Listen Now

When it comes to bonds, one of the most common questions I hear is: “Should I own individual bonds or bond funds?” Today, I’ll answer that—and more importantly, I’ll show you the right way to use bonds so your overall portfolio is easier to live with through market cycles.

In this article, I’ll bust a few persistent myths about individual bonds, explain why reinvested income—not price movements—drives long-run bond returns, and close with why I prefer non-index approaches for fixed income.

And if you’re wanting help sorting out bonds with your investment portfolio, schedule a call with me and I can help get you started working with Plancorp.

Sign up for my newsletter so you can easily reply to my emails with your thoughts or questions for the podcast:

The Real Role of Bonds

Think of bonds as the shock absorbers of your portfolio—not the engine. Their primary job isn’t to produce the highest return or the most income; it’s to reduce overall volatility so you can stick with your long-term plan, especially when stocks get rough. If you start with that mindset, a lot of confusion about individual bonds versus bond funds clears up quickly.

Individual Bonds vs. Bond Funds — Myth Busters

Myth #1: “Individual bonds are safer because I can hold to maturity.”

Holding a bond to maturity may spare you from realizing (or seeing evidence of) a price decline, but it doesn’t spare you from the economic reality of a lower-than-market yield if rates move up after you buy. And while you may not see the price of your bond decline on the statement or brokerage website, the market price is in fact different–all you have to do is try to sell it and you’ll see that.

Now some people will say, “Well, that’s why I always hold to maturity,” but that ignores the opportunity cost: you’re locked into yesterday’s yield while the market may be offering more attractive income today.

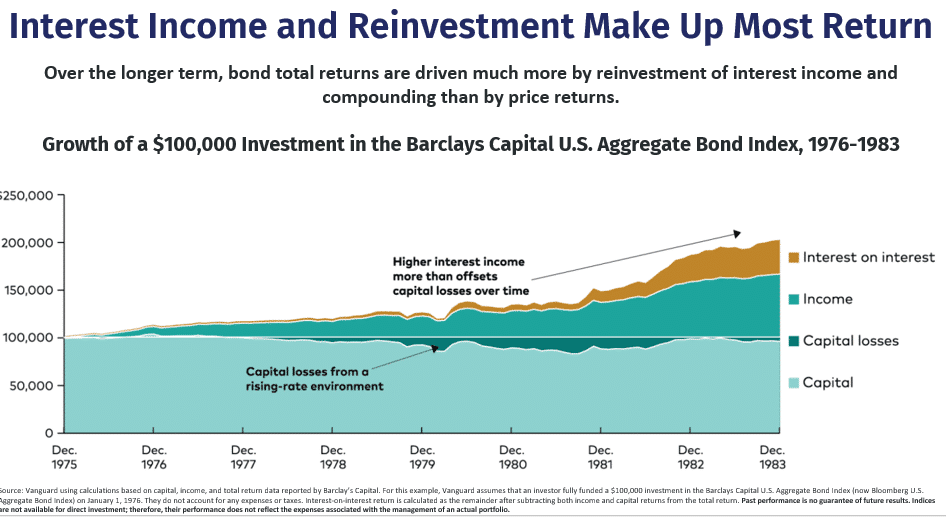

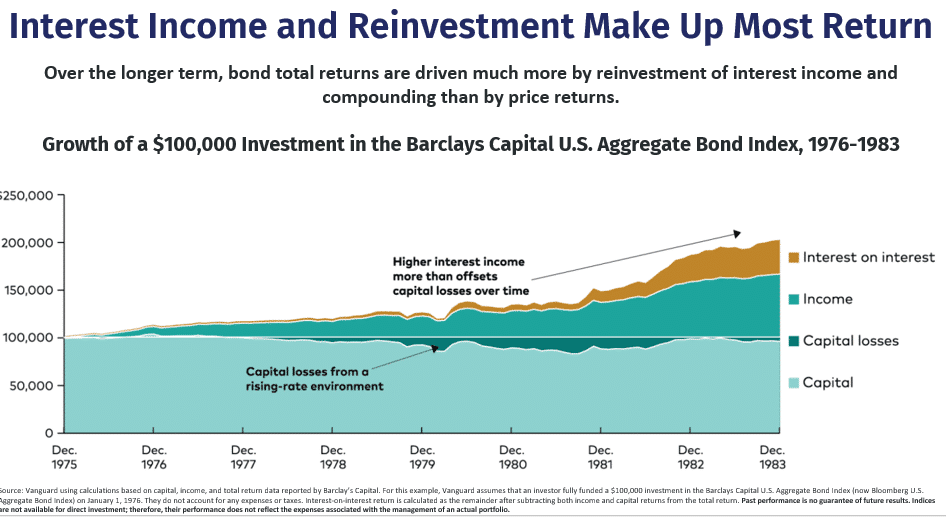

This is where investors often misread what actually drives returns. Over a long horizon, reinvested income and compounding tend to dominate total returns—not short-term price moves. One of my favorite charts showing this comes from Vanguard:

The idea of your bond funds losing money feels scary, especially if it’s something you aren’t used to, but you have to remember that the income offsets any price losses you may experience. And it’s that income that overwhelmingly makes up the total return your bond funds produce.

Something that people struggle a lot with when thinking about this decision is the income vs the total return of bonds. Earlier this year I covered this topic extensively in EP.203 Income vs. Total Return: Which Strategy Builds A More Reliable Retirement?

Myth #2: “Buying individual bonds avoids fees.”

It’s true you won’t see an expense ratio on a CUSIP in your brokerage account. But you’re still paying—in the spread and dealer markups embedded in the price. Those costs are real, they vary by issue and size, and they’re rarely transparent to a retail buyer. With funds, the cost is visible and often lower than what most individuals pay when sourcing and trading bonds on their own.

The typical odd-lot retail purchase will have embedded trading costs between 0.45% and 0.60%, but that can be even higher for municipal bonds and some corporate issues.

Myth #3: “Bond ladders give me more control and certainty.”

Ladders can feel comforting because you pick the rungs and dates.

And here’s the real problem: how is this any different than a bond fund? When you are just rolling the maturing bond’s principal into a new bond, you’ve basically created an undiversified bond fund that has less flexibility to reinvest efficiently across sectors and maturities as markets move. Not only that, but the interest income is likely to drag on performance as you can’t really buy individual bonds with your interest payments.

Remember the key lesson: reinvestment at prevailing yields is a huge driver of total return. A fund that continuously reinvests across thousands of bonds can usually capture that income opportunity more effectively than a static ladder you have to manually maintain.

So why bond funds?

Bond funds (and ETFs) provide instant diversification, access to global markets, professional trading, and systematic reinvestment at current yields. They also reduce issuer-specific risk and operational headaches that come with sourcing, pricing, and rolling individual bonds. For most investors—especially those near or in retirement who value smoother outcomes—funds are the cleaner tool.

The Problem with Bond Index Funds—and What I Prefer Instead

Now that we’ve established a clear preference for using bond funds instead of individual bonds, I have to point out that investing in an index fund is very different for bonds than it is for stocks.

Not all bond funds are created equal. Traditional debt-weighted indexes come with structural issues that investors should understand.

- Noneconomic buyers dominate large parts of the market. More than half of global fixed income is held by participants who aren’t trying to maximize risk-adjusted returns—roughly 22% central banks and 32% banks and insurers. Their mandates and constraints can distort supply, demand, and pricing. A market that’s heavily influenced by noneconomic buyers is not the same as the diversified, profit-seeking equity market many people imagine.

- Debt-weighting rewards the most indebted issuers. In bond indexes, the biggest weights go to the entities that issue the most debt, not the ones with the best fundamentals. That’s the opposite of what most investors think they’re buying.

- Concentration and correlation sap diversification. Take the Bloomberg U.S. Aggregate Bond Index as an example: it’s heavily tilted to government and mortgage-backed securities—with Treasuries around 40% and government-related/MBS pushing the overall share north of 70%. Historically, Treasuries and agency MBS have shown high correlations (around 0.8), which means you’re not getting as much diversification as the label “aggregate” implies.

See More: EP.99 The Problem With Investing in Bond Indexes

My preference: non-index bond offerings. That includes systematic, rules-based strategies or low-cost traditional active management that can:

- Avoid blindly overweighting the most indebted issuers,

- Be selective about credit and structure,

- Keep duration and sector exposures aligned with objectives, and

- Trade flexibly around new issuance, rebalancing, and liquidity to harvest incremental yield.

The goal isn’t to “swing for the fences.” It’s to build a more thoughtful bond sleeve that actually does the thing we need it to do: reduce volatility of the overall portfolio.

Bonds Inside a Total Portfolio

Here’s how to connect this to day-to-day decisions:

- Stability first. Bonds are there to lower portfolio volatility so you can stay invested in equities—the long-term growth engine—without losing sleep. If you pay too much attention to yield, you’re going to end up with riskier exposures than are necessary for this portion of your portfolio (private credit is a great example).

- Global exposure helps. Diversifying beyond the U.S.—often with currency-hedged global bonds—can further smooth the ride because different economies and yield curves move on different schedules. Whether this is a global bond fund or using a core bond fund that gives the manager the ability to allocate globally, the purely mathematical case for global bonds is significantly stronger than the mathematical case for global stocks. So if you believe in international stocks, you should believe in more so in global bonds.

- Tax location matters. If you’re in a high tax bracket with taxable accounts, municipal bonds may be appropriate. Two weeks ago I published a full episode on munis you can reference for details; today we’ll keep our focus on the core concepts.

The Primary Role of Bonds in Your Portfolio

The primary role of bonds in your portfolio isn’t income generation or earning the highest return—it’s to lower overall volatility. But there’s a right way to do it and a wrong way to do it.

If you’d like help designing a bond strategy—or a complete portfolio—that fits your goals and lets you sleep at night, visit CallWithPeter.com to schedule a call with me and my team at Plancorp.

Resources:

- EP 203: Income vs. Total Return: Which Strategy Builds A More Reliable Retirement?

- Comparison of Transaction Costs

- EP.99 The Problem With Investing in Bond Indexes

- EP 221: Muni Bonds Explained: How To Incorporate Tax-Free Income With Investing For Retirement

- CallWithPeter.com

The Long Term Investor audio is edited by the team at The Podcast Consultant

Submit Your Question For the Podcast

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

I read every single one and appreciate you taking the time to let me know what you think.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.

Disclosure: This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Plancorp LLC employees providing such comments, and should not be regarded the views of Plancorp LLC. or its respective affiliates or as a description of advisory services provided by Plancorp LLC or performance returns of any Plancorp LLC client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

Please see disclosures here.