Listen Now

Last week, I was interviewed by USA Today about whether or not it’s time to hoard cash.

The article notes that “stock indexes have been breaking records in 2025,” and valuations have risen to a level we haven’t seen since just before the peak of the dot-com bubble in 1999-2000.

Interestingly enough, the media request for this topic came just minutes after I received a text about the same thing from a worried investor, so I’m guessing that more than a few people are wondering: “With markets at all-time highs and so much uncertainty, is now the time to move some money to cash?”

Sign up for my newsletter so you can easily reply to my emails with your thoughts or questions for the podcast:

Stock Market Highs Are Normal

Pairing a scary narrative with a factual statement like “the stock market is at all-time highs” is exactly the type of headline that garners attention and leads to more clicks (and more advertising revenue).

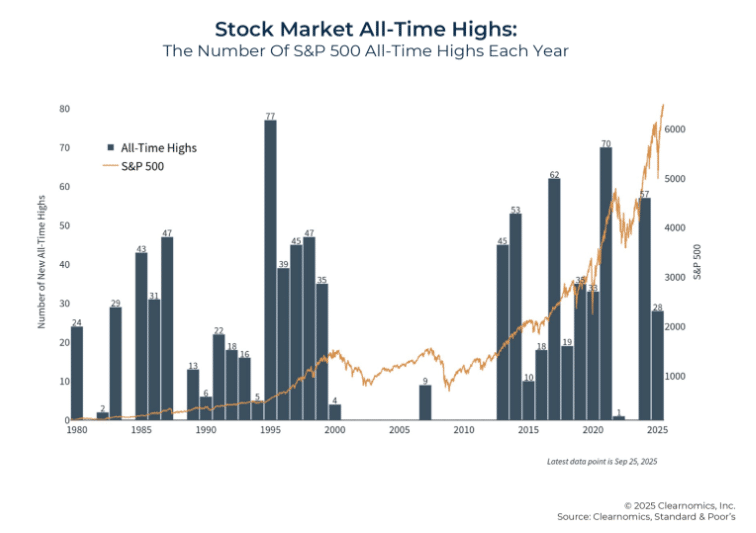

The S&P 500 has made 28 new highs this year, and last year it made 57 new highs. Clearnomics offers a nice historical look at the number of S&P 500 all-time highs each year in the chart below.

Even the USA Today article rightly points out that a new all-time high isn’t reason to panic. Instead, they point to valuations, or the price investors are paying for stock index fundamentals. Specifically, the article references the cyclically adjusted price-to-earnings ratio (or CAPE ratio), which stands at 39.65 for the S&P 500.

Typically, the price-to-earnings ratio, known as the PE ratio, looks at the price investors are paying for 12 months of earnings. The CAPE ratio, popularized by Nobel Laureate Robert Shiller uses a decade’s worth of inflation-adjusted earnings to give a longer-term view of valuations than just a single year of nominal earnings.

Valuations are relevant to long-term returns–the higher the price you pay for earnings, the lower your long-term expected return–but valuations are a notoriously bad short-term indicator.

One of the first articles I published at Plancorp in April 2015 was titled Valuations and Return Expectations, offering a detailed analysis of long-term returns whenever the CAPE ratio was over 25. Here is an excerpt from that article just a little over a decade ago:

“Valuation is a terrible market timing tool – market valuations tend to stay at relatively high or low levels for extended periods of time – but they are useful in setting expectations. Current valuations suggest that stock prices are vulnerable to unexpected shocks and long-term returns have an increased probability of trailing historical average returns. Still, we expect market exposure to continue delivering higher long-term returns than fixed income, alternatives, or cash.”

I feel the same way today as I did ten years ago.

Digging Into Stock Market Valuations and AI-Driven Leadership

My analysis a decade ago was focusing on periods in which the CAPE ratio was over 25 and today it is nearly 40. So naturally, I think it’s fair to wonder what’s going on.

One thing that I’ve really been beating the drum on throughout 2025 is the importance of earnings. Corporate earnings continue to surprise to the upside and profit margins remain strong–something that has seemingly held true since coming out of the Financial Crisis.

Add in the fact that balance sheets look healthy and corporate guidance has been far more optimistic since the beginning of the year (when tariff policy clouded the ability of businesses to make projections about the near-term future of their businesses), and it’s easy to see why investors are bidding up prices. Oh and Fed rate cuts only help that narrative.

I think what has many investors on edge, however, is all of the talk about how we might be in an AI-bubble.

Cliff Asness, one of the most respected researchers in quantitative investing has my favorite definition of a bubble. He says that a bubble is when valuations are so high that no reasonable future outcome can justify current prices.

Are we in an AI-driven bubble?

There is a quote from my current working draft of The Perfect Portfolio that feels appropriate:

“Innovation will always excite. Excitement will always invite speculation. And speculation—unchecked—will always end in pain. The perfect portfolio doesn’t ignore innovation, but it engages with it through disciplined diversification, ensuring history’s lessons temper today’s euphoria.”

I don’t think stock market prices are so high that no reasonable future outcome can justify current prices, but I’m almost certain that we will look back on today, maybe ten years from now, and see that money poured into a lot of AI bets.

For now, though, the strength of earnings in the U.S. isn’t just an AI story. Yes, leadership is still concentrated, but earnings growth has broadened across sectors, with cyclical areas contributing alongside tech.

The Problem With Going to Cash in Your Portfolio

Here’s the problem with going to cash, even with just a portion of your portfolio.

Obviously it would be great to miss the downside and get back in before things rebound. As I noted in USA Today, the problem is that you need to be right twice–once when you get out and once on when to back in. Predicting the future is obviously impossible, so hoping to predict it correctly twice in a row is a big ask.

I want to dig into both instances where you have to be right.

First, let’s say you choose to get out now. The opportunity cost of being wrong is very high. The market can go years without a meaningful downturn.

Speaking of which, what is a meaningful downturn? Are you trying to avoid a 10% drop? A 20% drop? 30%?

The market falls 10% roughly every 12 months, so I’m not sure avoiding that type of drop makes sense. That’s just the cost of higher expected long-term returns. I sort of feel the same way about 20% drops, which happen on average roughly every three years or so (I’m intentionally using round numbers). We nearly had a 20% drop in 2025 already–it was 19 point something, so we were basically there and already we’ve recovered and some.

The 30% or greater drops happen about once a decade. Avoiding one of these would undoubtedly be great, but you could be waiting for a long time.

Which brings me to the second time you have to be right: how do you know when to get back in?

I’ve witnessed maybe a dozen investors over my nearly two decade career who went to cash and didn’t get back in when markets are down. Because when the market is down 10%, it feels like the decline might reach 20%. And when it’s down 20%, it’s easier to talk yourself into the idea that it will drop 30%.

Not once have I witnessed an investor make a timely re-entry into the market. Some people never really get fully reinvested. And the amount of anxiety that comes with the decision always seems to be an order of magnitude greater than staying invested through all of the market’s ups and downs.

In short, market timing is emotionally satisfying in theory and punishing in practice. You need to be right twice—when to get out and when to get back in—and the second decision is almost always harder. Meanwhile, markets can advance meaningfully from prior highs because earnings keep compounding. The data show that sitting out waiting for “a better entry” often means never getting the compounding you were investing for in the first place.

The better question is usually: “Is my allocation appropriate—and am I executing it consistently?”

Actionable Checklist

If you’re tempted to raise cash because of all-time highs, let me offer you a quick checklist to run through:

- Purpose Check: Do I need this money in the next 1–3 years? If yes, cash or short-term bonds. If no, keep growth money in growth assets.

- Policy Check: Am I off my target allocation by more than my rebalancing bands? If yes, rebalance.

- Process Check: If new money is hard to commit, can I dollar-cost average over 3–6 months to stay on schedule?

- Behavior Check: Am I reacting to headlines—or following my written plan?

All-time highs and uncertainty can coexist. They usually do. Valuations deserve respect, not fear; earnings deserve more credit than they get; and your plan deserves to be executed with calm consistency.

Markets will always give us reasons to hesitate. Your job is to keep your process stronger than your emotions.

Resources:

- Pre-order my new book: The Perfect Portfolio

- Read my interview with USA Today

- Check out my previous article: Valuations and Return Expectations

The Long Term Investor audio is edited by the team at The Podcast Consultant

Submit Your Question For the Podcast

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

I read every single one and appreciate you taking the time to let me know what you think.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.

Disclosure: This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Plancorp LLC employees providing such comments, and should not be regarded the views of Plancorp LLC. or its respective affiliates or as a description of advisory services provided by Plancorp LLC or performance returns of any Plancorp LLC client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

Please see disclosures here.