Investing is a zero sum game in which individual investors frequently end up on the losing side, but that doesn’t have to be the case. I believe individual investors have significant advantages if they would only simplify the game. I’ll explain through the context of Colonel Blotto, which is a classic zero sum game in which one player’s gain is another one’s loss.

The rules of Colonel Blotto are simple: two players are given a set of soldiers to distribute across a set of battlefields. Neither player knows how the other has allocated their soldiers in advance. The winner of each battlefield is the player that has the greatest number of soldiers allocated to that field. The player that wins the most battlefields wins the game.

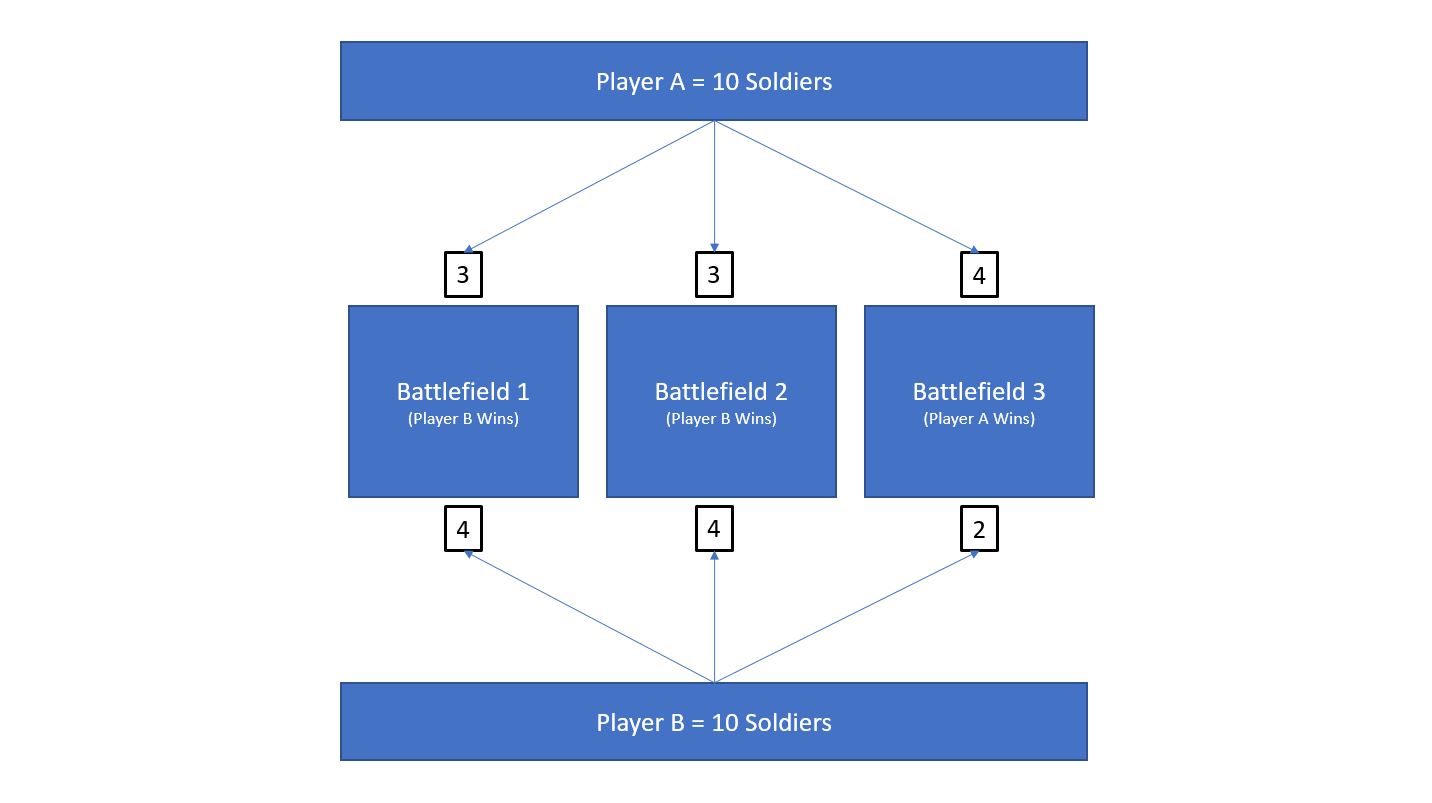

Let’s start with a simple example where Player A and Player B each receive ten soldiers to distribute across three battlefields. Player A distributes 3, 3 and 4 soldiers to the three battlefields. Player B decides to go 4, 4, 2. Below is a graphic of this scenario in which Player B wins the game by winning two out of three battlefields.

This simple version of Colonel Blotto resembles Rock, Paper, Scissors. Each player has an equal chance of winning assuming they allocate rationally – an irrational allocation would be 8, 1, 1 because you are almost certainly going to lose two of three battles and, thus, lose the game.

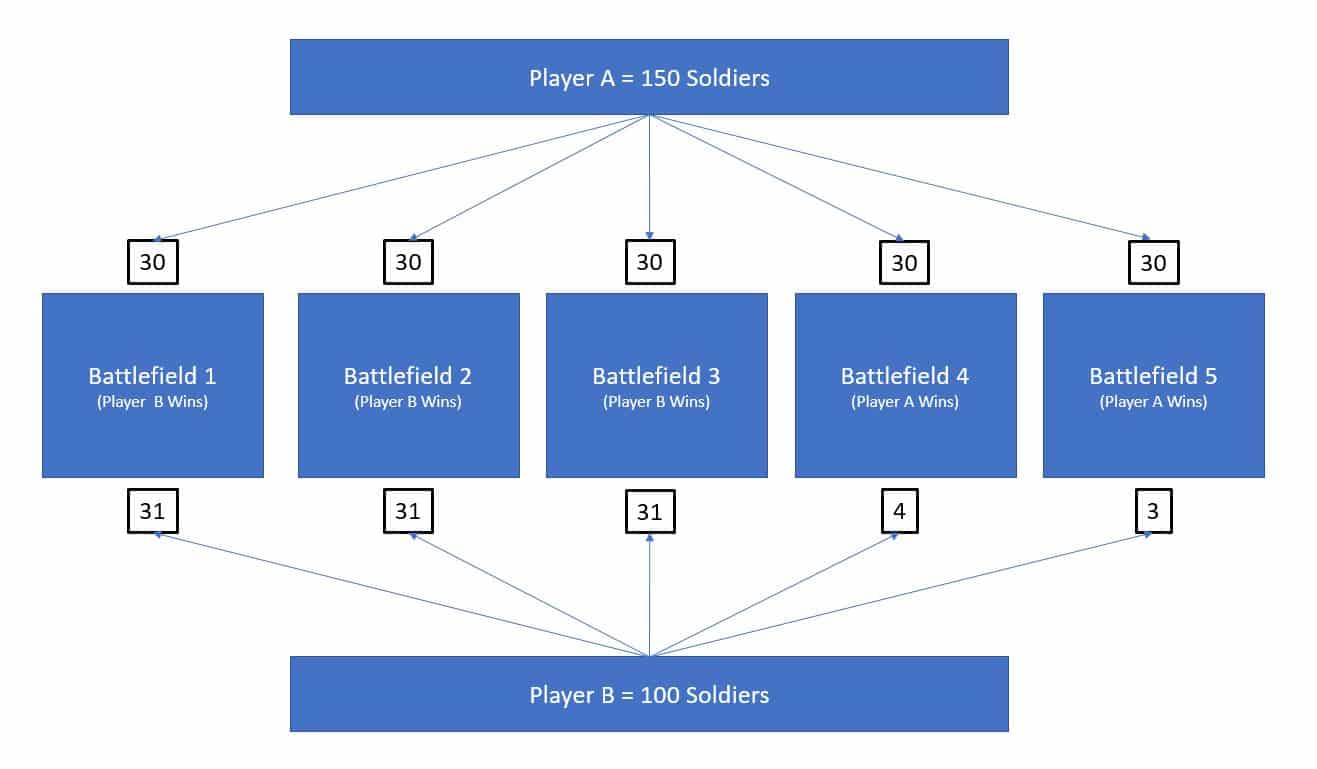

Now let’s examine a more interesting scenario in which Player A is allocated 150 soldiers and Player B gets 100 soldiers to distribute across three battlefields. Player A is the clear favorite and simply needs to allocate 50 soldiers to each of the three battlefields to ensure victory.

Player A’s advantage is weakened, however, if we complicate the game by adding battlefields. By increasing the number of battlefields from three to five, Player A’s potential combinations of soldiers and battlefields leap from 11,026 to 19,720,001. Meanwhile, Player B’s potential combinations rise from 4,851 to 3,764,376.

Player A is still the favorite to win, but the increased complexity from additional battlefields improves the probability Player B pulls off an upset. For illustrative purposes, you can see below that Player A’s simple strategy of evenly distributing soldiers no longer guarantees victory (although it isn’t hard to come up with a superior strategy for Player A in this specific situation).

The main takeaway from Colonel Blotto is that complicating the game decreases the relative importance of natural advantages in competition. To increase the chances of winning in Colonel Blotto, the favorite should seek to simplify the game.

Individual investors should take note because they are competing against millions of people in the zero sum game of investing. In my opinion, individual investors have several advantages over many other market participants:

- They have a long time horizon.

- They don’t need to concern themselves with how they are performing versus a peer group or an arbitrary index.

- There is no career risk involved with their portfolio decisions.

- Their investment results are private and don’t require public consideration.

Unfortunately, individual investors have seen the importance of their natural advantages diminished by parties that complicate the game. Wall Street, for example, complicates things by selling exotic products that charge higher fees, using complicated models to make overly precise predictions, encouraging portfolio activity and increasing the number of decisions you need to make.

Financial media isn’t helping either. They cover the game and benefit from making it seem like a daily activity. Good investing is boring, but the media creates a sense of urgency and encourages bold predictions as if they are the source of an informational edge.

Individual investors: take back your advantage and simplify the game.

- Minimize trading and reduce the number of decisions you make.

- Keep costs low. Don’t pay more than 0.30% for a diversified portfolio and be mindful of taxes.

- Develop a thoughtful asset allocation that matches your risk tolerance and stick to it for multiple decades.

- Define asset classes more broadly and hold fewer funds across fewer accounts.

- Don’t worry about having the most interesting investments at cocktail parties.

- Set financial planning goals and evaluate those more frequently than your portfolio.

It is boring to contribute a big % of my paycheck into my 401k plan investing in a portfolio of passive investment funds with automatic rebalancing.

It is always tempting to buy an individual security of a company whose services/products I use a lot. I spend quite a bit of money in Costco and use google all the time. The only way I control my urge to buy those stocks is to remind myself that when I am buying or selling an individual security, I am likely trading with an institutional investor. Chances are slim that I have the insight or resources to compete with them.

I find reading your article helpful to remind me that the road to success should be simple and straight forward.