With election season heating up, debates on what a Trump or Biden victory could mean for the stock market are intensifying, too.

Questions on how each candidate’s potential victory would impact the market aren’t unique to the 2020 U.S. presidential election. We see similar discussions and predictions every four years, as headlines bombard investors about the latest polls and potential policy changes or tax reforms.

While it’s only natural to wonder what the outcome of the election will mean for your investment portfolio, worrying about it (or trying to accurately predict what the market will do) is usually a waste of both your time and energy.

Why? Because acting on those worries and tinkering with your portfolio based on hunches about election outcomes could lead to costly mistakes that you later regret. Here’s why strategic investors know better than to get caught up in this guessing game.

Markets Are Forward-Looking, So Making Predictions Is Harder Than It Seems

While policy decisions and the regulatory environment no doubt have an impact on the economy and markets, they’re still just two factors that influence market movements and prices. Stock returns are influenced by thousands of others, too, including valuations, corporate profits, business cycles, monetary policy, and so on.

In addition, the increasingly global economy makes the actions of a single government less important – even if it’s the U.S. government. Remember, S&P 500 generates more than 50% of revenues outside the U.S.

Millions of market participants are collectively assigning probabilities on these and other inputs as they agree to buy and sell securities in the market. This builds expectations about the future into the market prices we see today.

It’s also a big part of why predicting market outcomes is so difficult. As an election nears, the rhetoric and investor attention to it increase. While that may drive you to want to make adjustments to your portfolio, remember that it’s those very same things the market is already reacting to accordingly.

In other words, markets begin to discount the outcomes and implications based on the same information that’s making you start to worry if you should perhaps do something with your investments.

Markets are anticipatory, and investment opportunities must be framed relative to current pricing. Gaining an edge requires looking beyond the obvious, and to the nuance and potential that may lie beneath the headline.

Cause and Effect Aren’t Neatly Linked in Financial Markets

Promises and proposals made on the campaign trail offer an indication of a candidate’s intentions, but bureaucracy, compromise, lobbying, and politics help shape the reality once an elected official is actually in office.

At the same time, markets don’t always behave as conventionally expected. Investors typically desire simplified explanations where they can draw a direct and clear line from a cause to an effect. But just because our brains prefer to understand our world in this way does not mean that is how our systems behave.

The stock market is a complex adaptive system in which cause and effect are not easy to link. Market movements, particularly over short periods like presidential terms, are random (and yes, the four years that make up one presidential term, and even eight years if the same president is elected twice, are both “short-term” when we’re talking about investment periods).

Market Returns Tend to Vary Widely Around Elections

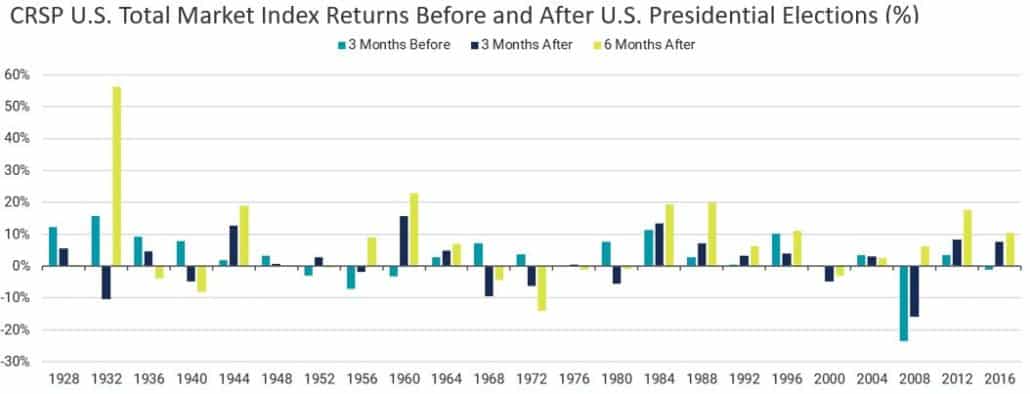

Avantis Investors analyzed data for 23 presidential elections from 1928 through 2016, and looked at market returns in the three months leading up to the month of the election as well as three and six months after the month of the election.

You can see their findings in the chart below:

What does this tell us? Average returns are positive in all three periods for the 23 election years, but those returns vary widely.

For example, the average return for the six-month period following the election month is about 7.5%, but the range goes as far as about -14% to more than +56%.

There’s no clear pattern here – and therefore, no easy way to know with certainty what any one candidate’s election victory will mean for the stock market before or after Election Day.

Historically Speaking, Politics Have Little Long-Term Market Impact

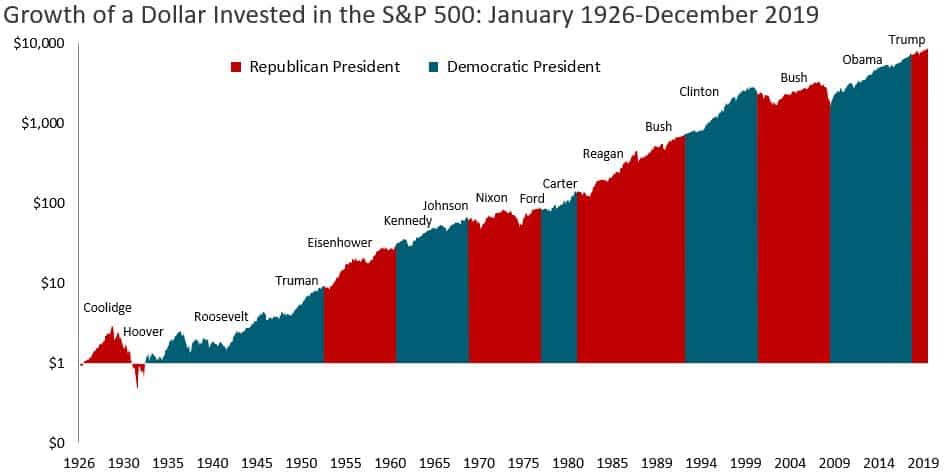

It’s extremely difficult not to let personal political views and opinions get in the way when trying to make a guess at what the stock market will do pre- and post-election. But the historical facts are clear: the stock market has advanced regardless of which party is in the White House.

Shareholders invest in companies, and companies tend to focus on growing their business regardless of who is in office. As such, it is little surprise that there is no conclusive evidence to suggest the president’s party has any statistically significant impact on U.S. equity market returns.

In the long-run, stocks have rewarded disciplined investors through both Democratic and Republican presidencies:

What all of this should tell you as an investor is that it’s important to stay invested in the market. But, as we see every four years, the uncertainty of impending elections causes many investors to retreat to cash while waiting out the volatility.

While the election will dominate the headlines over the next couple of months, I suggest taking a break from worrying over its impact on stock market returns. Regardless of your expectations about the outcome, step back and think about the bigger picture.

Times like these are precisely when the importance of having a long-term financial plan in place is highlighted. When you have such a long-term strategy, then you gain more peace of mind knowing that it considers the uncertainties around these sorts of events – and eliminates the need to react on the fly to the latest news or headline.

Instead of fretting over what a single election outcome may or may not mean for the markets in the near future, focus on the bigger picture and stick to your overall plan.

…

Chart Disclosures:

* Chart source: Avantis Investors. Data from 7/31/1928 to 5/21/2017 using Ken French’s Data Library. CRSP U.S. Total Market Index comprised of nearly 4,000 stocks across mega, large, small, and micro capitalizations, representing nearly 100% of the U.S. investable equity market. Indices are not available for direct investment. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. Past performance is not a guarantee of future results. Actual returns may be lower.

** Chart source: Dimensional Fund Advisors. Index returns are S&P data © 2020 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. Past performance is not a guarantee of future results. Actual returns may be lower.