Diversification is said to be the only free lunch in investing, but that’s not entirely true because the extra fees associated with more exotic asset classes frequently offset the benefits of otherwise attractive diversifiers.

Most people understand the importance of investment costs and accept that diversifying asset classes should have higher investment management fees, but few people understand how much of the diversification benefit fees consume.

A paper published earlier this year in Financial Analysts Journal by William W. Jennings and Brian C. Payne compares the incremental benefit of diversification with the incremental cost of such diversification for institutional investors – their results show fees absorbing a shockingly high portion of allocation alpha.

U.S. equity market exposure explains a significant portion of the return and volatility for different asset classes, while the remaining risk-adjusted “allocation alpha” is the true benefit of an asset class outside traditional U.S. stocks, bonds and cash (Leibowitz and Bova 2005). Because allocation alpha is independent of overall market movement and does not rely upon active management, investors should only pay fees for the diversification benefit portion of an asset class.

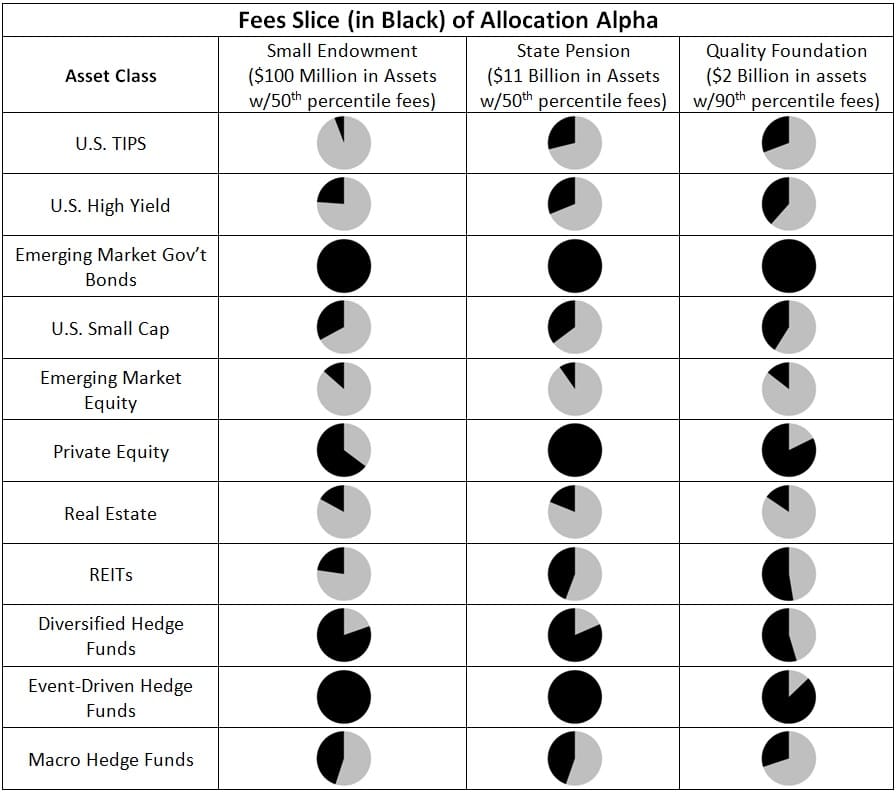

The graphic below is from the Jennings and Payne article, which compares the cost of asset class exposure (shaded in black) relative to the diversification benefit known as “allocation alpha.” Since the entire pie is considered to be the diversification benefit, the grey portion can be interpreted as the after-fee diversification benefit.

As you can see, fees (in black) can eat up a significant portion of the risk-adjusted diversification benefit. Exposure to allocation alpha is valuable and should come at some sort of cost; however, fees consuming more than 50% of the benefit make it difficult to justify the inclusion in a portfolio.

Jennings and Payne find that of the 45 asset classes in J.P. Morgan’s Long-Term Capital Market Return Assumptions, only 27 have positive allocation alpha and fees that are below 50% of the alpha. When using the more comprehensive Fama French Five-Factor model to derive allocation alpha – adjusting for the market, size, value, term and credit premiums – the number of acceptable asset classes shrinks to 22!

It is also important to note that this analysis focuses on institutions that don’t pay taxes, but diversifying asset classes tend to be less tax-efficient. Taxes will reduce allocation alphas for individual investors, which means that fees will consume an even bigger portion of the after-tax benefit of diversification.

The authors draw several good practical implications for making investment decisions:

- Don’t pay fees for what can be accessed cheaply through simple equity market performance.

- Incremental diversification benefits shrink as the number asset classes increases.

- Your mix of core stocks and bonds will drive return and volatility more than diversification alpha.

- Use passive exposure to diversifying asset classes if possible.

- When the opportunity arises, consider funds that combine multiple asset classes to reduce costs and taxes.

- Avoid fund-of-fund expenses.