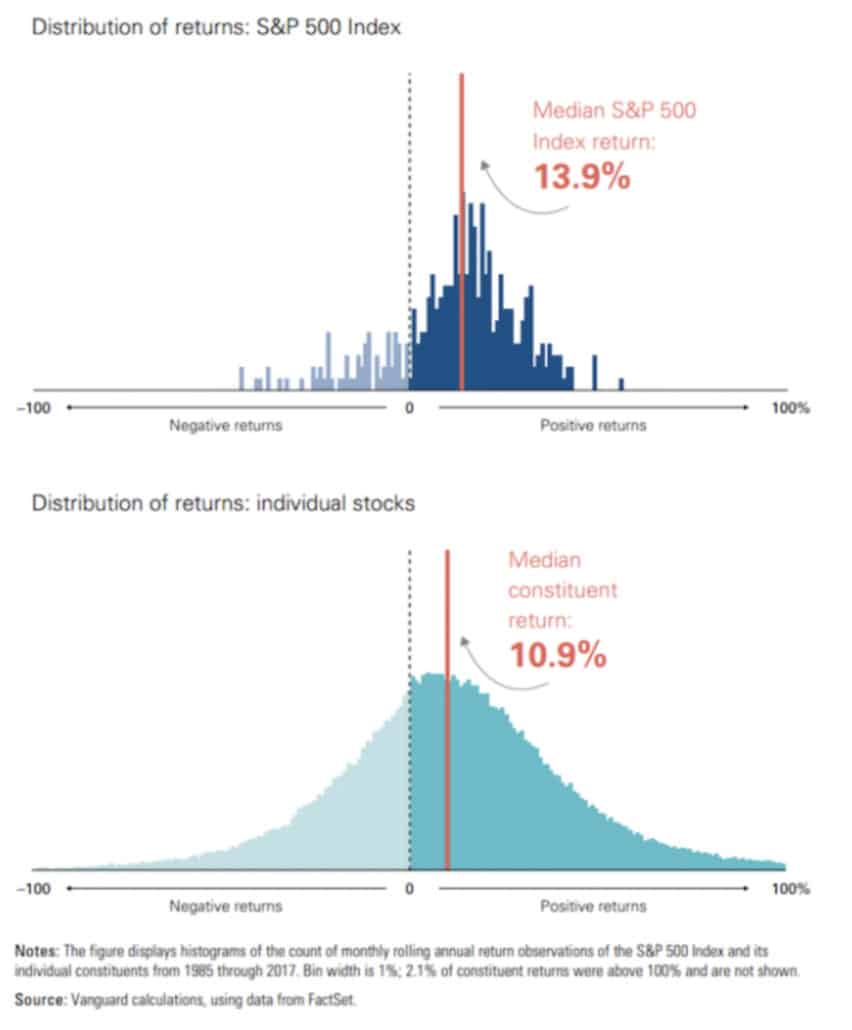

Where we lack certainty, we can turn to probability, and the probabilities suggest that individual stocks are much riskier than you might realize.

Looking at historical rolling annual returns, Vanguard found that individual stocks trail the median S&P 500 return 75% of the time.

Even worse, JP Morgan found that 40% of companies that were ever in the Russell 3000 experienced a permanent 70% decline in price from peak levels.

But even if you were to ignore those probabilities and gamble on an individual stock or two, how would it change your life if you happened to pick a massive winner?

Would you retire early? Buy a yacht?

My guess is it wouldn’t change anything. The only way it could change your lifestyle (currently or in the future) is if you bet an outsized portion of your net worth on individual securities or specific sectors.

Given the probabilities, I think you would agree that betting a large percentage of your net worth in this manner is simply irresponsible. If you guess wrong and have a large amount of your wealth wiped out, can you afford to start over from scratch? And remember, in this situation you’d be doing so without the benefit of the longer time horizon you enjoyed when you first began investing.

If I haven’t convinced you on the dangers of owning individual stocks or even sector-specific ETFs, and you still want to try to hit a home run, knowing that it won’t change your lifestyle if you’re right – then I’d ask the most important question: What’s the goal?

If the goal is to provide yourself entertainment, I actually understand that and even sympathize with it. If your financial house is in rock-solid shape – and I mean ROCK solid – then here is a suggestion:

Put a small amount of money, I’d say no more than 1% of your net worth, in a separate taxable account from your primary investments. Then make your bets in that account. Go crazy. Have fun. But leave your core long-term investments alone.

We know the odds suggest that owning individual stocks will make you trail the overall market and even experience a permanent loss of capital. But you should also know that a good financial plan doesn’t require you to hit home runs. It merely requires you to earn a decent return that compounds its way into exponential wealth growth.

Good investing is boring. If you’re having more fun watching your portfolio than watching paint dry, you’re probably doing it wrong.

3. Your portfolio lacks diversification.

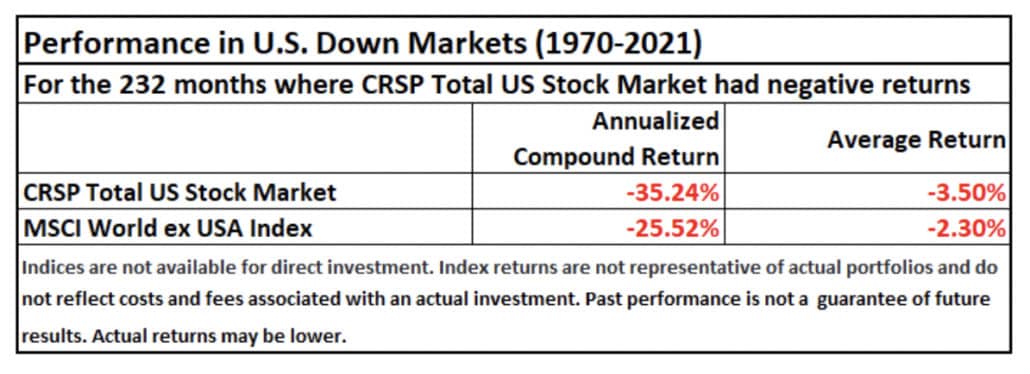

U.S. large cap stocks, as measured by the S&P 500, has been the dominant asset class ever since the Financial Crisis, but non-U.S. stocks have historically performed better than U.S. stocks in down markets.

The fact that U.S. and non-U.S. stocks don’t move in perfect tandem means that combining them can improve risk-adjusted returns. In plain English, that means you earn more return for the amount of volatility experienced.

You also really ought to have some of your portfolio in bonds. You might scoff at the low yields on bonds today, but the purpose of bonds isn’t income, it’s role in a portfolio is to reduce volatility. And even though bonds are down year to date, they are providing that volatility reduction thus far.

Look, the key to successful investing is minimizing mistakes and not interrupt compound interest.

Volatility doesn’t interrupt compound interest, but it does dampen it. Volatility also makes investing more uncomfortable.

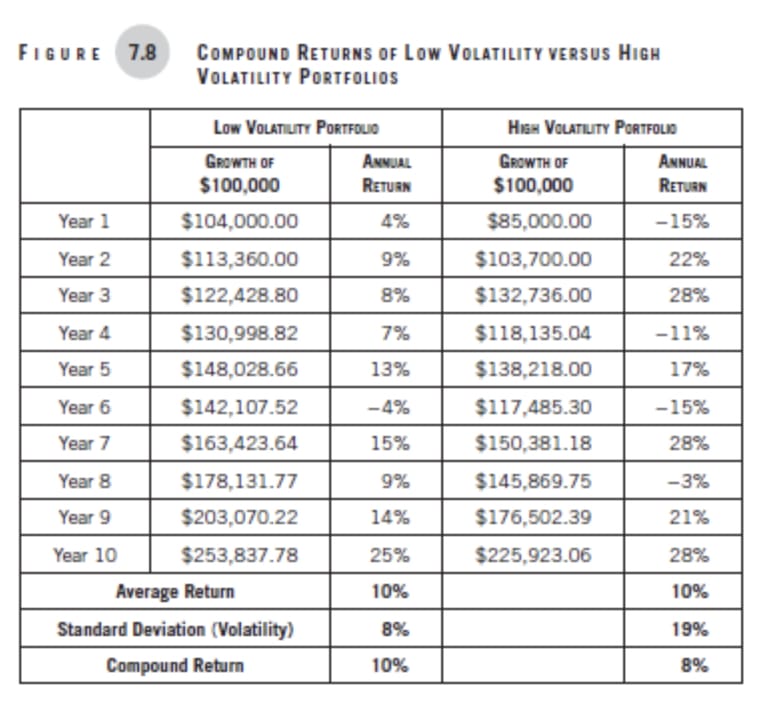

Diversification helps reduce volatility and makes the investment experience more tolerable. But just as importantly, it also improves returns. Compound returns are higher when volatility is lower. So if you have two portfolios with the same average return and different levels of volatility, the portfolio with less volatility will have higher compounded returns. Seeing the math behind this is easier to do visually, so I’ll drop a table from my book that illustrates this phenomenon.

Remember, a truly diversified portfolio owns everything, which also means it always owns the worst performers. So you know your well-diversified if there’s always a part of your portfolio that you find a bit underwhelming.

If you aren’t diversified now, that would be a very good reason to be concerned about market volatility.

Finally…

4. You don’t have a long-term financial plan.

Market downturns are likely to continue occurring with a similar magnitude and frequency as they have in the past. Rather than try to predict when or why they will occur, it’s far better to plan on them.

Without a plan, you don’t have any sense of how losses of any size impact you, and any actions you might take will be purely reactionary — a recipe that historically results in bad outcomes.

You hear me say this sort of thing all the time, but it’s true. You can’t make an informed decision about anything in your financial life without a plan.

If none of the four things I’ve highlighted in this episode apply to you, then you really shouldn’t worry about market volatility.

Stay the course and focus on things you can control.

Now, to my special announcement.…

My publisher accidentally sent me a box of my book, Making Money Simple. So I’m going to give away copies to the first 25 people that go to peterlazaroff.com/freebook. Just select Podcast on the dropdown menu, enter your information, and I’ll personally drop a signed copy in the mail in the next week or two.

But before you rush to do this, please know that if you input an invalid email address or mailing address, the system won’t process the request, so take your time.

If you don’t get in the request before the copies run out, then please consider purchasing a copy on Amazon.

Thanks again for listening. Until next time, to long term investing!

Resources

- Get a free copy of my book Making Money Simple at peterlazaroff.com/freebook

- How Often Should You Expect a Stock Market Correction?

- Submit your question for the show through my “Ask Me Anything” form

Get Your Finance Questions Answered

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

If you enjoy the show, you can subscribe wherever you listen to podcasts, and please leave me a review. I read every single one and appreciate you taking the time to let me know what you think.

About the Podcast

Long term investing made simple. Most people enter the markets without understanding how to grow their wealth over the long term or clearly hit their financial goals. The Long Term Investor shows you how to proactively minimize taxes, hedge against rising inflation, and ride the waves of volatility with confidence.

Hosted by the advisor, Chief Investment Officer of Plancorp, and author of “Making Money Simple,” Peter Lazaroff shares practical advice on how to make smart investment decisions your future self with thank you for. A go-to source for top media outlets like CNBC, the Wall Street Journal, and CNN Money, Peter unpacks the clear, strategic, and calculated approach he uses to decisively manage over 5.5 billion in investments for clients at Plancorp.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.