There are typically two good reasons for adding an investment to your portfolio: return enhancement and diversification.

The easiest way to increase your return profile is through asset allocation by increasing the proportion of stocks relative to bonds.

Diversification is a little trickier.

As an asset allocator, I focus more on how new exposures impact a portfolio as a whole, not just how the exposure works on its own. Ideally, you combine assets that don’t move in tandem or are lowly correlated with each other.

The problem with good diversification is that it doesn’t feel good when it’s working.

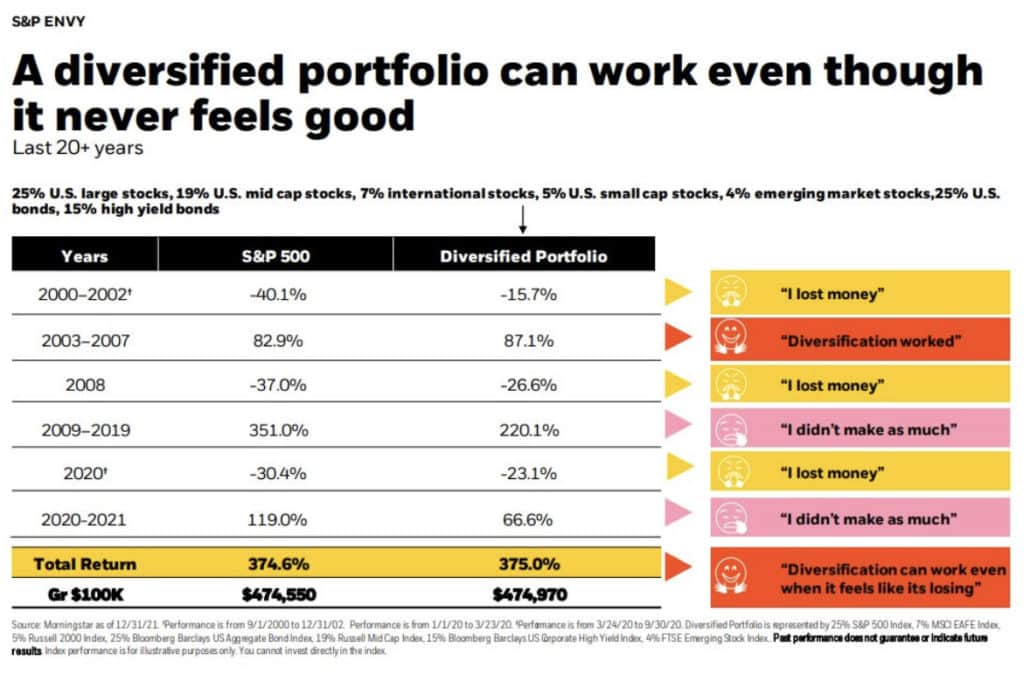

Being diversified means there’s always a part of your portfolio that is disappointing. Perhaps nobody has captured the life of a financial advisor better than BlackRock in the graphic below.

My career started in 2007, just before the Financial Crisis, so I never really got a taste of clients saying: “Diversification worked! Thanks!”

Instead, my first several years of client conversations were more along the lines of: “Why do we have so much U.S. stocks?”

The S&P 500 finished the 2000s with a negative annual average return, so people were typically clamoring for more International and (especially) Emerging Markets exposure.

But at some point in the early 2010s, the conversation shifted as the S&P 500 became the best performing asset class. Suddenly people were saying: “Why do we own so much International when it never wins? We should own more of the S&P 500.”

This sentiment has weakened a touch, but it largely continues to persist today.

Diversification lowers volatility and improves compounding.

I’ve never met someone that doesn’t believe diversification is a good thing. But very few people understand the math behind its importance.

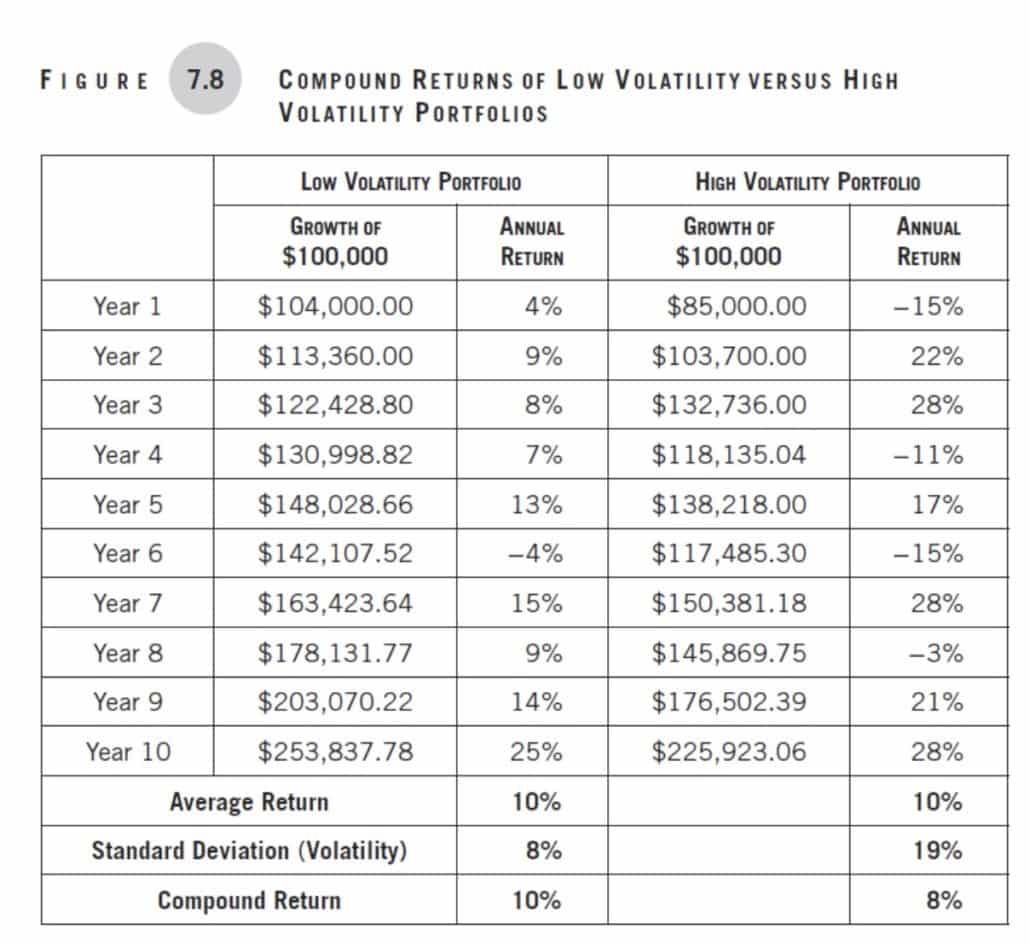

The reason diversification is important is that it reduces volatility. For two portfolios with identical average returns, the one with lower volatility will have higher compound returns. The example below is from my book: Making Money Simple.

The Two Most Important Things To Understand About Diversification

If there were two ideas I could magically impart on everyone’s brains, this mathematical case for diversification would be one.

The second is that being well-diversified means owning some of the winners and losers. If there is a part of your portfolio you hate, that’s a sign you’re really well diversified.

Keep those two things in mind the next time diversification doesn’t feel good.

…

RESOURCE: Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.