A growing number of investors are interested in Environmental, Social and Governance investing, known as ESG. That term is becoming more common, but ESG still means different things to different people.

While some investors are drawn to the socially responsible side of ESG investing, others approach ESG factors as a way to evaluate risks and opportunities and create more sustainable portfolios.

Because there are a lot of approaches that you can choose from, each with very different objectives, Peter shares his view of this rapidly growing investment space.

Listen now and learn:

- 6 methods for incorporating ESG strategies in your portfolio

- How to define your ESG motives to align with your strategy

- Why ESG funds don’t belong in 401(k) plans

Episode

Outline

In late 2017, I was tasked with building Environmental, Social, and Governance (ESG) portfolios for Plancorp.

And to be honest, I was initially less than thrilled because my past experiences with these types of portfolios were not necessarily positive.

ESG strategies previously showed up to me as ones driven by emotions, where people tried to align their investment portfolios to their personal values — and, as a result, it generally hurt their performance along the way.

But then I started to do my research to build out Plancorp’s ESG portfolios and I quickly discovered a lot had changed in the ESG space from when I formed those initial impressions.

How ESG Investments Have Changed from Past to Present

First of all, ESG investing no longer refers only to values-based investing. There are a lot more products and strategies available for investors.

More importantly, there is an increasing amount of compelling research showing that companies doing a good job of addressing ESG issues in their business tend to outperform companies that are doing a poor job on ESG issues.

That’s good news for the growing number of ESG investors who want to build portfolios aligned with environmental, social, and governance issues.

But if you want to incorporate ESG investments into your own portfolio, it also means you’re required to navigate a wide range of approaches and options to find the best fit for your personal beliefs and financial goals.

Same Label, Different Strategies for the Today’s ESG Investor

Because ESG investing can mean a lot of different things, I’m going to break them down into six different methods for incorporating ESG criteria into your investment strategy — along with their respective advantages and potential downsides — to help you decide what’s right for you:

1. Exclusionary Screening

This is the oldest method and is sometimes the first approach people associate with “socially responsible” investing because traditional socially responsible investing is driven by avoiding investments with objectionable activities.

Exclusionary screening removes companies from your portfolio based on products or business activities that conflict with your values. That might include businesses associated with alcohol, tobacco, gambling, oil drilling, or weapons manufacturing, just to name a few examples.

Pros: Negative screening is a values-driven approach that lets you align your investments with your investor’s ethics, morals, or religious beliefs.

- For example, if your religion prevents you from investing in certain companies because of the products or services they sell, exclusionary screening can help you eliminate those businesses from your portfolio.

- This approach allows you to participate in the markets on your own terms, and that’s better than keeping 100% of your money in cash.

Cons: Research suggests that this approach is harmful to your overall returns.

- It also may leave you less diversified than you otherwise could be by using a different investment strategy.

- Worst of all, negative screening can exclude companies you actually like overall — for example, a strict exclusion for alcohol could require you to reject a company like Amazon because it sells alcohol through its grocery store chain, Whole Foods.

- Another example that happened years ago when I had to build and manage a portfolio of individual stocks based on a rather strict set of exclusions, the client was surprised that we couldn’t include AT&T, but you could access the Playboy channel through their cable business, which caused AT&T to turn up on the exclusion screen.

As I mentioned at the start of the episode, I was not particularly excited at first when I had to build Plancorp’s ESG portfolio, and it was these experiences with negative, exclusionary screening that shaped my feelings.

But these days there are funds available that use an alternative to the traditional exclusionary approach, which is to use ESG factors – such as the potential impact of climate change, labor standards, or board composition – to analyze investment risks and opportunities.

- Sustainable investing or responsible investing are commonly used labels for this approach, utilizing positive screening to promote desirable outcomes while pursuing financial returns.

Unlike the traditional exclusionary approach of socially responsible investing, positive screening rewards companies with good ESG qualities with the goal of boosting long-term, risk-adjusted returns.

- Instead of ruling out Walmart or Target because they sell cigarettes, for example, these companies might be included in such a portfolio because they are among the top four users of solar panels in the United States.

The primary way you will see positive screening utilized in funds these days is through…

2. Best-in-Class Selection

This approach is an evolution from the original exclusionary model. Rather than excluding companies for their products and activities, funds that use a best-in-class selection method will score all the companies in a representative index on a host of ESG factors. Then, it rewards the leaders on ESG metrics by overweighting those stocks within the index.

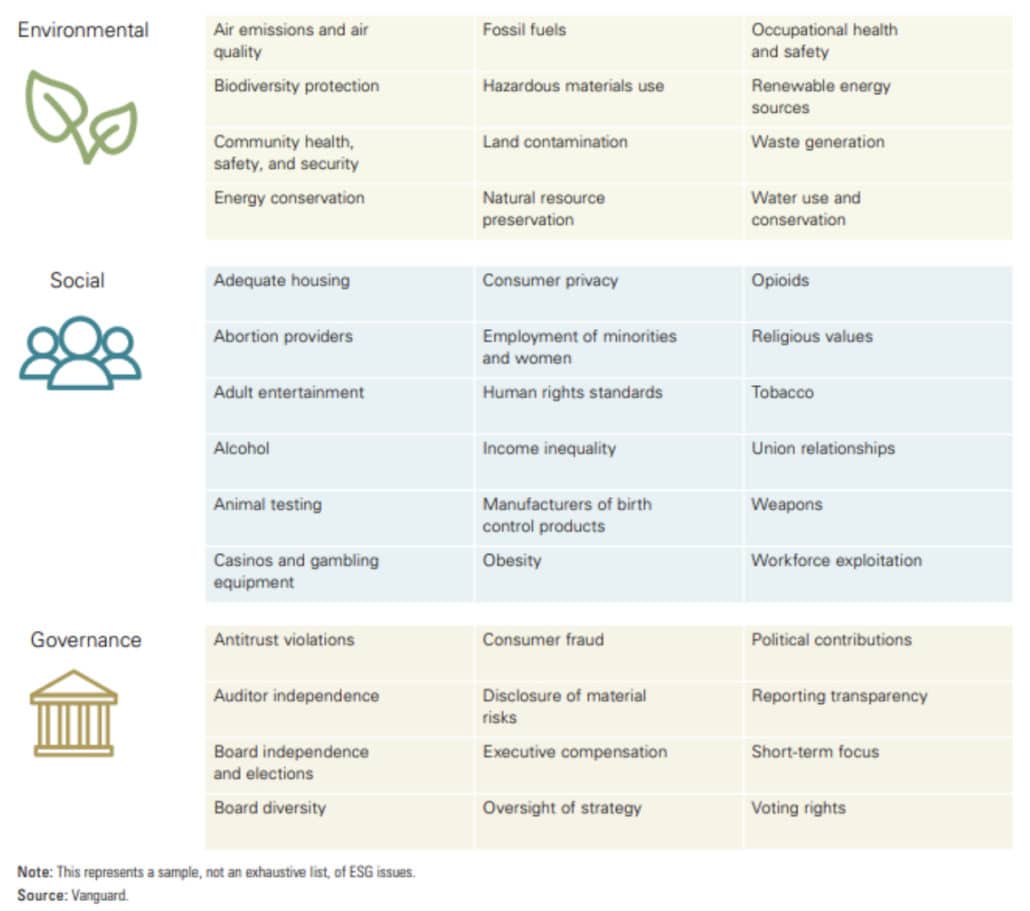

Just to give you an idea of some of the different ESG issues that can be scored and screened on:

Pros: Positive screening lets you align your investments with either your values or sustainability goals by underweighting or avoiding the companies that don’t excel at ESG. Equally important, research shows that positive screening doesn’t necessarily hurt performance or harm diversification.

Cons: The primary drawback to positive screening is limited information. ESG data isn’t standardized and relies on companies to self-report, so ESG data sets used for the security selection process aren’t perfect.

On to the next approach, which can sometimes be classified as a positive screening approach and that is…

3. ESG Integration

The ESG integration approach examines ESG criteria alongside traditional financial analysis. This method recognizes that issues like climate change, social inequality, and corporate governance can affect a company’s long-term performance — but ESG Integration strategies don’t emphasize specific ESG-related goals. The point of the integration is to use ESG factors to pursue better risk-adjusted returns.

Pros: Examining ESG factors gives investors more information to help assess a company’s risk profile and return potential. Research suggests this may improve risk-adjusted performance over long periods.

Cons: Again, the data used to analyze stocks is limited and non-standardized. Plus, true integration approaches are usually available only in active portfolios, which unfortunately tend to underperform simple indexes in aggregate.

So of the two positive screening approaches, the most product development is being done in the Best-In-Class methodology, in part because it’s relatively easy to manage once the rules for weighting ESG scores are created and the end product is relatively easy to understand.

So far I’ve highlighted three approaches to ESG investing: Exclusionary Screening, Best-in-Class (or Positive Screening, and an Integration Approach.

While the most popular ESG funds invest in securities based on overall ESG performance, there are also more targeted ESG strategies such as thematic funds…

4. Thematic Investing

Thematic funds focus on a single ESG-related area, such as clean energy, sustainable forestry, female leadership, or good board governance. These funds then seek to invest in companies that are most actively working to address the chosen issue while avoiding those that are not.

Pros: If you’re passionate about one particular issue, this method allows you to allocate your dollars to companies or projects that are directly related to what you care about most.

Cons: Because these funds are built around a narrowly defined theme, they can lack diversification. They also put non-financial objectives over financial ones, which sometimes result in higher costs and may hurt long-term performance.

The fifth strategy is…

5. Impact Investing

Impact investing is even more targeted — and as the name implies, it tends to explicitly prioritize impact over return (which is unique among ESG strategies).

This highly targeted approach invests in particular projects designed to achieve specific measurable goals, such as building affordable housing. The focus here is less on generating a financial return and more on using capital to create positive change in the world by meeting specific social or environmental outcomes. Examples include things like constructing low-income housing, water sanitation, or clean energy initiatives.

Pros: Because impact investing has clearly defined goals, you can put your money to work directly toward solutions for issues or problems that you feel are most important for the greater good. The financial return potential is a clear step above charitable giving, because you expect to generate some type of return on your investment.

Cons: This method tends to produce below-market rate returns. There’s often a lot of risk involved, too, because you’re dealing with highly concentrated projects.

The final strategy for ESG Investing is…

6. Active Ownership or Corporate Engagement

Active owners use ownership rights to directly engage with companies on ESG issues, such as using proxy votes to try to change the behavior or practices of the company. Owning even a single share of a company entitles you to show up at shareholder meetings and raise hell, file complaints with regulatory authorities, and send letters airing your demands.

Pros: When you take an active role, you can make your voice heard. This corporate engagement gives you a chance for a more hands-on role in pushing for change.

Cons: Having true influence through active ownership requires you to own a major stake, which is why some investors pool their resources and do this as a group. Most individuals simply don’t have the time and bandwidth to be active to the degree required to influence significant change within the corporation’s structure or means of doing business. And, even if you do show up to meetings, there’s no guarantee you’ll see results.

Because there are a lot of approaches to ESG investing that you can choose from, each with very different objectives, understanding different ESG implementation methods is critical. If you want to be an ESG investor, you need to know your motivations.

Choosing an ESG strategy comes down to knowing what kind of ESG investor you are.

If your motive is to strictly align your investments with your beliefs and values, even at the cost of investment performance, then you’re probably want to use exclusionary screening to keep companies out of your portfolio or choose targeted thematic/impact investments that align with your beliefs. But keep in mind that doing so will limit diversification options for your portfolio — and research suggests that could hurt your long-term returns.

If your motive is to do some good with your money while preserving investment performance or if your motives are purely financial, then using a positive screening or integrative approach to ESG investing may appeal to you instead. Research suggests this approach has the greatest potential for improving risk-adjusted returns, but also is less likely to be harmful to returns than an exclusionary approach.

For investors taking a more integrative approach, you must accept that ESG analysis is still an emerging discipline. Critics often complain that ESG data is limited, non-standardized, and biased because companies are self-reporting.

While there is truth to this, I believe that particular bit of criticism does miss a key point: These companies are willingly turning over more information.

- That provides us as investors additional criteria that we can use to evaluate them.

- In fact, one academic study found that companies providing greater transparency into their operations outperformed others in down markets.

- Another paper found that companies with the lowest ESG scores are more volatile.

While it’s easy to get hung up on the nuances of the data, my take is that more information is always better for investors trying to assess a company’s potential.

So if you’re considering ESG investing, take time to understand your motivations, and go in fully aware of what each approach is (or isn’t) trying to accomplish. That way, you’ll be more likely to find a strategy that does some good for the world, without doing harm to your own financial goals.

Once you’ve figured out why you’re drawn to ESG and what you hope to get from it, you can more easily evaluate the methods for adopting an ESG investing strategy that best fits your goals.

Using ESG to Stay the Course

There’s no right or wrong reason to be an ESG investor. From my perspective, though, a positive screening or integration approach to ESG investing makes the most sense. Either way, ESG potentially offers one more important benefit: It may help manage your own behavior.

The ability to weather market volatility and stick with an investing plan are critical to achieving positive returns over time. If ESG investing provides an emotional attachment to your portfolio that makes you more likely to stick with investment for the long-haul, that’s a good thing in my book.

Why ESG Funds Do Not Belong In Your 401(k)

One final thing on ESG Investing that I feel obliged to discuss…

As interest grows in environmental, social and governance (or ESG) investing, a lot of people may wonder why their 401(k) plan does not offer ESG funds. I’ve even noticed some smart financial thinkers suggest that people should lobby their employers to add ESG funds to 401(k) lineups.

At first glance, the logic is there. For many investors, the savings in their 401(k) accounts may be the bulk of their wealth, and they want to invest in a way that reflects their values.

Plus, there’s a growing body of research that shows companies doing a good job of addressing ESG issues in their business tend to outperform companies that are doing a poor job on ESG.

Yet for all the good reasons to pursue an ESG investment strategy, I don’t think 401(k)s are the place for ESG funds.

Let me explain. A workplace retirement plan is designed for a diverse group of participants, which creates variables that don’t exist when constructing a portfolio for an individual or family.

Employer-sponsored retirement plans use one set of investment options for a wide range of investors with varying degrees of sophistication, wealth, and circumstances. Trustees of these plans should manage them in a way that upholds the employer’s fiduciary duty while meeting their primary plan design objective: select investments that encourage investor participation while minimizing potential mistakes.

While I don’t believe use of ESG funds necessarily represents a failure to uphold a fiduciary duty, I’m concerned about the slippery slope that it creates around participant behavior, which should very much be part of trustees’ concerns.

A 2001 paper by Sheena S. Iyengar and Mark R. Lepper challenges the assumption that more choice is better for investors in a 401(k) plan, as it can lead employees to do nothing rather than make a selection from an overwhelming amount of options.

In 2004, Sheena S. Iyengar, Gur Huberman, and Wei Jiang studied nearly 800,000 employees and found that participation in 401(k) plans is higher for plans offering a handful of funds compared to plans offering ten or more options.

While it might seem that adding ESG funds might encourage additional employees to participate in their retirement plan, the research suggests the opposite. The more fund options added to a 401(k), the higher the chances that some investors simply don’t participate. Without eliminating other fund options, adding ESG funds to a menu of choices is only likely to drive participation down.

For participants who do engage and make investment selections, plan trustees must worry about the harmful mistakes investors often make. In my direct experience working with plan participants, the most common mistakes I see include performance chasing and false diversification.

Despite the common warning that “past performance is no guarantee of future results,” many 401(k) investors regularly change their investment mix, dumping lagging funds to invest in those with the best recent performance. This behavior locks in relative or absolute underperformance and leaves investors expecting big gains that may not materialize.

This seems particularly relevant today given that many ESG funds have recently outperformed simple index funds during the last one-, three- and five-year periods (which align with periods of performance often displayed alongside the fund options in employer-sponsored retirement plans). By adding in ESG fund options, trustees may inadvertently increase the temptation for employees to chase performance and end up with smaller returns over time.

False diversification is another potential mistake people make. With more funds to choose from, an employee might decide to invest in nearly all of them – thinking more funds provides more diversification for their portfolio. In reality, the participant’s selection frequently results in owning multiple funds that invest in essentially the same way.

Adding an ESG fund to your plan may not help you diversify an investor’s overall portfolio at all, particularly if participants lack a basic understanding of asset allocation (as many do in my experience).

The decision to add ESG funds to a 401(k) plan should go beyond considering the merits of ESG investing in a vacuum. Plan trustees must consider the behavioral implications in designing their fund lineups to give employees the greatest chance for success.

There is plenty of evidence that adding more fund choices to a plan increases the likelihood of investing blunders.

- Use your money to advance ESG issues outside of your retirement plan. You can invest in ESG funds outside of your 401(k). A financial advisor can help you ensure that your ESG allocation aligns with your goals and investment strategy. Alternatively, save diligently and build enough wealth to give directly to the organizations focused on issues you care most about.

- Take an active ownership approach. Buy a single share of stock in the company or companies you dislike most from an ESG perspective, then go to their shareholder meetings and speak your mind during Q&A on the open microphone. Attending a shareholder meeting might require you to buy a plane ticket, book a hotel room, and even take time off work – which could be a significant investment and clearly not realistic for everyone – but it’s one way to make your voice heard.

- Give your time and talent. This is an often-overlooked way to contribute, but it can be a powerful one. You might start by identifying policies in place with your own employer that you’d like to see changed, and then addressing those with the company’s management. Maybe that means leading a team that makes recommendations on establishing a more equitable parental leave policy, reducing the company’s carbon footprint, or increasing diversity in the workplace. Or, if there’s a community organization you’d like to support, but your financial resources are limited, think about other ways you could contribute such as volunteering on weekends or taking on a role with the board.

Get Your Finance Questions Answered

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

If you enjoy the show, you can subscribe wherever you listen to podcasts, and please leave me a review. I read every single one and appreciate you taking the time to let me know what you think.

Until next time, to long-term investing!

About the Podcast

Long term investing made simple. Most people enter the markets without understanding how to grow their wealth over the long term or clearly hit their financial goals. The Long Term Investor shows you how to proactively minimize taxes, hedge against rising inflation, and ride the waves of volatility with confidence.

Hosted by the advisor, Chief Investment Officer of Plancorp, and author of “Making Money Simple,” Peter Lazaroff shares practical advice on how to make smart investment decisions your future self with thank you for. A go-to source for top media outlets like CNBC, the Wall Street Journal, and CNN Money, Peter unpacks the clear, strategic, and calculated approach he uses to decisively manage over 5.5 billion in investments for clients at Plancorp.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.