People check their portfolios way too frequently, which increases their chances of seeing a loss. Losses aren’t necessarily a problem – in fact, they are a crucial part of a well-functioning market – but the emotions that losses invoke cause us to make mistakes.

Our human instinct is to react to danger, specifically to run and hide from it. This instinct helped humankind from an evolutionary perspective, but it hampers our ability to make good investment decisions.

Downturns in the stock market seem obvious with the benefit of hindsight, particularly when we have so many “experts” that eloquently describe the cause of a downturn after the fact. This creates the illusion that market movements can be predicted.

Predictions create reason for more trading activity. More trading activity typically leads to more errors. But we can simplify things by planning on downturns as part of the investment experience.

Losses Are Normal

We never know when or why the next correction or bear market will happen. What we do know is that market downturns happen on a regular basis. Rather than trying to predict the timing or cause of the next downturn, you’re better off planning on historical levels of volatility persisting over time.

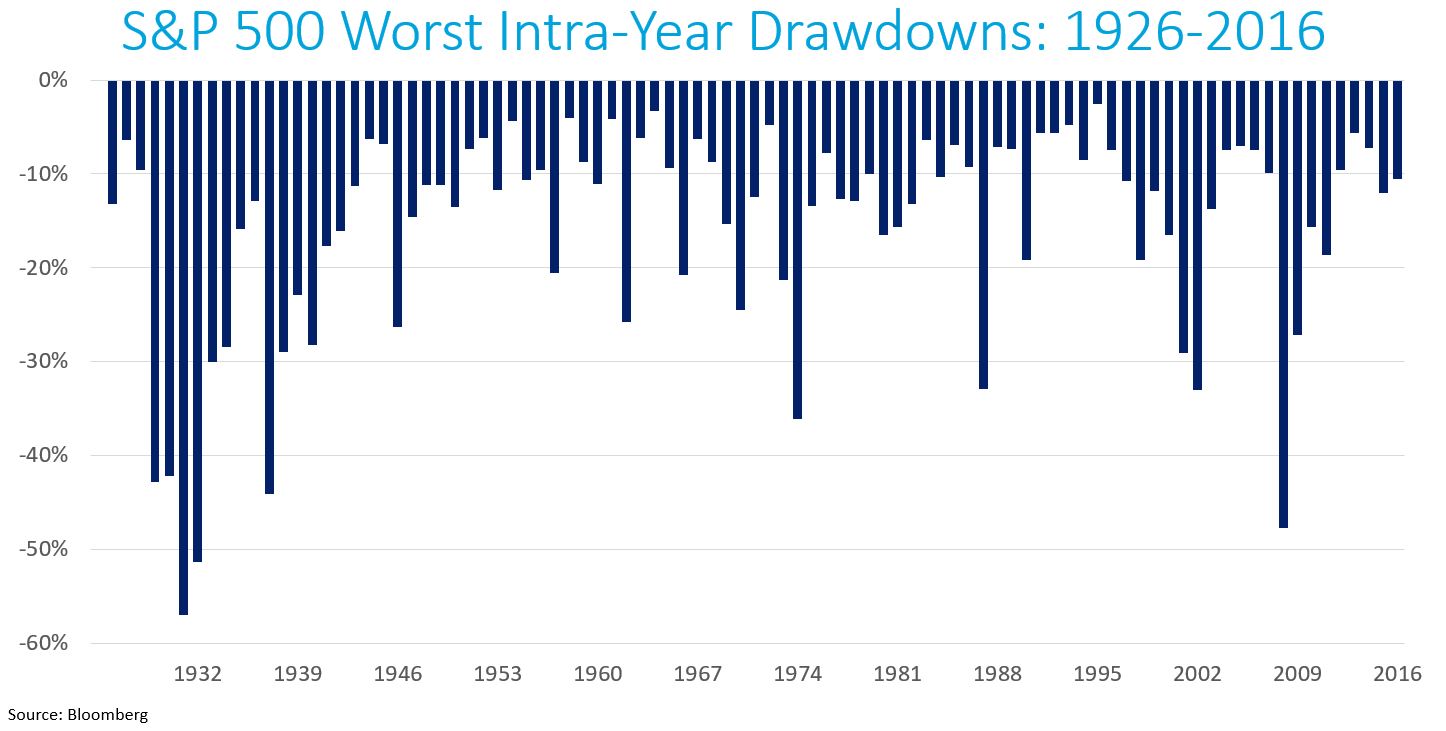

The chart below details the worst drawdowns for the S&P 500 every year dating back to 1926. Double digit losses occur in 65% of calendar years and nearly a quarter of the time losses are greater than 20%.

What does this tell us about investing in the market? Investors must be willing to lose money on occasion – sometimes a lot of money – to earn the average long-term return that attracts most people to stocks in the first place. The good news is that you can reduce the chance of loss by agreeing to stay invested over a long period of time.

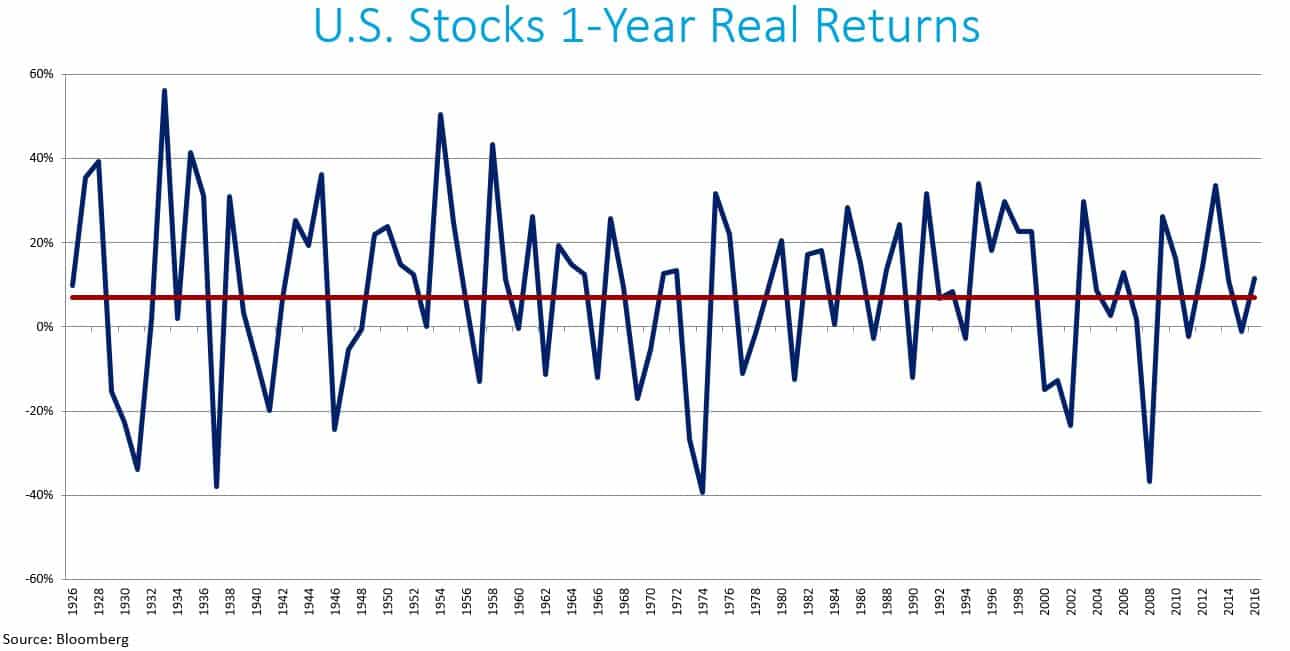

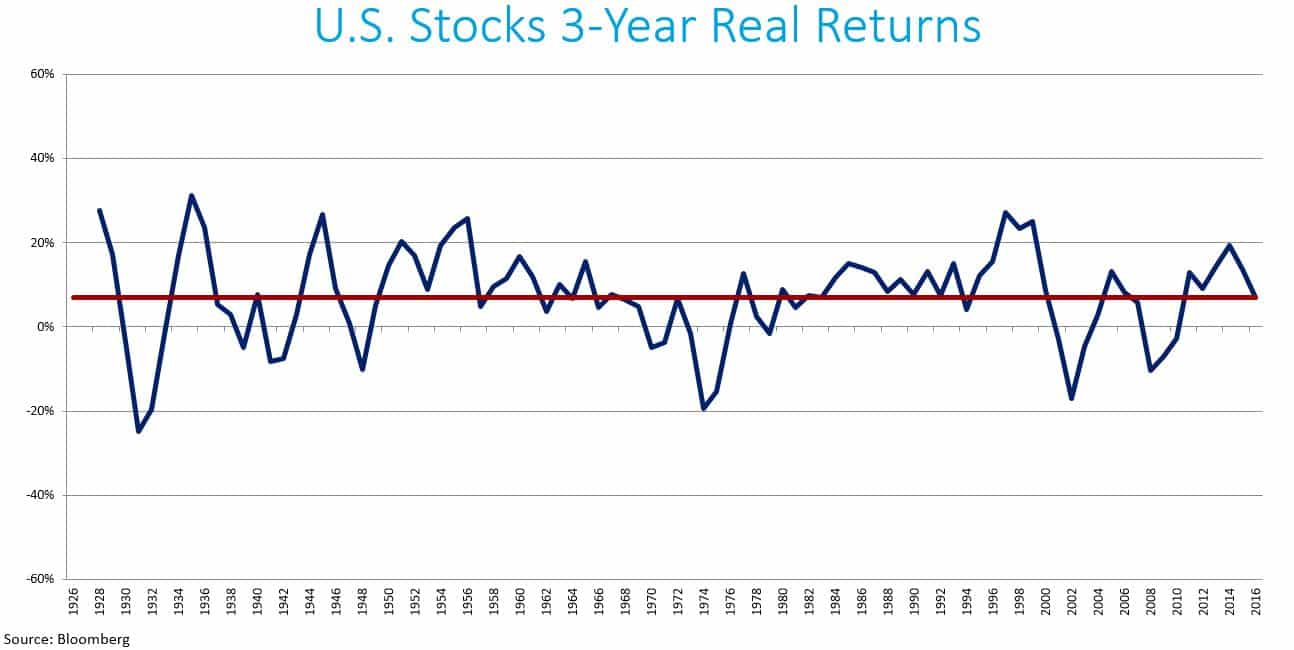

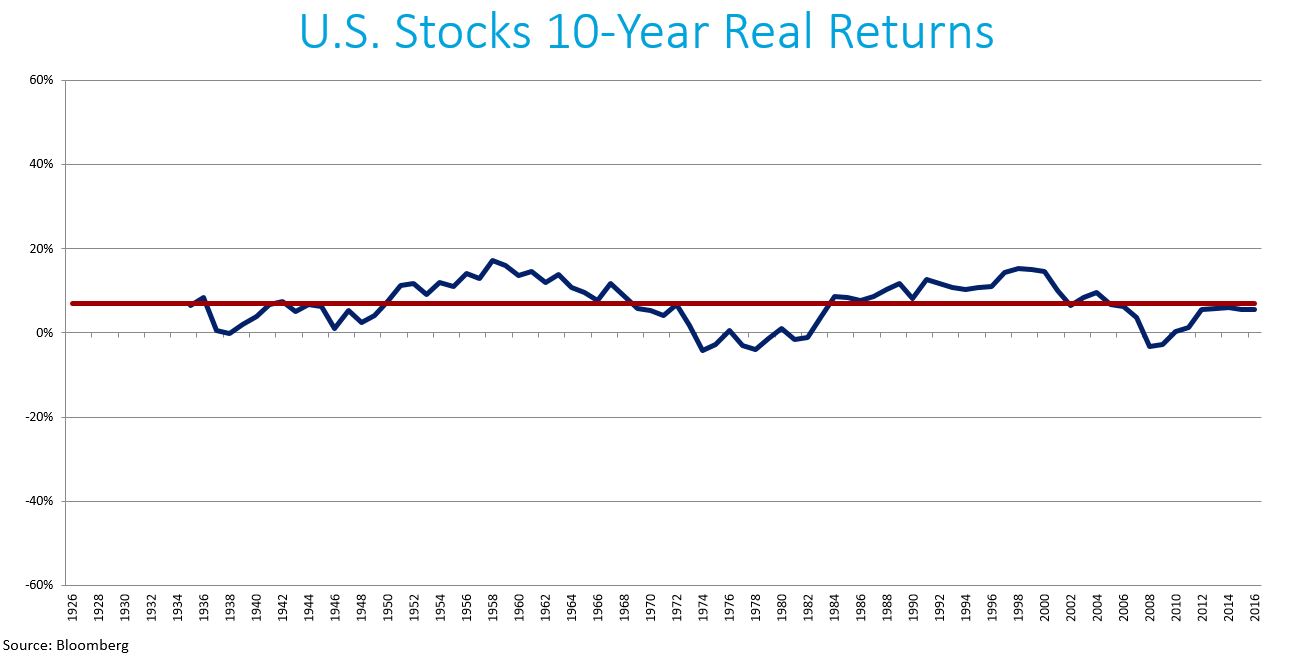

Markets are highly uncertain in the short-term. But in the long-term, the range of outcomes narrow. You can see this by comparing one, three, and ten-year real returns (blue lines) to the average ten-year real return (red lines) on the total U.S. stock market:

Stock returns greatly deviate from the average return over one-year periods, but returns tend to smooth out over time. The long-term feels like an eternity to live through in the moment, but those that maintain discipline will be rewarded over time.

Volatility is Not the Enemy

Uncertainty is a good thing because it allows stocks to provide higher returns than bonds and cash. When we look back at times in which there was a high degree of certainty about the future, we typically identify that type of sentiment as the symptom of a pending market bubble and precursor to a period of smaller equity returns.

There is no way for people to reasonably predict when and why downturns occur. But we can reasonably expect them to continue occurring with a similar degree of frequency in the future. That means we can plan for them – and you’re better off planning on downturns regularly occurring than trying to predict when stocks will take a tumble.

If you are nervous about the market, you are better off reviewing the underlying assumptions in your financial plan than making changes to your portfolio. A thoughtfully-crafted financial plan takes periods of bad performance into account through Monte Carlo analysis, and does so without emotion. That way you spend less time predicting and more time planning around things you can control like your savings rate, asset allocation, taxes, and investments costs.