Listen Now

Should You Do a Roth Conversion Before Current Tax Law Expires?

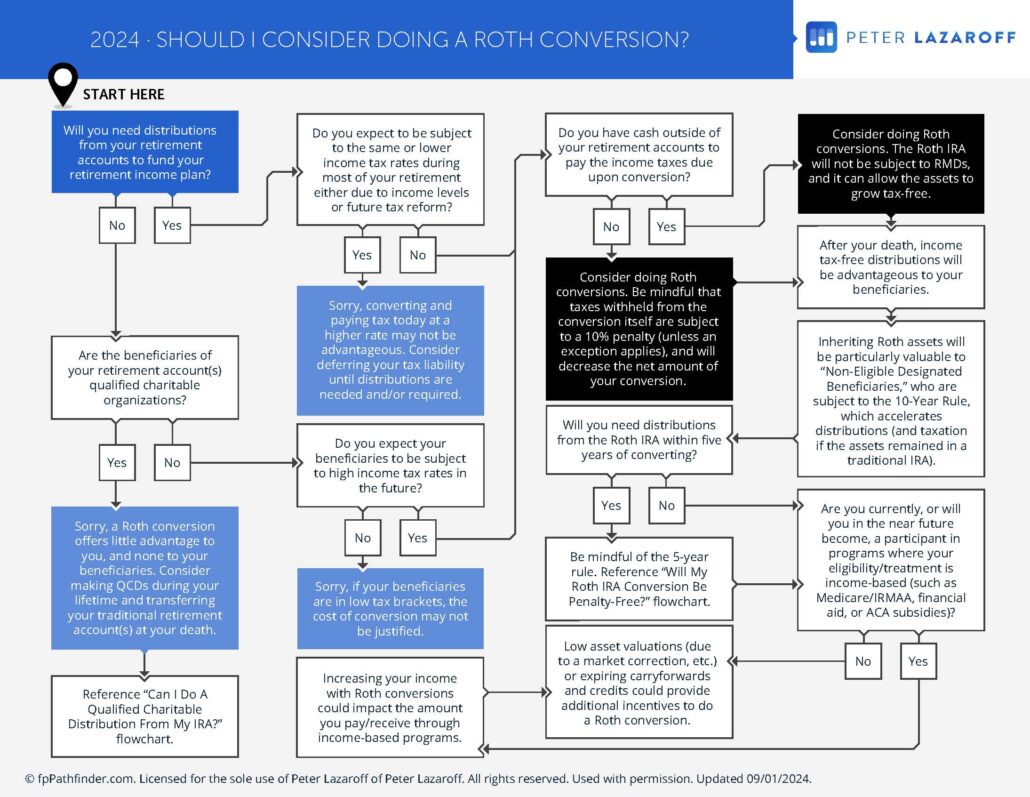

Today, we’re exploring a timely topic: Roth conversions and the potential expiration of the Tax Cuts and Jobs Act in 2026. For many of us, this presents an important opportunity to lock in today’s lower tax rates.

With tax rates set to increase in 2026 when the TCJA expires, it’s crucial to think about your tax strategy now. Roth conversions let you pay taxes upfront, potentially at a lower rate, shielding you from higher future taxes. But with only a couple of years left to act, time is running out to take advantage of the current tax environment.

Sign up for my newsletter so you can easily reply to my emails with your thoughts or questions for the podcast:

Roth Conversions Explained

A Roth conversion involves transferring funds from a traditional IRA to a Roth IRA. You’ll pay taxes on the converted amount, but future growth and withdrawals will be tax-free. The big question is: do you pay taxes now, or later? The best candidates for Roth conversions are people who expect their tax rate to rise in retirement or those looking to avoid required minimum distributions later on.

Tax Planning with Roth Conversions

Timing and tax bracket management are key when considering a Roth conversion. One common strategy is to “fill up” a tax bracket. This means converting enough money to reach the top of a lower bracket without spilling over into a higher one. Let’s take a look at how this might work with a few examples.

1. Filling Up a Lower Tax Bracket

Imagine a couple in their early 60s, semi-retired, earning $60,000 annually. They’re in the 12% tax bracket, which tops out at around $89,000 for married couples filing jointly. They decide to convert $20,000 from their traditional IRA to a Roth IRA. This moves them closer to the top of their current bracket, allowing them to pay just 12% on the conversion now, rather than potentially higher rates in the future. The goal is to strategically convert enough over several years to minimize their lifetime tax liability.

2. Exercising Incentive Stock Options (ISOs)

A tech executive in their mid-50s is considering exercising a significant amount of ISOs. Roth conversions can be a bit more complex when you factor in equity compensation. The executive’s income is already volatile due to the large income spike when exercising ISOs, so they must carefully balance the decision. If they convert too much into a Roth IRA, they could push themselves into a much higher tax bracket. On the other hand, spreading out the ISO exercises and Roth conversions over a few years might provide a tax-efficient strategy.

3. Accelerating or Delaying Charitable Contributions

Another situation involves a high-net-worth individual who makes substantial annual charitable donations. She’s contemplating whether to accelerate her contributions before 2026, thereby reducing her taxable income now. In her case, a Roth conversion in conjunction with charitable deductions could offset a portion of the taxable income triggered by the conversion. But should she accelerate donations now or wait? There’s no one right answer, but aligning charitable giving with a Roth conversion can help manage taxes.

4. Reducing the Size of Your Estate

For someone concerned about estate taxes, a Roth conversion offers a unique opportunity. By converting to a Roth IRA, they’re essentially shrinking the size of their taxable estate. A retiree with substantial assets might consider whether paying taxes on a conversion now will lower the overall tax burden for their heirs later. This could be part of a larger estate planning strategy, but decisions around estate taxes and Roth conversions must be carefully weighed with an advisor.

State Tax Considerations for Roth Conversions

Beyond federal taxes, state tax implications add another layer of complexity to Roth conversions. The potential sunset of the $10,000 cap on state and local tax (SALT) deductions in 2026 could impact your decision. For example, if your federal tax rate increases, but you can get a higher deduction on state taxes, then it might make sense to wait on a Roth conversion. However, if you’re subject to the Alternative Minimum Tax (AMT), that deduction may disappear, making an immediate conversion more appealing.

State residency plays another critical role. If you’re living in a high-tax state now but plan to retire to a lower-tax state, waiting until you relocate could result in significant savings on your Roth conversion. Timing matters, and getting it right is essential to minimize your lifetime tax burden.

Use Tax Projections to Make Informed Decisions

All of this reinforces why it’s crucial to work with a financial advisor who understands tax strategies. This isn’t a decision to make on your own—running a detailed tax projection will help you weigh federal and state tax considerations and determine the best course of action. Given that the TCJA expires in 2026, it’s important to start this conversation sooner rather than later.

Roth conversions are not a one-size-fits-all strategy. Every situation—whether it’s filling up a tax bracket, managing stock options, combining charitable contributions, or even planning your estate—requires careful thought and planning. The important thing is to take a step back, look at your entire financial picture, and act before 2026.

Resources:

The Long Term Investor audio is edited by the team at The Podcast Consultant

Submit Your Question For the Podcast

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

I read every single one and appreciate you taking the time to let me know what you think.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.