As of this moment, the S&P 500 is 11% off its highs.

As Ben Carlson recently pointed out, these types of losses should be expected as the stock market loses 5% or more in 95% of years, 10% or more in 63% of years, and 20% or more in 26% of years.

But even though these types of drawdowns are completely normal, you might be feeling a bit uneasy. Some people should be more concerned than others, especially if any of the following are true:

1. You went to cash.

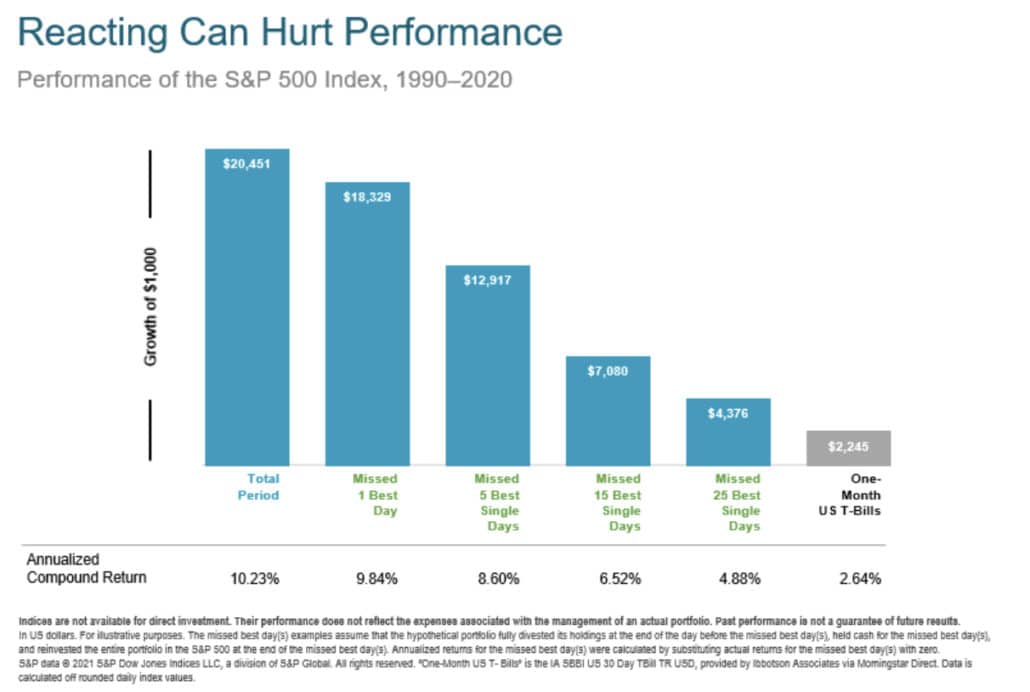

Even if you could accurately predict the future, knowing how the market will react is impossible. Going to cash requires you get it right twice — once when you sell stocks and once when you buy back in — making an already tall task insurmountable.

Plus, the best days for the stock market historically follow the worst days. Missing out on those returns from the best days basically locks in permanent underperformance versus the overall market.

Source: Dimensional Fund Advisors

2. You own concentrated individual stock positions.

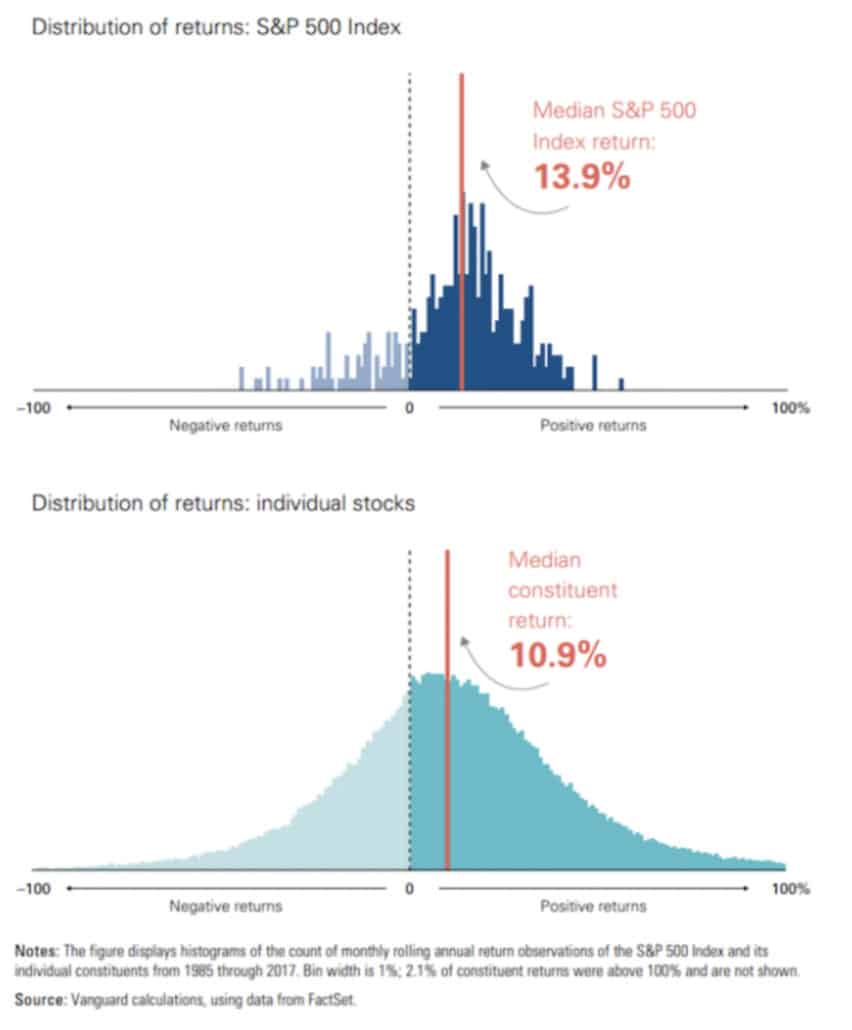

Where we lack certainty, we can turn to probability, and the probabilities suggest that individual stocks are much riskier than you might realize.

Looking at historical rolling annual returns, Vanguard found that individual stocks trail the median S&P 500 return 75% of the time. Even worse, JP Morgan found that 40% of companies that were ever in the Russell 3000 experienced a permanent 70% decline in price from peak levels.

Source: Vanguard

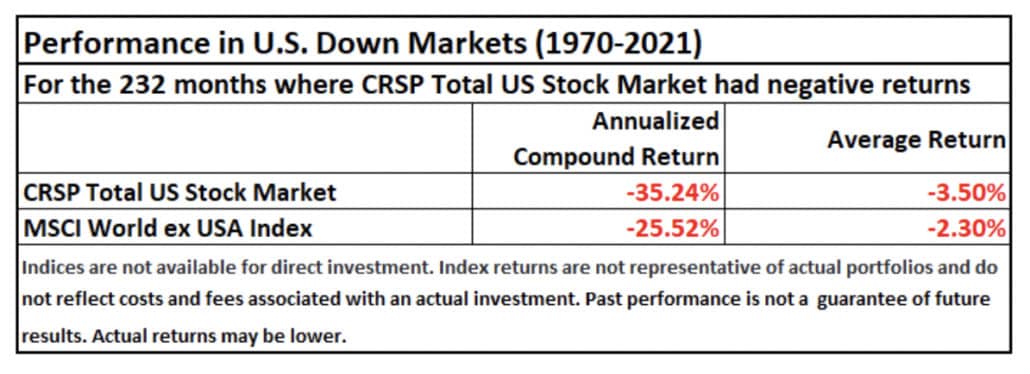

3. Your portfolio lacks global diversification.

U.S. large cap stocks, as measured by the S&P 500, has been the dominant asset class ever since the Financial Crisis, but non-U.S. stocks have historically performed better than U.S. stocks in down markets.

The fact that U.S. and non-U.S. stocks don’t move in perfect tandem means that combining them can improve risk-adjusted returns. In plain English, that means you earn more return for the amount of volatility experienced.

4. You don’t have a long-term financial plan.

Market downturns are likely to continue occurring with a similar magnitude and frequency as they have in the past. Rather than try to predict when or why they will occur, it’s far better to plan on them.

Without a plan, you don’t have any sense for how losses of any size impact you, and any actions you might take will be purely reactionary — a recipe that historically results in bad outcomes.

If none of the above situations apply to you, then you really shouldn’t worry about market volatility.

Stay the course and focus on things you can control.

…

RESOURCE: Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.