Listen Now

Should you manage your money or hire a professional to help?

In the first of a three-part series on hiring an advisor, you will learn:

- How to think about doing any given task versus hiring a professional

- The value of an advisor according to a prominent Vanguard study

- Common mistakes investors make on their own

Show Notes

At some point, most investors face the same dilemma: should you manage your money yourself or hire a professional to help you?

As a financial planner, I am biased towards suggesting that investors seek out help. That being said, let me share a quick story to give more context to my suggestion to hire help.

You Can Get by Okay On Your Own

When I bought my first home in May 2010, I was dead-set on having a big yard. With that bigger yard came bigger responsibilities. I had to spend time and effort cutting the grass and maintaining the lawn – something I never needed to do before.

Initially, it took me about two to three hours to mow the lawn. Eventually, I got efficient enough to finish the job in about 90 minutes. I always felt that the time commitment was manageable and the result was pretty good.

I know I was supposed to cut it every 5-6 days, but I really only had time to do it on the weekends, so usually I would get around to it every 6-8 days.

But there were many times that I didn’t have time to cut the grass on the weekend. Sometimes that was due to other commitments and, admittedly, sometimes it was just due to laziness.

Regardless of the reason, the longer grass meant it took longer to cut the next time and the lawn didn’t look as nice. The worst was when I’d put it off a day without looking at the weather, only to be surprised by three days of rain. Then cutting the grass really became a problem.

All and all, I got by just fine. I didn’t kill the grass and I’d like to think the lawn looked pretty good. Then I saw what it looked like when a professional did the job.

There’s No Substitute for Expertise

The summer my son Tommy was born, I decided to hire Leo to cut the grass for $35 a week so I could spend more time with my wife and newborn. This turned out to be a better decision than I could have ever imagined.

Leo did the little things I wouldn’t have thought to do or known how to do properly.

He periodically changed the direction in which he cut the grass to encourage healthier growth. He fertilized and seeded strategically. He cut the grass a specific length depending on weather conditions or the area’s exposure to the sun. He edged around our flower beds and plants.

The end result was a drastically healthier and superior-looking lawn. But, even more importantly, hiring a professional gave me more time to focus on things that are more important in life.

Finances Are Not Complicated, But Mistakes Are Costly

People who take a do-it-yourself approach to any job—be it landscaping or financial planning—do so to save money or because they enjoy the work.

Do-it-yourselfers are also okay with “getting by just fine,” as I was with my lawn, but the difference between “just fine” and doing well with your money is significant.

Much like Leo did a variety of things to improve my lawn’s health and appearance, a financial professional does things you would never think to do.

Building and executing a financial plan is not necessarily rocket science, but not knowing what you don’t know can seriously limit growth. Plus, mistakes can cost huge amounts of money.

The mistakes and missed wealth-enhancing opportunities aren’t always obvious to do-it-yourselfers because they don’t possess the tools to accurately evaluate their financial life.

Financial advisors, on the other hand, have the tools and processes to dramatically improve your financial outcomes.

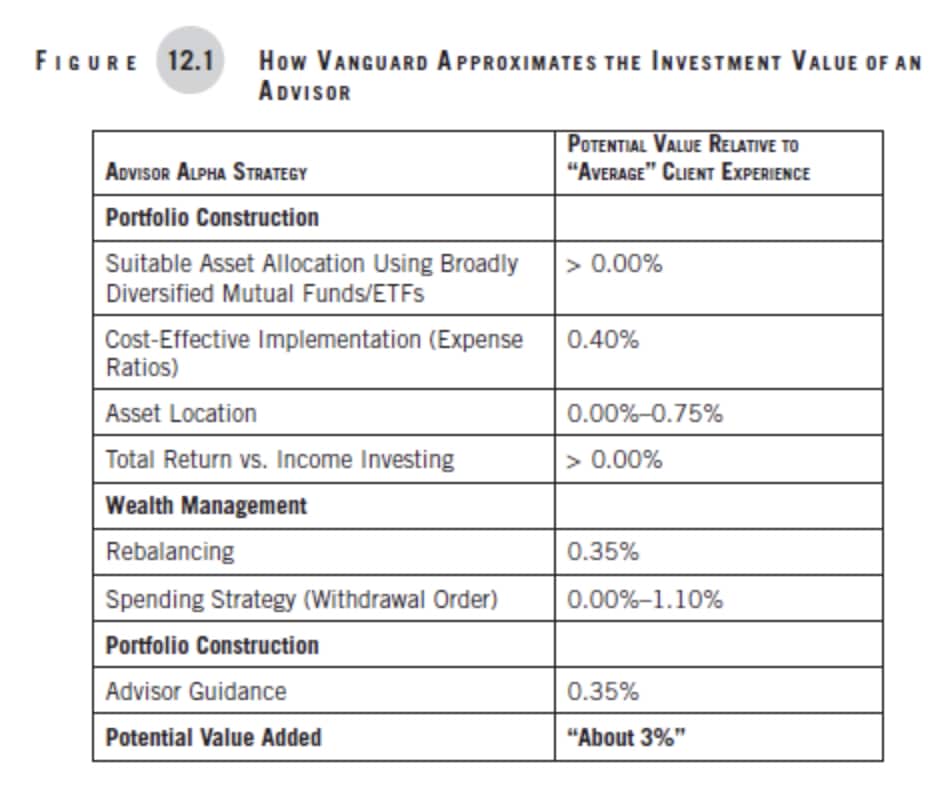

In fact, an ongoing Vanguard study estimates that financial advisors add “about 3 percent” in relative return to an individual’s investments. I outline these best practices that contribute to Vanguard’s estimate of a financial advisor’s value in my book: Making Money Simple.

As Vanguard’s study explains, the value of an advisor is not consistent over time; you shouldn’t expect that 3 percent to show up each and every year.

An advisor’s value, from strictly an investment perspective, largely comes from managing behavior and staying the course. I’ve seen first hand how valuable interventions in times of panic can be, and those interventions can potentially offset a lifetime of fees.

But even outside the times of heightened volatility, investors unknowingly make a lot of behavioral and emotional mistakes that hurt their performance. Unfortunately, this isn’t always obvious because they don’t have the reporting or tools to notice.

And this is no mistake, the brokerages where your accounts are held don’t have an incentive to show performance in the way a financial advisor would. The same is true for many of the most popular robo-advisors. Performance is shown in a manner that largely glosses over your mistakes.

I remember explaining this a few years ago at a presentation to a group from the American Association of Individual Investors. This is a large association with chapters across the country made up of people that prefer the Do It Yourself approach over having a financial advisor.

One gentleman came up to me after my presentation and demanded that I see his spreadsheet tracking performance. He insisted that he was the rare exception to the idea that individual investors don’t have an accurate picture of their performance.

I can’t tell you how many do-it-yourselfer performance spreadsheets I’ve seen in my career, but not once have I seen someone do it correctly — and this group includes some really really smart people.

“I’ve seen many “do-it-yourselfer” performance spreadsheets in my career, and not once have I seen someone do it correctly” – Peter Lazaroff

This gentleman was no different. I knew he wouldn’t be tracking the necessary daily ending values for his portfolio (he was pulling data quarterly), but he also wasn’t accounting correctly for inflows and outflows (which is an incredibly common DIY error, too); plus he had some incomplete information on one small account and one not insignificant account, so those had to be excluded from his analysis, which obviously meant he couldn’t see the whole picture.

Of course, he had no idea until I provided the feedback. And that leads me to one final point on investing…when you are investing on your own, you lack a natural way to check your work, so to speak. It’s helpful to have an objective party around for such things, but also it’s difficult to truly know what you don’t know about investment management.

Now, I’ve been honing in on the investment merits of hiring an advisor, but your decision to hire a professional shouldn’t be only about investments.

Choosing an advisor who provides comprehensive financial planning beyond traditional investment advice can get your entire financial house in order and keep it that way forever.

This includes proactively assisting in estate planning, tax projections, insurance analysis, entitlement strategies, and more—just as importantly, a financial professional makes sure all these aspects work in harmony.

The Vanguard study doesn’t attempt to quantify the value of comprehensive financial planning because, as the authors noted, we don’t need to see oxygen to know it’s beneficial.

My article: The 8 Essential Elements For a Complete Financial Plan is worth downloading if you’ve never worked with an advisor and want to know what it’s all about beyond the obvious things such as investing.

Again, there is a crowd of people that prefers to do this work on their own, but I always wonder why?

I think most people would turn to a lawyer to interpret laws or argue a case in court on their behalf. I’d also imagine that very few people would prefer to have medical care from anyone but a doctor.

Doctors and lawyers spend years receiving specialized education and their skills are enhanced throughout their career with regular practice. People are quick to hand over jobs to those professionals. There are also high barriers to carrying out medical or legal tasks on your own, but there are absolutely no barriers to investing on your own.

Anyone can invest on their own, but research shows us time and again that they are likely to do worse than if they hired a financial advisor.

But perhaps even more importantly, hiring a professional frees you up to do the things you love most in life and alleviates the stress that can come from managing your own financial matters.

“Hiring a professional frees you up to do the things you love most in life and alleviates the stress that can come from managing your own financial matters.” – Peter Lazaroff

While I am biased in thinking that choosing a good advisor is one of the best decisions you can make, I’m not naïve to the fact that choosing the wrong advisor can do more harm than good.

Choosing a financial advisor can be a confusing process, especially because different professionals adhere to different standards of client care. Making matters worse is the litany of fancy titles and the alphabet soup of designations that professionals stick on their business cards.

In the next episode of this series, I’m going to explain the differences between various financial professionals so that you can make an informed decision when choosing one.

Until next time, to long term investing.

Resources

- The 8 Essential Elements for a Complete Financial Plan

- 5 Questions People Don’t Ask Their Financial Advisor (But Should)

- Get my free worksheets to get in your finances in order in just one click.

Want Your Question Answered on the Show?

Submit YOUR question through my “Ask Me Anything” form on my podcast page. Or, sign up for my newsletter. Many people reply directly to my newsletter with questions and general comments, which I really love, so keep them coming.

About the Podcast

Long term investing made simple. Most people enter the markets without understanding how to grow their wealth over the long term or clearly hit their financial goals. The Long Term Investor shows you how to proactively minimize taxes, hedge against rising inflation, and ride the waves of volatility with confidence.

Hosted by the advisor, Chief Investment Officer of Plancorp, and author of “Making Money Simple,” Peter Lazaroff shares practical advice on how to make smart investment decisions your future self with thank you for. A go-to source for top media outlets like CNBC, the Wall Street Journal, and CNN Money, Peter unpacks the clear, strategic, and calculated approach he uses to decisively manage over 5.5 billion in investments for clients at Plancorp.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.