There is an important decision long-term investors make and it is one of the few things in the world of investing fully within your control: Asset allocation.

What is Asset Allocation?

Asset allocation is an investment strategy used to balance risk and reward by allotting a portfolio’s assets to a mix of stocks, bonds, cash, and other assets according to an individual’s goals and risk tolerance.

A famous paper published 1986 determined that asset allocation explains 93.6% of variation in portfolio returns. More recent research suggests that 88% of the returns you can earn and volatility you encounter is a result of your asset allocation.

(It’s worth noting that these studies on asset allocation assume you don’t attempt to time the market or try to beat the market through security selection.)

Your portfolio will always rise and fall with the overall market. But the mix of stocks, bonds, and cash in your portfolio will dictate the range of possible outcomes and your long-term investing experience.

How Asset Allocation Impacts Your Investing Experience

The more stocks you own, the wider the range of potential outcomes and higher potential long-term returns. Bonds, on the other hand, sacrifice return in exchange for lesser volatility.

In other words, stocks are the driver of portfolio returns and bonds serve to dampen the volatility that comes with stock investing.

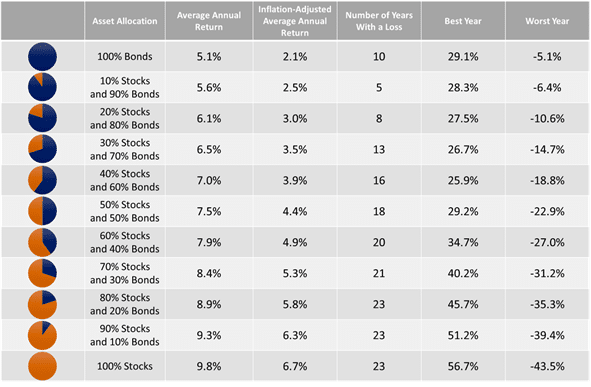

The table below is a simple example of this relationship using two broad asset classes – U.S. stocks (represented by CRSP Total Stock Market) and U.S. bonds (represented by Five-Year Treasury Notes) – to demonstrate the impact of asset allocation on returns and variability of returns.

The portfolios with a greater percentage of assets allocated to stocks have historically earned a higher return. However, those same portfolios with the highest return have also experienced the most years with a loss as well as the widest range of “Best” and “Worst” outcomes.

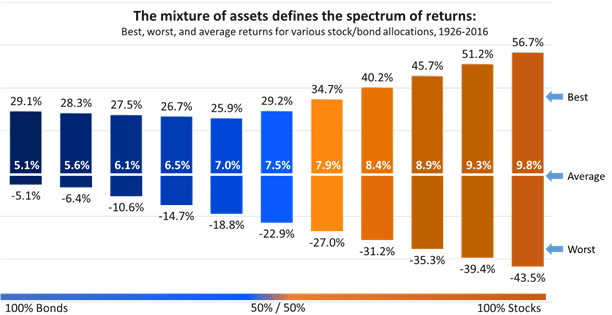

If the table above doesn’t resonate with you, we can depict the exact same information more graphically.

These examples demonstrate the vastly different investment experience an investor has with 20% allocated to U.S. stocks than an investor with 80% allocated to U.S. stocks. It also serves as a good example that all investing requires accepting short-term losses.

You can see in both tables that a portfolio with 50% stocks and 50% bonds lost more than 20% of its value in a single year. That’s painful to experience as an investor.

It also begs the question: Why not simply minimize the possibility of loss and finance all goals using low-risk investments?

Asset Allocation Helps to Manage Risk So You Can Grow Wealth

Avoiding the market volatility associated with stock investments can expose a portfolio to other, longer-term risks. One such risk is that you fall short of the required funding to meet your goals.

If the portfolio lacks sufficient exposure to riskier assets like stocks, then you may not generate returns sufficient to meet your goals over the long-term. Alternatively, portfolios that don’t take enough risk can require an unrealistic savings rate relative to your cash flow.

Another risk is inflation, which may actually outweigh the risk of short-term losses in the market.

If your portfolio doesn’t have enough stock exposure, you become more susceptible to losing purchasing power over time. Straight-line inflation of 3% would reduce a portfolio’s purchasing power by nearly 59% over a 30-year horizon.

Building an investment plan to meet your goals boils down to growing your savings faster than inflation without taking undue risks. You can accomplish this through a blend of broad asset classes: stocks, bonds, and cash.

Each have distinct characteristics that play an important function in a successful investment plan.

Good Diversification vs. Bad Diversification

While the examples above simplify asset allocation down to the split between U.S. stocks and U.S. bonds, there are benefits to diversifying beyond those two asset classes. Just try not to get carried away.

Any time you evaluate whether to add a new exposure to the portfolio, it’s crucial to weigh the expected net benefits versus the degree of uncertainty.

J.P. Morgan’s long-term capital market assumptions lists dozens of available asset classes, but the incremental diversification benefits shrink as the number of asset classes in your portfolio increase.

Similarly, U.S. equity market exposure explains a significant portion of the return and volatility for different asset classes. On top of that, fees frequently offset the diversification benefit of an otherwise attractive asset class.

These are a few of the reasons I believe more exotic exposures are bad for your portfolio in most cases.

Choosing the Right Asset Allocation for You

A great deal of investment success comes from avoiding mistakes and focusing on things you can control. Asset allocation is among the handful of things within your control, and offers an opportunity to simplify your investments to best leverage your natural advantages versus the rest of the market.

Ultimately, choosing an appropriate asset allocation can prove challenging when you try to do it on your own. It’s tough to accurately assess your own risk profile because your perspective is subjective.

If you want to dial in on the best allocation in your portfolio, consider working with a financial advisor or using a tool like BrightPlan to determine the right mix for you.

Next Steps…

Asset allocation is just one important element to consider for successful investing. There are dozens of other tips and strategies I can share regarding investing and personal finance.

If you would like to hear more about how I can help you, book a quick 15-minute call with me.

You may also enjoy the free worksheets and checklists I have that will help you make smart financial decisions like deciding if you should rent or buy a house, determine your net worth, or figure out how much cash flow you have every month.

…

RESOURCE: Do you want to make smart decisions with your money? Discover your biggest opportunities in just 9 questions with my Financial Wellness Assessment.