The United States is an exceptional place to invest and they’ve historically delivered higher returns than international stocks.

That begs the question: Does it make sense to own international stocks? Are US stocks enough for your portfolio?

Listen now and learn:

- The primary driver of recent US stock outperformance

- Why factor investing in a global manner tells a different story

- How International stocks perform during periods of low returns for US stocks

Listen Now

Show Notes

The United States is an exceptional place to invest. Our institutions, markets, and laws make us relatively attractive to many other places in the world. We also have many of the biggest and best companies in the world.

And when you look at long-term historical returns, US stocks outpace developed international stocks by over a full percentage point per year.

That begs the question: Does it make sense to own international stocks?

Two iconic investors, Warren Buffet and Jack Bogle, have publicly argued against it.

Warren Buffet says an index fund portfolio of 90% S&P 500 and 10% Treasuries is probably good enough for most investors. Jack Bogle argues that US large-cap stocks derive plenty of their revenue from overseas and, as a result, international stocks aren’t necessary.

Of course, quotes from these investment icons are regularly taken out of context. Neither pretends this is evidence-based advice. At different times, both admit the advice is geared toward investors who need to keep it simple (due to their level of assets, education, or resources) rather than those who want to generate the highest returns for the lowest risk.

Aside from these two investment legends, almost everyone else agrees that the diversification benefits of owning a global portfolio of stocks are reason enough to do so.

That said, the way diversification shows up on performance statements makes it challenging to appreciate its benefits. So rather than going through the mathematical benefits of diversification as I have in the past, here I’m going to focus almost exclusively on the relative performance of US versus International stocks.

Historical Performance of US and International Stocks

Almost a decade ago, I wrote a piece for the CFA Institute assessing an allocation to global stocks comparing US stock returns to the MSCI World ex-US Index, which tracks the returns of developed international countries.

I usually use the MSCI All Country World ex-US Index when talking about the performance of non-US stocks because it includes both developed and emerging markets, but that dataset only goes back to the 1990s whereas the MSCI World ex-US goes back to 1970.

There were times when International stocks (the 70s, 80s, and 2000s) did better and US stocks did better (90s and 2010s). But looking at the entire dataset from 1970 to May 2023, US stocks have outperformed by about 1.6 percentage points per year.

But the entire dataset didn’t always look this way. Had we made this comparison at the end of 2010, US stocks historically trailed International stocks. And I can clearly recall my conversations with investors at the time—it seemed as if everyone wanted to know why we didn’t hold more non-US stocks, particularly emerging markets.

It’s funny how historical returns, particularly recent returns, influence investors’ expectations for an asset class. But that’s precisely what has caused and will always cause investors with a diversified portfolio to question the portion of that portfolio that is currently losing.

Being diversified by definition means that you must always own the losers—there is no way to be diversified and only own the winners.

Now, back to performance…

A paper published last month in The Journal of Portfolio Management dives deeper into the recent outperformance of US stocks versus developed International stocks. An important piece of understanding their findings is the drivers of return. In any given year or time period, you can attribute asset classes or even individual stock returns to three things:

- Changes in earnings per share

- Changes in cash paid to shareholders (dividends or buybacks)

- Changes in valuations

In The Journal of Portfolio Management article analyzing the recent outperformance of US stocks, the authors found that changes in valuation were the primary driver. In other words, US stock outperformance is largely attributable to it getting more expensive.

“So, what does it mean that almost all the US’s victory came from repricing?

At a high level, there are two ways a country’s equity market can beat the competition: 1) outgrow on the fundamentals or 2) outgrow on the price multiple to fundamentals (i.e., become more expensive).

The first way—winning on fundamentals—may or may not be repeatable (fundamental edges at the very least might be sticky, so they could be somewhat persistent). But, as shown here, this was hardly the case for US equities over the past 30 years.

The second way—winning simply because people were willing to pay more for the same fundamentals—is likely not repeatable. In other words, don’t get too excited if a country wins mostly because it got more expensive. If anything, valuations have a slight tendency to mean revert, at least when they are at extreme levels.“

Globally Diversified Factor Investing

Up to this point, we’ve been talking exclusively about passive index investing, but investors applying a factor approach have seen different results.

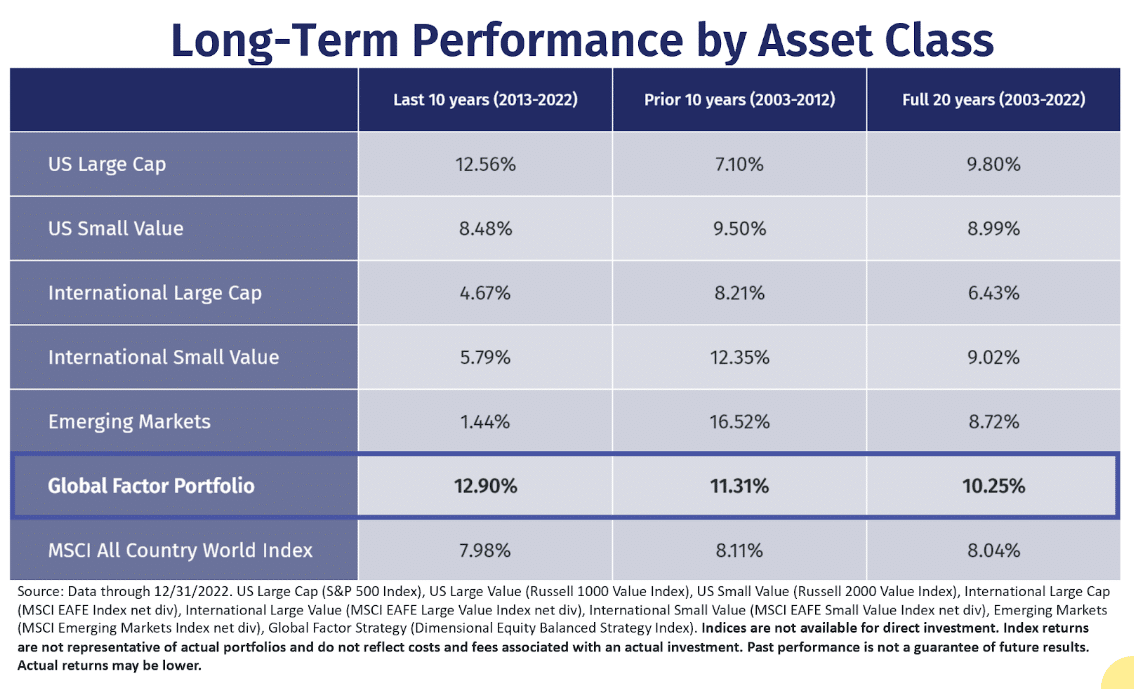

Below is a table that I regularly update for clients that compares the performance of different asset classes over the last ten years, the prior ten years, and the full 20-year period.

US Large Cap represented by the S&P 500. The MSCI All Country World Index (at the bottom) is a market-cap-weighted index for the entire world including the US, developed international, and emerging markets. Global Factor Portfolio is represented by the Dimensional Equity Balanced Strategy Index, which is a factor-based index with systematic exposures to value, size, and profitability factors.

This table does a really nice job of letting you see how the winners differ from one decade to the next, but the consistent winner across all periods is a globally diversified, factor-tilted portfolio.

The Benefit of International Stocks When US Stock Performance is Weak

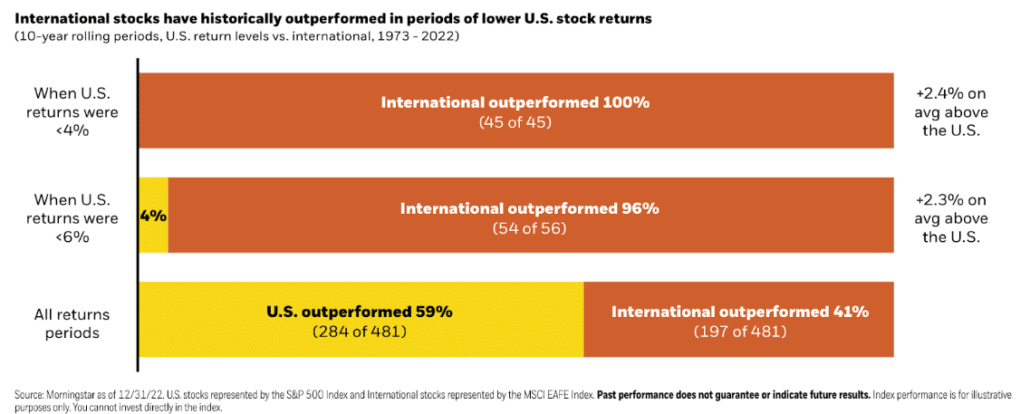

One final comparison I like to point out when talking about International stocks is their performance during periods of low returns in the US.

According to the BlackRock research below, International stocks outperformed US stocks 96% of the time when US stock returns were less than 6%. And when US returns were less than 4%, International outperformed 100% of the time.

We can’t know what the future holds for US or International returns, but let me share one more input, this time from Vanguard.

Vanguard regularly publishes 10-year annualized return and volatility forecasts based on the running of their capital markets model using a 2-point range around the 50th percentile of the distribution of probable outcomes. They have an annual 10-year return projection for U.S. equities of 4.1% to 6.1%.

Obviously, these are just model predictions, but I’m willing to appeal to the market timer in you if that’s what it takes because Vanguard’s projections paired with BlackRock’s historical data showing International’s outperformance over US stocks when returns are less than 4% or 6% should at a minimum give you second thoughts about an all-US stock portfolio at this point in time.

Owning International Stocks Still Makes a Ton of Sense

As I said at the beginning of the episode and in many past articles written on this topic, the primary case for owning international stocks is about diversification, but diversification in action is pretty tough to live through.

There is an entire generation of investors who’ve seen international diversification drag down returns, but the long-term case for it remains strong. Not only do financial theory and even common sense support the idea, but a greater understanding of the context behind recent performance also gives a fuller picture of how to think about returns going forward.

Resources:

- Assessing An Allocation To Global Stocks by CFA Institute

- International Diversification Still Not Crazy After All These Years in The Journal of Portfolio Management

- Why Bother With International Stocks by BlackRock

Submit Your Question For the Podcast

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

If you enjoy the show, you can subscribe wherever you listen to podcasts, and please leave me a review. I read every single one and appreciate you taking the time to let me know what you think.

About the Podcast

Long-term investing made simple. Most people enter the markets without understanding how to grow their wealth over the long term or clearly hit their financial goals. The Long Term Investor shows you how to proactively minimize taxes, hedge against rising inflation, and ride the waves of volatility with confidence.

Hosted by the advisor, Chief Investment Officer of Plancorp, and author of “Making Money Simple,” Peter Lazaroff shares practical advice on how to make smart investment decisions your future self with thank you for. A go-to source for top media outlets like CNBC, the Wall Street Journal, and CNN Money, Peter unpacks the clear, strategic, and calculated approach he uses to decisively manage over 5.5 billion in investments for clients at Plancorp.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.