Watch Now

Listen Now

Welcome to this episode of the “Long-Term Investor,” a proud member of the Retirement Podcast Network.

Today we’re joined by Christine Benz, Director of Personal Finance at Morningstar. I invited Christine to share insights from a fascinating paper she co-authored with Amy Arnott and John Rekenthaler, titled “The State of Retirement Income 2023.”

Christine Benz is Director of Personal Finance for Morningstar and senior columnist for Morningstar.com. She also co-hosts a podcast, The Long View, which features in-depth interviews with thought leaders in investing and personal finance. She has been named to Barron’s list of 100 Most Influential Women in U.S. Finance multiple times.

Christine also wrote one of my all-time favorite personal finance books, 30-Minute Money Solutions: A Step-by-Step Guide to Managing Your Finances, which is easily one of my favorite personal finance books because it’s so actionable and well-organized – I’ve included on a number of book lists I’ve compiled for the Wall Street Journal and Forbes over the years because of the outsized impact it had on my own personal finance philosophy.

In this episode, we discuss fascinating insights from a paper she co-authored with Amy Arnott and John Rekenthaler, titled: The State of Retirement Income 2023. She also gives us a sneak peek at her upcoming book: How to Retire – 20 Lessons for a Happy, Successful, and Wealthy Retirement.

These are my notes from our conversation…

Sign up for my newsletter so you can easily reply to my emails with your thoughts or questions for the podcast:

Motivation Behind the Research (0:28)

Christine explains that the genesis of the research stemmed from a keen awareness of the pivotal role that withdrawal rate strategies play in retirement planning.

By addressing the critical question of how much one can safely spend each year without risking financial depletion, the research seeks to empower individuals with knowledge and strategies that align with both their financial goals and the realities of the market.

Recognizing that retirees face the daunting task of making their savings last, the team sought to address the limitations of existing models, which predominantly rely on historical market data.

But as Christine notes, these models often fail to account for current market conditions–such as yields and valuations–which can significantly impact the viability of withdrawal strategies.

To address this issue, Christine and her team integrated Morningstar investment management’s forecasts for equity and bond returns over the next 30 years, aiming to provide a more accurate and relevant framework for retirees.

The result is a more dynamic and responsive approach to retirement planning, considering the impact of starting conditions such as current yields and valuations on withdrawal rates.

The 4% Withdrawal Rule: An Overview and Its Shortcomings (1:54)

Originated by Bill Bengen in 1994, the 4% rule has long been heralded as a safe guideline for retirees to manage their portfolio withdrawals without the fear of outliving their savings.

The 4% withdrawal rule is a principle deeply ingrained in the fabric of retirement planning.

However, as Christine pointedly observed, this rule, while foundational, does not fully encapsulate the dynamic financial landscape retirees navigate today.

Christine elaborated on the fundamental limitations of Bengen’s model, which presumes a static withdrawal strategy—adjusting annually only for inflation—ignoring the real-world spending fluctuations that characterize retirement.

In reality, retiree expenditures tend to decrease as they age, and unexpected costs can cause spending to be anything but uniform. This variance highlights a critical gap between the rule’s theoretical underpinnings and practical application.

Furthermore, our conversation delved into the evolving perspective of Bengen himself towards his rule.

Despite its popularity, Bengen has expressed a desire to distance himself from the rigid interpretation that has taken hold, suggesting a more nuanced understanding is necessary.

This pivot underscores a growing recognition within the financial planning community that the 4% rule may serve better as a starting point rather than a one-size-fits-all solution.

Christine also touched on the broader implications of adhering too strictly to the 4% rule, particularly in the context of today’s economic environment.

With fluctuating market conditions, low yields, and high valuations marking recent years, a fixed withdrawal rate could potentially jeopardize the financial security of retirees. This conversation underscored the need for a more adaptable approach, one that takes into consideration the retiree’s spending habits, lifestyle desires, and the current economic climate to tailor a withdrawal strategy that ensures longevity and stability of retirement savings.

In essence, our reevaluation of the 4% rule with Christine illuminated the complexities and nuances of retirement planning.

It highlighted the importance of flexibility, personalization, and a keen awareness of market conditions in crafting a withdrawal strategy that not only preserves wealth but enhances the retiree’s quality of life.

This segment of our discussion offered a profound insight into the evolving landscape of retirement income strategies, urging both retirees and financial planners to adopt a more informed and adaptive approach.

Variables Impacting the Ideal Withdrawal Rate (05:15)

In our conversation, Christine adeptly navigated through the complex variables that determine the ideal withdrawal rate for retirees, shedding light on the multifaceted nature of retirement planning.

She emphasized that beyond the foundational guidelines like the 4% rule, individual circumstances and preferences play a crucial role in shaping a retiree’s withdrawal strategy.

Christine underscored the importance of personal introspection in retirement planning, particularly in assessing one’s comfort with spending fluctuations.

She highlighted that individuals accustomed to a steady paycheck might prioritize a more consistent withdrawal rate to mimic their working years’ income stability.

Conversely, those comfortable with variability might opt for a strategy that allows for adjustments based on market performance, potentially increasing their initial withdrawal rate but also adapting to preserve portfolio longevity.

The discussion further explored the retiree’s asset allocation, pointing out how the composition of their investment portfolio directly impacts their withdrawal rate.

A more conservative portfolio, for instance, might necessitate a lower withdrawal rate to mitigate risk, whereas a portfolio with a higher allocation to equities could potentially support a higher withdrawal rate due to its growth potential.

Another critical factor Christine brought to the forefront was the retiree’s desire for bequests.

The conversation delved into how individuals who prioritize leaving a financial legacy might adopt a more conservative withdrawal approach to ensure the preservation of their capital for future generations. This perspective contrasts with retirees more focused on maximizing their spending during retirement, who might lean towards a higher withdrawal rate.

Christine also addressed the significance of incorporating current market conditions into the withdrawal rate decision-making process.

Acknowledging the limitations of relying solely on historical data, she advocated for a forward-looking approach that considers prevailing economic indicators such as yields and stock valuations. This method helps tailor the withdrawal rate to better withstand the unpredictability of future market performances, ensuring retirees can maintain their desired lifestyle without the risk of depleting their savings prematurely.

The conversation around factors influencing withdrawal rates highlighted the need for a bespoke approach to retirement planning.

Christine’s insights revealed that a successful withdrawal strategy hinges on a delicate balance between personal preferences, financial goals, and the ever-changing economic landscape. This segment of our episode offered listeners a comprehensive guide on how to navigate the intricate process of determining a withdrawal rate that aligns with their unique retirement aspirations and financial realities.

The Impact and Value of Early Financial Gifts (10:45)

I asked Christine to share a story from an article she had written on the profound impact of early financial gifting on both the giver and the receiver.

She shared personal anecdotes and insights that painted a vivid picture of how timely financial support can significantly influence the lives of loved ones, often in more meaningful ways than traditional inheritances delivered later in life.

Christine began by discussing the general trend among retirees to conserve their wealth with the intention of leaving a substantial inheritance to their children or beneficiaries.

While the sentiment behind this approach is commendable, Christine questioned its practicality, suggesting that financial gifts given earlier, when beneficiaries are at pivotal stages of their lives, could have a more transformative effect.

She emphasized how such gifts could help loved ones achieve milestones like purchasing a home, funding education, or starting a business, thereby contributing to their long-term stability and success.

Sharing a personal story, Christine recounted how her parents’ decision to help with a down payment on her first home had a lasting impact on her family’s life. This act of generosity not only facilitated homeownership at a critical time but also allowed her family to establish roots in a community, enriching their lives in countless ways. Christine’s narrative illustrated the ripple effect of early financial gifts, highlighting the emotional and practical benefits that extend well beyond the monetary value of the gift itself.

The conversation then explored the nuances of gifting, with Christine noting the importance of timing and thoughtfulness in maximizing the gift’s value to the recipient.

She pointed out that financial gifts can serve as a powerful tool for retirees to witness the positive outcomes of their support during their lifetime, fostering stronger relationships and creating cherished memories.

Christine also touched upon the psychological barriers that often prevent retirees from making early financial gifts, such as fear of running out of money or concerns about encouraging financial dependency.

She argued that with careful planning and open communication, retirees could navigate these concerns effectively, ensuring that their generosity strengthens the financial independence and well-being of their loved ones.

This segment of our discussion with Christine offered a refreshing perspective on the traditional concept of inheritance, advocating for the strategic use of early financial gifts as a means to enrich the lives of loved ones in real time.

Christine’s insights underscored the dual benefits of such gifting: providing practical support to beneficiaries when it’s most needed and offering retirees the joy and satisfaction of seeing their generosity make a difference.

This compelling conversation challenges listeners to reconsider the timing and impact of their financial legacy, highlighting the profound influence that thoughtful, early financial gifts can have on the lives of those they care about.

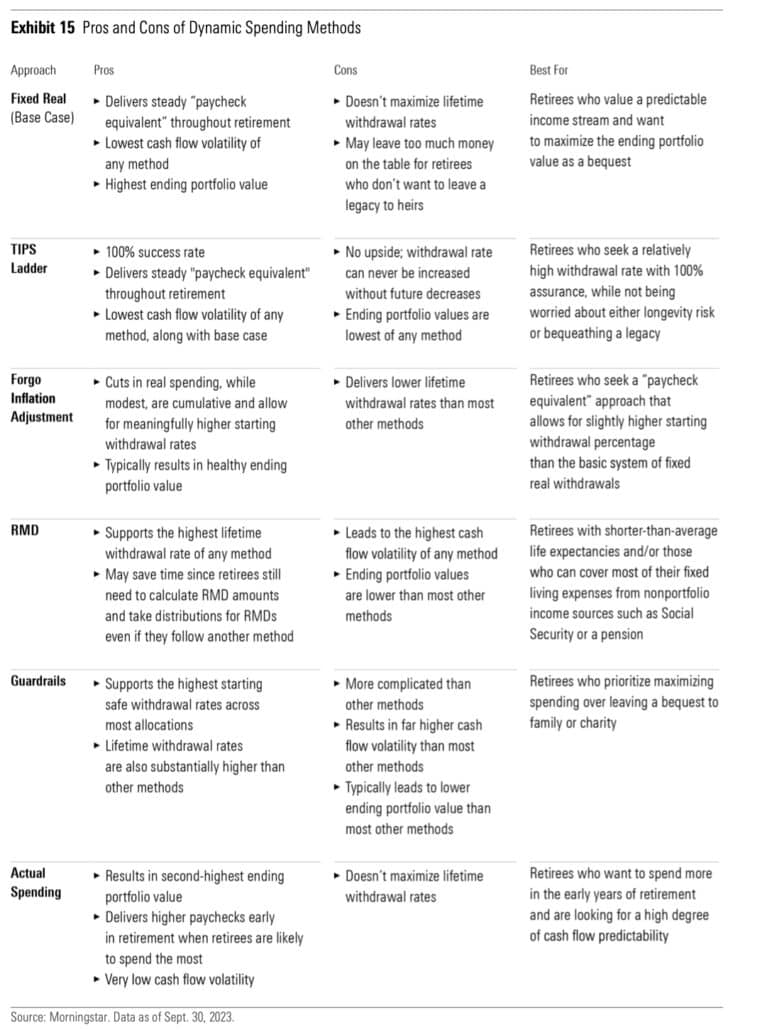

The Advantage of Dynamic Spending Strategies (15:16)

In an engaging part of our discussion, Christine shared her expertise on the benefits of adopting dynamic spending strategies over the traditional fixed withdrawal approach.

This segment illuminated the flexibility and resilience these strategies offer, allowing retirees to adapt their spending in response to market fluctuations and personal circumstances, ultimately safeguarding their financial security throughout retirement.

Christine introduced the concept of dynamic spending by explaining how it differs fundamentally from the fixed withdrawal rate method, which adjusts only for inflation and does not account for the actual performance of the investment portfolio.

She emphasized that while the fixed method provides a sense of predictability, it lacks the adaptability required to navigate the financial ups and downs retirees might face. This is where dynamic strategies shine, offering a tailored approach that adjusts withdrawals based on market conditions and portfolio performance.

One of the simplest yet effective dynamic strategies Christine discussed involves making minor adjustments to withdrawals following market downturns.

For example…

Foregoing inflation adjustments in years following a portfolio loss can help preserve capital, allowing the portfolio more room to recover. This approach, Christine notes, is straightforward and can be easily implemented by retirees, providing a slightly higher starting withdrawal rate without significantly increasing risk.

Diving deeper, Christine explored more sophisticated dynamic strategies, such as the guardrails system, which sets upper and lower withdrawal limits based on the portfolio’s performance.

This system allows for increased withdrawals following good market years and reduced spending after poor performances, thereby maintaining a balance that aims to extend the longevity of the retiree’s savings.

Christine highlighted the elegance and effectiveness of this strategy in maximizing spending flexibility while protecting against the risk of depleting retirement funds prematurely.

The discussion also covered the strategy of aligning withdrawals with required minimum distributions (RMDs), which naturally adjust based on both the portfolio balance and the retiree’s age.

While this approach offers a method to dynamically adjust withdrawals, Benz pointed out its potential drawback of causing spending volatility, which may not suit all retirees.

Throughout this segment, Christine articulated the core advantage of dynamic spending strategies: their capacity to provide retirees with a more responsive and personalized approach to managing their retirement income.

By aligning withdrawals more closely with actual portfolio performance and personal spending needs, these strategies can help retirees navigate the uncertainties of the market and personal life changes, ensuring a more stable and secure financial foundation in retirement.

This insightful conversation on dynamic spending strategies highlighted their critical role in modern retirement planning, offering a nuanced understanding of how retirees can optimize their financial well-being by embracing flexibility and adaptability in their withdrawal approach.

Upcoming Book: “How to Retire – 20 Lessons for a Happy, Successful, and Wealthy Retirement” (21:07)

In the latter part of our episode, Christine introduced an exciting new project, her forthcoming book titled How to Retire – 20 Lessons for a Happy, Successful, and Wealthy Retirement.

This book promises to be a comprehensive guide, blending financial acumen with life wisdom to navigate the multifaceted journey of retirement. Benz’s passion project aims to distill decades of expertise into actionable lessons, making the path to retirement clearer and more enjoyable for everyone.

Christine shared that the inspiration for the book stemmed from her extensive experience in the field of personal finance and retirement planning, coupled with her realization that there’s a wealth of knowledge among experts that isn’t fully tapped into by the general public.

Each chapter of the book is structured as a lesson taught by thought leaders in various aspects of retirement planning, including financial advisors, college professors, and authors who have made significant contributions to the understanding of retirement.

Highlighting the book’s unique approach, Christine explained that it not only covers financial lessons but also delves into non-financial aspects that contribute to a fulfilling retirement.

This includes managing health, nurturing relationships, and making meaningful use of time. She underscored the importance of these often-overlooked areas, which play a crucial role in ensuring a well-rounded and satisfying retirement experience.

Two chapters Christine previewed were contributions from Carolyn McClanahan, focusing on health care and longevity, and Laura Carstensen, addressing the role of relationships in retirement.

McClanahan’s chapter offers insights into navigating the complexities of health care in retirement, emphasizing proactive health management and financial planning for medical expenses.

Carstensen’s contribution, on the other hand, sheds light on the significance of maintaining and cultivating relationships as we age, highlighting the profound impact of social connections on our well-being in retirement.

Christine’s discussion of her book also touched on the broader trend of retirement planning moving beyond mere financial preparation to include a more holistic view of what it means to lead a rich and fulfilling life post-career.

She expressed hope that the book would serve as a valuable resource for both financial advisors and individuals alike, providing a well-rounded perspective on retirement planning that balances financial security with personal growth and happiness.

With its blend of expert financial guidance and deep dives into the qualitative aspects of retirement, How to Retire – 20 Lessons for a Happy, Successful, and Wealthy Retirement promises to be an indispensable guide for anyone looking to make the most of their retirement years.

Resources:

- Christine’s Podcast: The Long View

- 30-Minute Money Solutions: A Step-by-Step Guide to Managing Your Finances

- Paper she co-authored: The State of Retirement Income 2023

- Her new book: How to Retire – 20 Lessons for a Happy, Successful, and Wealthy Retirement

- Her past interview on LTI: EP 30: Your 2022 Financial To-Do List With Christine Benz

The Long Term Investor is edited by the team at The Podcast Consultant

Submit Your Question For the Podcast

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

I read every single one and appreciate you taking the time to let me know what you think.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.