A conversation with Josh Bannerman, co-host of the mega hit podcast Stacking Benjamins. Although he chooses to be anonymous on his show, he is known for speaking freely about financial planning and investing.

Listen now and learn:

- The story of how Stacking Benjamins became the success it is today

- How people get in trouble when making long-term decisions

- Why time is the great equalizer with investing

Listen Now

How People Get in Trouble Making Long Term Investment Decisions w/ Josh Bannerman and Peter LazaroffWatch Now

Show Notes

I have a very special guest today. Someone that is huge in the personal finance community. He is the co-host of Stacking Benjamin’s, which is the only podcast that the personal finance community’s Plutus Awards has retired from competition after winning the coveted Best Podcast Award twice.

If you’re a fan of the Stacking Benjamin’s Podcast, you know him as “OG,” which stands for “The Other Guy.”

I’m so lucky to know OG as Josh Bannerman, the acclaimed financial advisor, and Certified Financial Planner®.

OG’s role on the show is that of an industry insider, speaking freely about “behind the scenes.” He frankly shares thoughts on the state of the financial planning industry and guides listeners toward better money solutions.

For more on OG and his firm’s page, click here.

Here are some notes I jotted down from our conversation.

1:42 – The story of how Stacking Benjamins got started

Joe and Josh started Stacking Benjamins 10 years ago. When they started the show, they wanted to make the topic of money more fun. Now they have tens of thousands of listeners tune in every week.

Most people are willing to tell a complete stranger about a health issue, but they’re afraid to tell someone (even a close friend or family member) about our money questions. Josh and Joe wanted to create an environment for money conversations that was fun and approachable.

Josh has been a financial professional since 1999, but decided to remain anonymous as the “Other Guy” because he felt it made his opinion more believable if there was no attachment between his firm and the show. Sort of like the “Under Cover CFP.”

8:50 – Advice in public versus advice to clients

Financial media, in general, offers answers that at best are good enough or an 80% solution. It’s not always the best answer, but it’s usually good enough for a large part of the population.

When you can work with a client 1-on-1, you get a more quality personalized decision that’s a 90% or 100% solution.

15:35 – Josh and Peter talk investment philosophy

Peter asks: What do you say to the person saying, “I’m worried about [crisis of the day], and I think we should do [fill in the blank] with my portfolio.”

Josh’s response:

The biggest determinant in long-term investor success is what people do when things don’t go their way.

We have so much data that with a high degree of confidence that we know what a certain mix of assets ought to offer in terms of returns and risk.

Every year we get another year of data to help inform our future decision making.

The thing people get in trouble with is making long-term decisions with short-term information.

If you look at a week or a month, there’s a decent chance the market is down. If you look at it in 30-year increments, it’s always going up.

As long as the CEOs of corporations continue trying to make profits, it’s hard to picture a multi-decade horizon that stock prices don’t rise. Plus factor in just general inflation, that alone ought to push prices higher.

21:34 – Why it’s important to avoid the big mistake

Josh tells a story of his little brother’s employer who pulled their money out of the market on March 23, 2020. Once you’ve made that mistake, it compounds forever and it’s almost impossible to recover.

Lots of people sat in cash after the Financial Crisis “waiting for it to experience a correction.” But if you didn’t do it then, why not? Because it’s scary. Even if you know the outcome and it’s uncomfortable, you got to do it.

Take a look at your behavior.

27:30 – When you are trying to outsmart something, what is that the result of? It’s often because you’ve fallen behind somewhere.

You can’t undo old decisions, but you can make good decisions going forward.

People sometimes think they need to do some radical thing to catch up. But catch up to what?

We’ve seen lots of people who start late or have made poor decisions turn it around and have a great retirement. If you find yourself in that spot, you don’t have to feel like you are playing catch up. You still have lots of time.

Time is the great equalizer.

32:00 – How Josh invests his money

Josh jokes that everything you can do with money, he has done twice. The first time he finds out it’s silly, the second time he does it because he wasn’t sure the first time was truthful. Credit card, penny stocks, you name it.

Rather than have a budget, he thinks about what he needs to do to reach his financial goals (like a Reverse Budget). As long as that happens on autopilot for the next 20 years, then everything will be fine. Josh also notes that his portfolio is 100% stocks and invested the same way as clients.

He also owns lots of illiquid business ownership and is in the process of liquidating some rental properties. Tons of AMEX points, too.

36:19 – What does it mean to be a long-term investor?

Josh shares his interest in multi-generational wealth.

He needs time on his side and thinks about his hypothetical 27 great-grandchildren retiring in 110 years. He wants to provide each of them with $25,000 in today’s dollars of monthly income. He calculates that would require about $7.5 billion in 110 years. To get there, he needs $300,000 today assuming some rate of return.

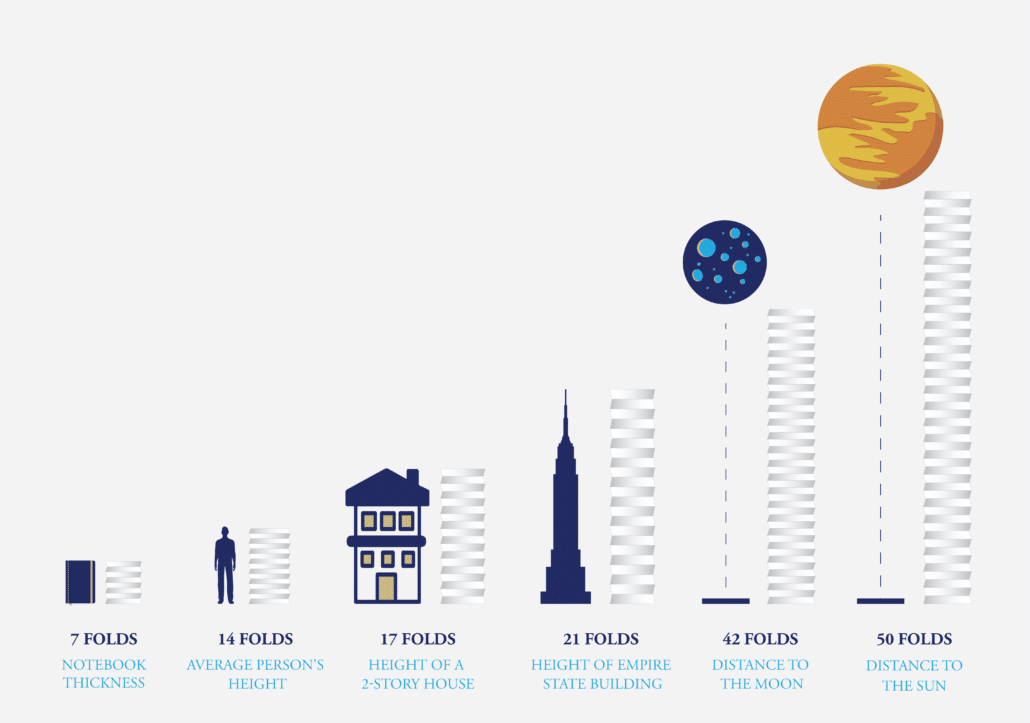

It’s impossible for our brains to recognize the power of compounding. Then Josh tries to trick me with an example from my own book related to compound interest (see below):

Figure 1.1: The Thickness of a Folded Piece of Paper

That’s what being long-term is all about: leveraging compounding.

There is more time than you think. You don’t have to swing for the fences. You don’t need anything that’s interesting. Just stick with the boring and simple stuff for decades.

Connect with Josh Bannerman

- His firm: Bannerman Wealth

- Podcast: Stacking Benjamins

- Twitter: @notthefakeOG

Resources

- Submit your question for the show through my “Ask Me Anything” form

Get Your Finance Questions Answered

Do you have a financial or investing question you want answered? Submit your question through the “Ask Me Anything” form at the bottom of my podcast page.

If you enjoy the show, you can subscribe wherever you listen to podcasts, and please leave me a review. I read every single one and appreciate you taking the time to let me know what you think.

About the Podcast

Long term investing made simple. Most people enter the markets without understanding how to grow their wealth over the long term or clearly hit their financial goals. The Long Term Investor shows you how to proactively minimize taxes, hedge against rising inflation, and ride the waves of volatility with confidence.

Hosted by the advisor, Chief Investment Officer of Plancorp, and author of “Making Money Simple,” Peter Lazaroff shares practical advice on how to make smart investment decisions your future self with thank you for. A go-to source for top media outlets like CNBC, the Wall Street Journal, and CNN Money, Peter unpacks the clear, strategic, and calculated approach he uses to decisively manage over 5.5 billion in investments for clients at Plancorp.

Support the Show

Thank you for being a listener to The Long Term Investor Podcast. If you’d like to help spread the word and help other listeners find the show, please click here to leave a review.

Free Financial Assessment

Do you want to make smart decisions with your money? Discover your biggest opportunities in just a few questions with my Financial Wellness Assessment.